ETF Trading Research 3/28/2017

Today’s Trades

I have included today’s trades in each section below. We had a mixed result day overall with JDST being the best trade of the day and the overnight hold of UWT. We did get out of some short the market ETFs at the right time.

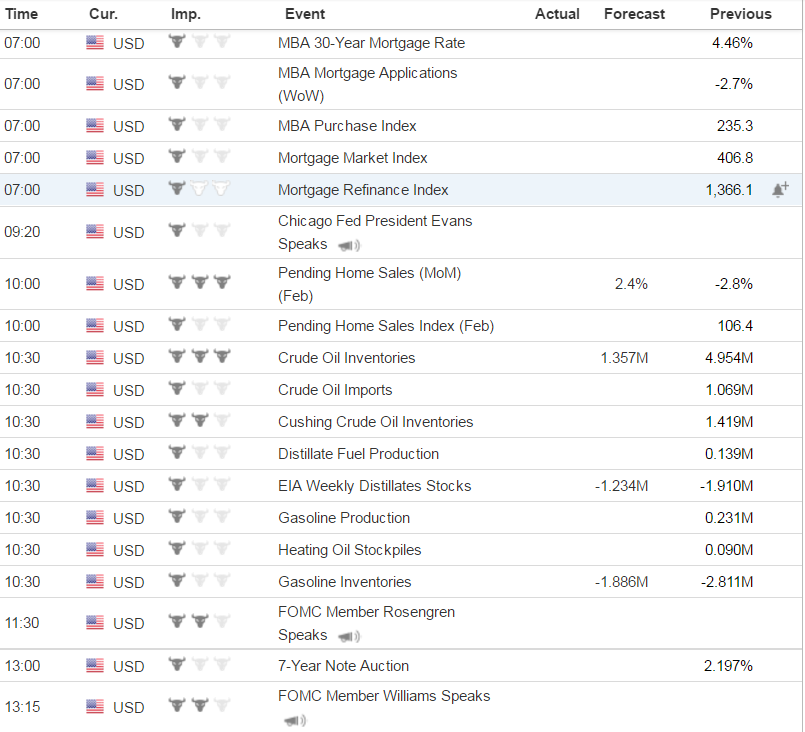

Economic Data For Tomorrow

It is amazing me how many Fed members are speaking today and again tomorrow. It’s almost like they were sent out by someone to “save” the market from falling. Very suspicious to me. Plus Steve Liesman had Fisher on TV to “talk up the markets.” Blatant in my opinion and I don’t trust pro-Fed Steve Liesman ever. He is shady to me. Also, how is it so that he gets all the Fed minutes to read off each time the Fed meets? I’m not saying markets are rigged, but the markets do believe in the Fed too much. Just stating my opinion after almost 2 decades of watching CNBC. They never did understand why gold was moving higher for many years. They would mock it. Now they ignore it, which is fine by me. When it finally does take off, and markets crash, which they will, they won’t know what hit em and no Fed member they promote will help the markets. My prediction is we ride gold up for now and the dollar lower, then a deflationary contraction will hit the markets and gold hard pushing the dollar much higher. It is after this episode that I see gold finally take off. I wrote about this in my Illusions of Wealth book.

Tomorrow we have 3 more Fed members speaking. We also have the important data for Pending Home Sales which disappointed last time and the Crude Oil Inventories that might get us a trade in UWT I am hoping (after the beginning whipsaw).

