ETF Trading Research 4/30/2017

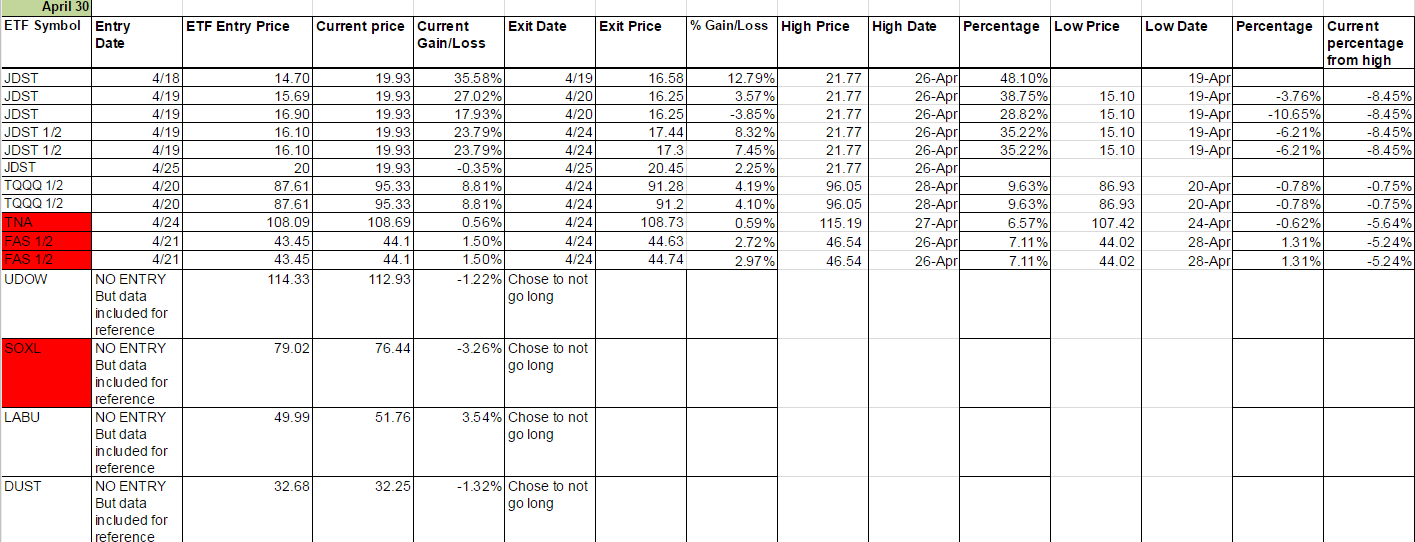

Today’s Trades – Current Trades (Non-Green – Bought/Sold/Hold) – Those highlighted in Yellow we are still long.

We stopped out of the last 1/2 shares of RUSS -0.98% but came out overall positive on the trade. Took a little hit on BZQ. Both continued lower. SDOW we are up almost 1% on and added TMF which is up 1.93%. UWT we took 2.10% on 1/2 shares and down on the other half but so far up overall on the trade. JNUG we locked in 4.73% profit and are up on the remaining half position but down a hair a the close on the last 1/2 pick up which was though lower than where we got out on the first half, so beating the buy and hold of that position at least. Those last 2 minutes of the day always can do some damage and they did but also bounced back up.

Economic Data For Tomorrow

Manufacturing PMI came in worse than expected in China yesterday and we are long YANG so that’s good. Tomorrow is a Holiday in China, and many other countries for Labor Day.

NOTE: We have the Fed meeting this week and normally it means more volatility. My guess is confusion for most traders rather than volatility but we’ll see what the Fed does and if anything lean short market and long gold afterwards.

Stock Market

Now that U.S. data is seen to be weak with a worse than expected GDP number, the Fed might even down play their talk of a June rate hike. This should be good for gold and bad for the market. Hard for me to find a bullish slant to this market right now but keep an eye on UVXY for some fear possibly now and if there is some, we’ll stay short. Also look to see if TMF and FAZ are both positive and we’ll keep leaning short the market. Futures opening lower in Asia and David Stockman had the following to say about Trump’s tax plan and Wall St. in general. I agree overall but will trade what the market tells me to.

Foreign Markets

I didn’t like at all RUSS and BZQ reversing on us, even though we took some profit from RUSS. I would actually go long them both tomorrow if they are up at the open over Friday’s close. They are not green on the weekly so volatility is normal. Like the not so good data in YANG and yes, it was a little more risk but typically a slow mover and has a slight upturn going on and a good chart for a possible run to 13 again. Zooming out even more 14 is within reach if the data continues to disappoint. Add to this the war rhetoric with N. Korea and I don’t mind YANG here. Maybe we get a run in YANG.

