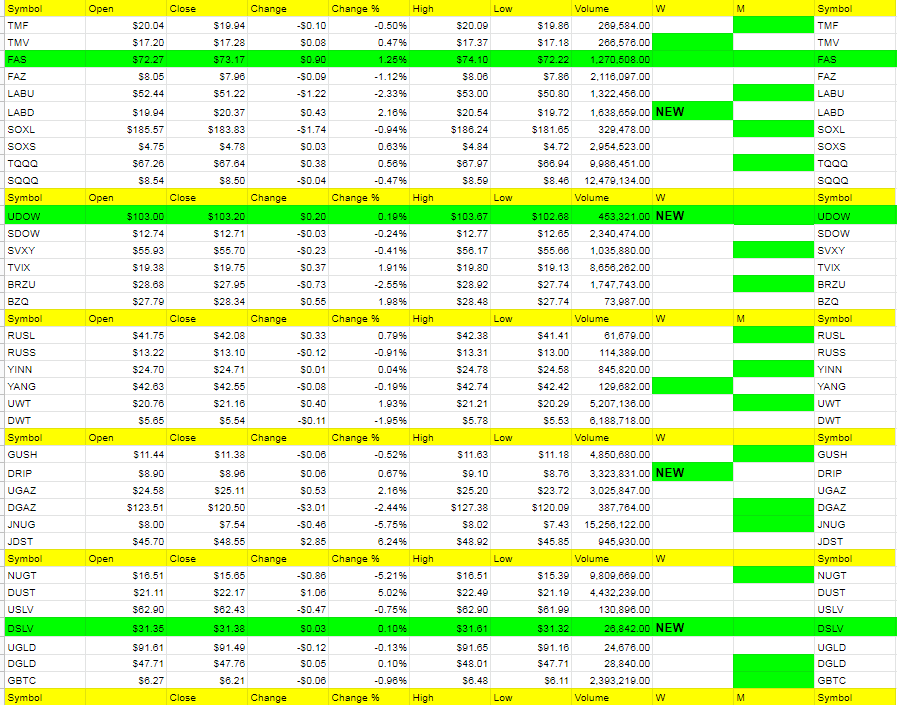

ETF Trading Research 4/30/2019

Today started out with a turn south and then we bought at the bottom and didn’t do any damage, but no home runs yet either. But /ES is over 2950 again and real close to the breakout over 2952. Tomorrow’s Fed will have us looking as some whipsaw both ways where we can wait for the dust to settle and jump on the trend, whatever direction that is.

The Fed has had some decent data but I don’t think the do anything either way tomorrow. They won’t lower rates because data was good. They won’t raise rates as they don’t want to kill the markets that keep this game of finance alive. The fact is, and is becoming clearer, if things go to hell in the markets, it will be led by Turkey, or China, or some unknown Greece type issue. It won’t be the U.S. But markets don’t move in straight lines and this move up has been somewhat unreal and most agree on that fact.

When we do get the bigger downturn, and I do think that comes this year, 2200 is still the target area. TVIX will most likely be a 100% or more trade. Once that “thing” triggers the selling, watch out below. But for now, depending on what the Fed does tomorrow, if nothing though, we should head up to over 3000 since we broke 2950. After hours we are already up to 2955. LABU a bit of a laggard here too with TQQQ, oddly enough. 48.95 and 67.40 on the ask for reference. SOXL too wide a spread to talk about. TVIX though down to 19.34 on the ask.