http://www.investing.com/economic-calendar/

Stock Market

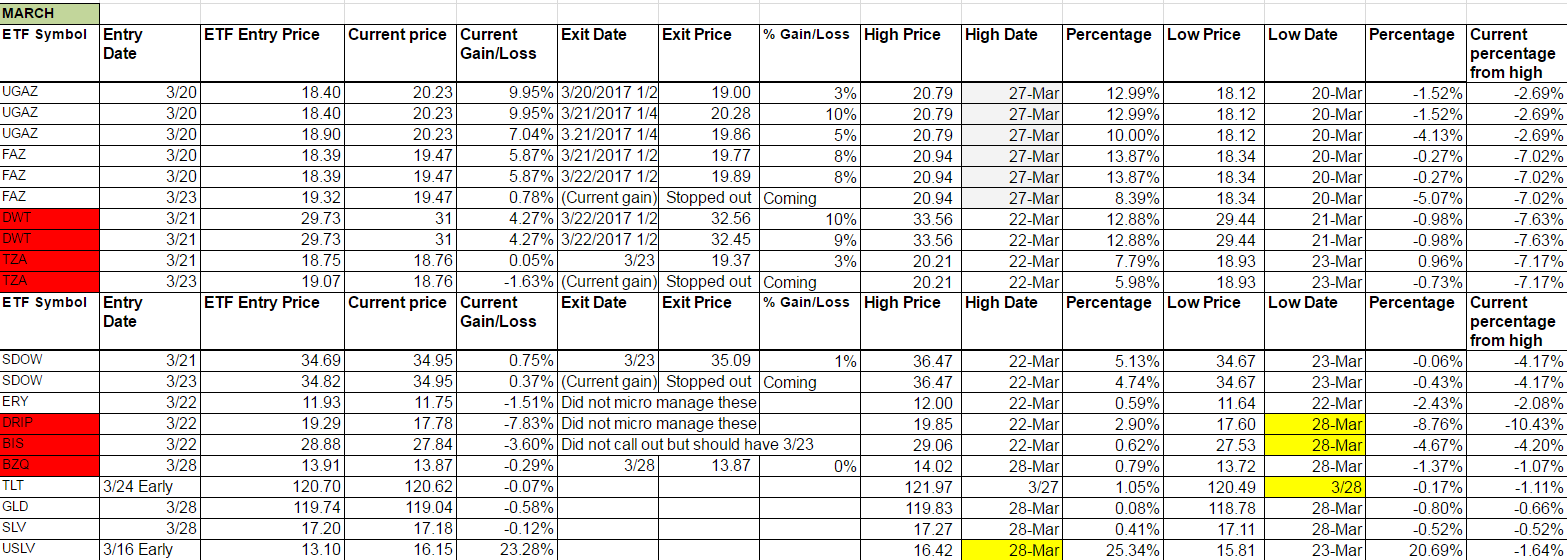

After 8 days of the market falling the DOW finally had a good one. I said over and over nothing moves in a straight line yesterday and we sold out and bought back in the short the market ETFs only because the trend was still with us, but sometimes you have to wake up and see price action has other ideas which we did today. Unfortunately I didn’t call anything long but I’m ok with that actually.

Foreign Markets

Last night’s report I said “with YANG and RUSS I prefer you wait until green weekly’s on these for a better opportunity but I have hit these early before.” I got us out maybe flat on YANG and a little loss on RUSS when I called us out of TZA, FAZ and SDOW. We’ll have our day eventually but for now will watch.

Interest Rates

Still long TLT and up on the trade. It went down as the market went up. Want to give it a chance over the next 24 hours to see if the markets revert quickly by Friday to lower prices and TLT back to 122 and more.

Energy

We got out of the overnight hold of UWT for decent profit. Tried it again and stopped out with small loss. Will wait for the data tomorrow now.

Precious Metals and Mining Stocks

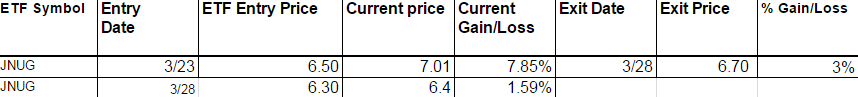

I hate having JNUG behaving the way it did but we did sell with a little profit of 3% and got a good chunk from JDST too which many of you wrote and said you did well. I call out stops and really spent a lot of time micro managing JNUG today and I think it paid off for us. I called us out a quick scalp of .25 and then got us back in for a nice run to 15.80 but it didn’t quite hit 16 like I wanted it to. Then the end of day I got us in JNUG and I do think there is a little risk here but we’ll see how she opens. Gold is above 1250 but the dollar is not below 99.48. Sivler though is behaving very well for us overall.