Interest Rates

We bought the dip in TMF and were rewarded. We’ll stick with it for now and look to see if we can trigger the green weekly for a bigger run.

Energy

Oil is down -.14 at present. We will have to make a decision come Monday on our remaining shares.

Precious Metals and Mining Stocks

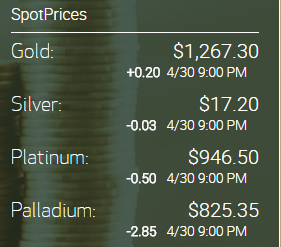

Gold was up a couple dollars when Asian trading opened up but now only up .20 cents to 1267.30 and silver -3 cents to 17.20. Dollar was down 10 cents now up 2 cents to 98.91. Really not expecting a flat line here. We should get some action but metals seem to be back on sync with the dollar here. I’m ok with a flat open and a day of rest before blast off higher. I can still put on a JDST trade if necessary but I see it more of a hedge than a lead trade over JNUG.

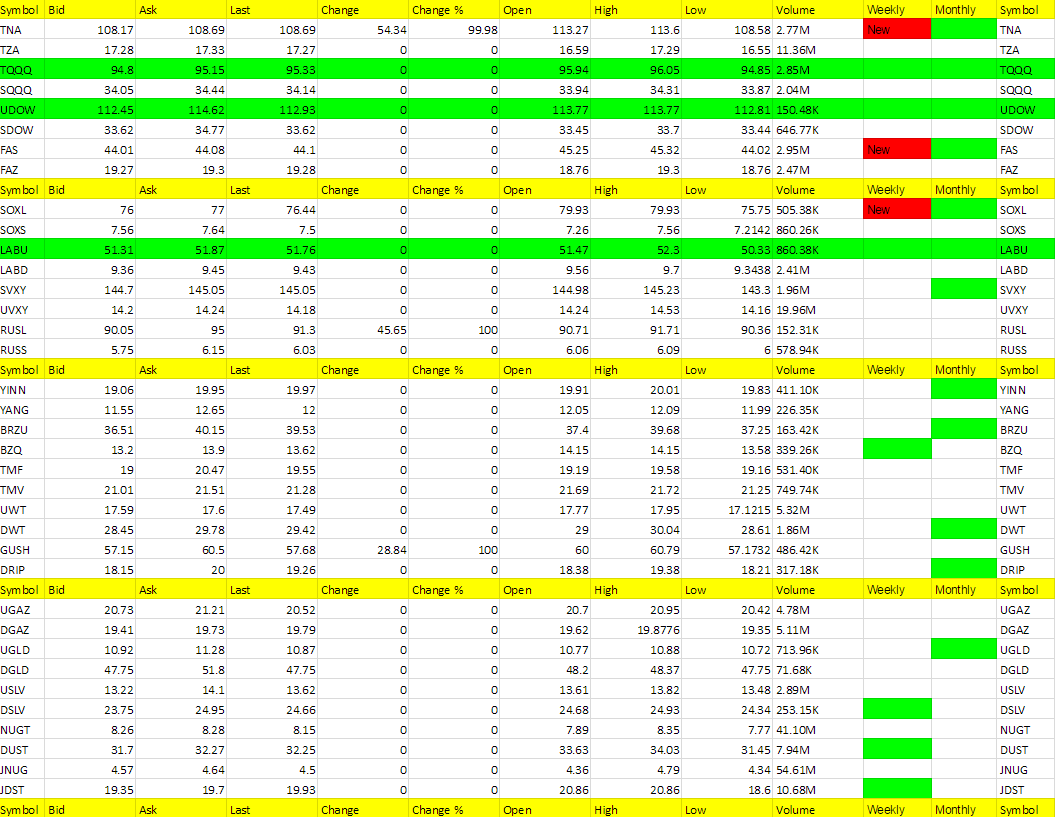

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

NUGT, SOXS, BRZU, TZA, JNUG, UGAZ

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

DUST, SOXL, JDST, TNA, DGAZ (TNA, FAS, SOXL (turned red on the weekly)

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. It is also used for tracking the percentage from high to keep a stop on remaining shares. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out before typically well before they start to fall again. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities too. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long. You’ll notice in the last column on the right it says “Current percentage from high.” This is your normal stop out for any ETF where I don’t specifically call it per the Trading Rules which lists the trailing stops for each ETF. It is a Trailing Stop percentage from the high and I have noticed the pattern that the closer it gets to 5% the sooner the ETF turns red on the weekly.

Grabbed the data late so I don’t have the change data or change data % but the Weekly and Monthly colors are in sync with 3 new red weekly’s; TNA, FAS and SOXL. The opposites of those become more attractive for longs now.