ETF Trading Research 3/14/2017

Today’s Trades

The Good

Scalped some good profit from JDST and UWT.

JDST we scalped once JNUG first broke 6.80 for a move from just under 17.50 to 17.95. We then bought JDST again at 17.50 and rode it to 17.95 for 2.57% and 18.50 for 5.7%. That offered some hedge for JNUG but not enough.

You might have got some profit from DWT, TLT. DWT entry was 17.22 and we are still holding and it is trading at 18.07 after hours, up 4.93%.

The Bad

Lost a little on UGAZ but it was a scalp early on. LABD didn’t move but a little. The green weekly’s from yesterday pulled back.

Holding JNUG too long with the hedge in JDST. We don’t do that with non-green ETFs.

The Ugly

Not keeping a stop and recognizing the strength in JDST. I wrote in the Trading Rules the ways to lose money with this service. Eliminate those 4 things and you’ll be fine. Me too.

Economic Data for Tomorrow

Lots of data tomorow but it’s all eyes on the Fed. Crude oil inventories too which should have us out of UWT before the report.

http://www.investing.com/economic-calendar/

Stock Market

Yesterday I said I still want to tread lightly as we have the debt ceiling issue and Fed both on March 15th. The same is true for tomorrow but the data might get us some early trades. I will lean lower but open to the data to confirm.

Foreign Markets

One day later and we got weak right away. Neutral overall right now but RUSS is still green on the weekly and where you can concentrate. I would keep an eye on YANG too.

Interest Rates

TLT I like into the Fed as we may get some good news for it since higher rates already are priced in here.

Energy

Got a scalp from DWT at best and got long UWT and doing good with the trade. Will get us out in the AM on the gap up or closer to the report if up a decent amount.

I said last night that ‘Tomorrow I am actually going to lean long UGAZ again as one more spike up and it should trigger green on the weekly.” We did get a quick move up once in but got stopped out.

Precious Metals and Mining Stocks

I said yesterday give them 48 hours too or going to be issues. We got the issues sooner than I wanted. Gold in after hours trading is holding steady at 1198.50 and silver 16.88. Prefer (obviously) they start a run up into the Fed, but it will depend on the dollar first moving below 101.51. It is 101.62 now. JNUG 5.77 last trade.

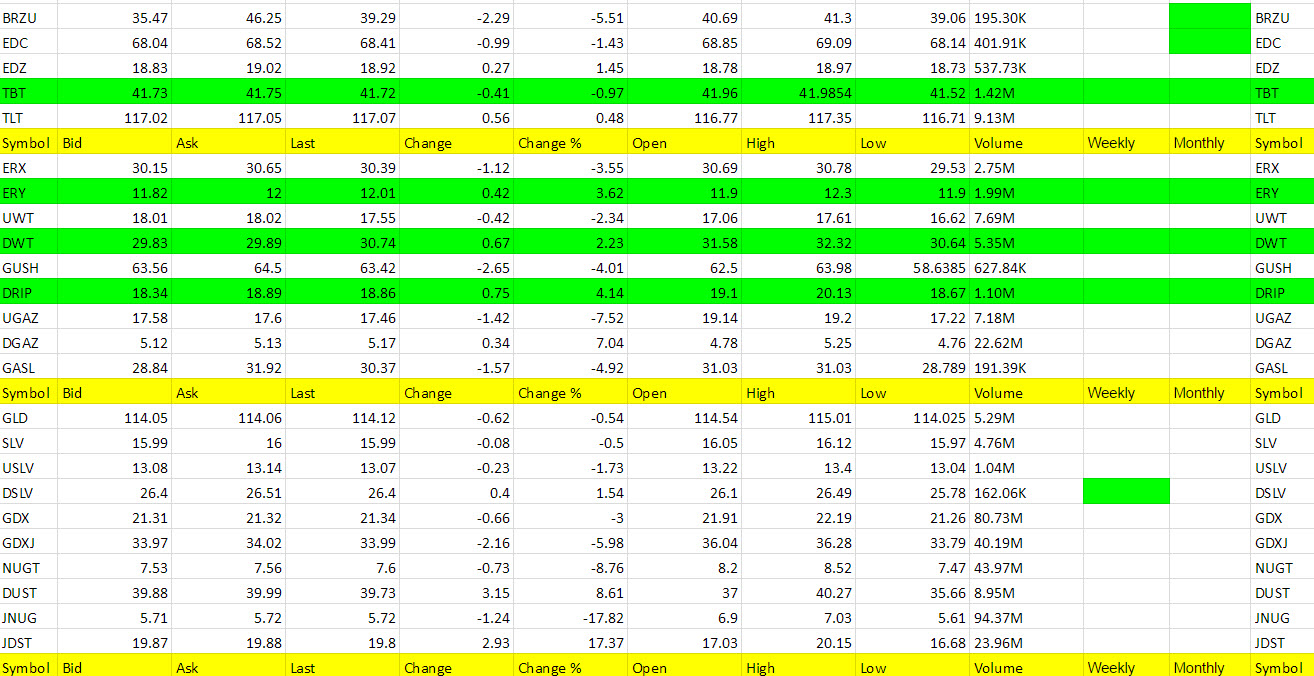

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

JDST, DUST, DGAZ, RUSS, DRIP, UVXY, ERY, LABD

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

Our 3 bold colored ones that had 2 days of good returns of 3% plus from last nights hot corner are leading the Cold Corner tonight.

JNUG, NUGT, UGAZ, GDXJ, BRZU, GASL, GUSH, RUSL, ERX, LABU

Green Weekly’s

No new green weekly’s, but after the Fed we should get some new trends going for us.

I am adding some additions to the green weekly report to help you with your stops and to recognize the green weekly’s that are still tradeable long as they break to new highs. Some of these that have broken to new highs are ETFs that we can enter again and get more profit from and I am working on a system to better recognize this. This is part of that system and you’ll see the date highlighted next to the new high or low price that has triggered. Obviously if you see it in the new low column it gives you a signal to keep a stop or it is simply an ETF that we already traded long but is on its way down again (which tells you to also look at its opposite to consider going long). You should be making your own list of these each morning to watch for during the trading day.