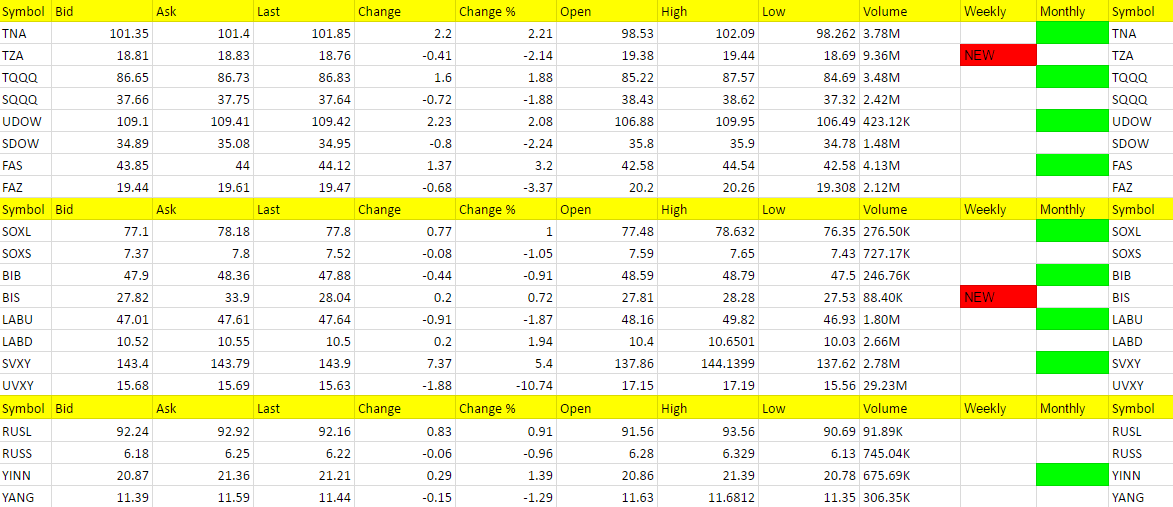

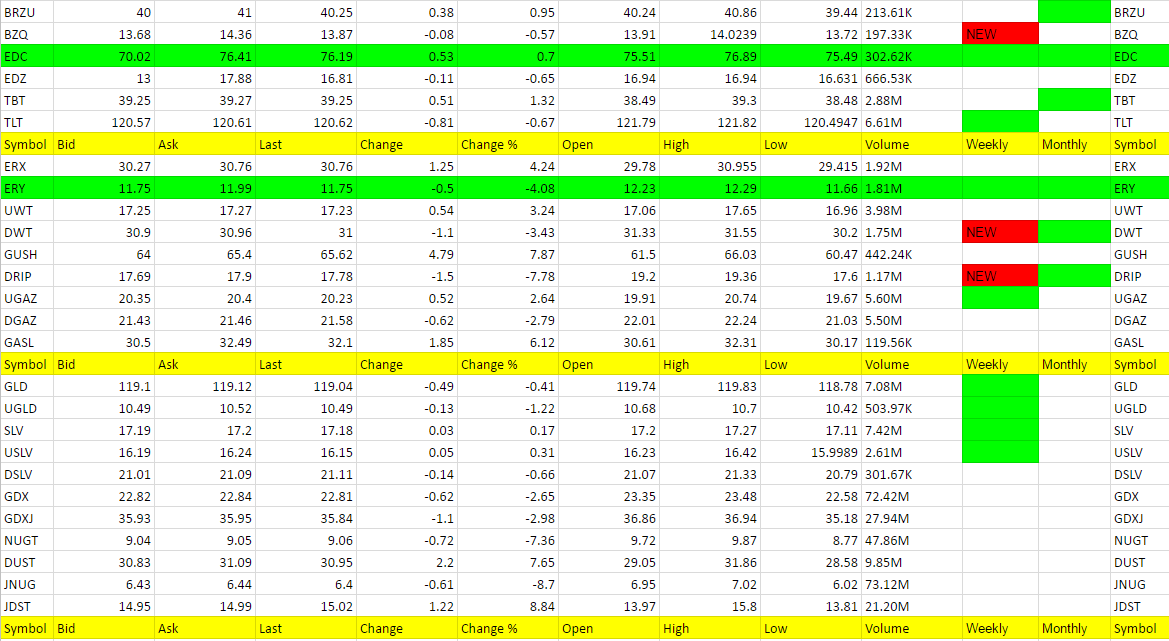

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

JDST, GUSH, DUST, GASL, SVXY, ERX, FAS, UWT

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

UVXY, JNUG, DRIP, NUGT, ERY, FAZ, DWT – keep an eye on UVXY tomorrow for you aggressive traders. 2 days in a row in the cold corner. Might get a scalp out of it. (TZA, BIS, DRIP and DWT turned red on the weekly)

Current Non-Weekly Green Trades We Are In

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. It is also used for tracking the percentage from high to keep a stop on remaining shares. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out before typically well before they start to fall again. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities too. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I took a screen shot of the price for TZA, FAZ and SDOW when we stopped out and had it on my latptop which I gave to my assistant tonight. So the prices we stopped out are without much loss or a little gain. Same with the 2nd attempt where we stopped out net -.15 on the 3 before the market took off higher.