ETF Trading Research 5/1/2017

The following was from a longer term subscriber today;

Doug,

Don’t worry about the losses today. Good thing they are limited and that is what I like about your service. You can’t win every single day. Did you forget how you rode almost the whole move down in miners in the past weeks?! It was absolutely top class and totally unbelievable to a novice like me. I don’t like EW guys btw for the same reason. It can always go either way with them. Your service is quite unique that you actually give calls and admit mistakes. Thank you for running it.

I am still long TLT (and ultra T-bond futures), I hope it filled the last gap today (April 7th low was 120.69 and today’s low 120.71), and won’t look back from now on. Bought back miners too.

I know for many that losses are nothing we want and I work hard to avoid them. But just saying “it’s Fed week and we could see volatility” isn’t enough. I am implementing some new non-green ETF rules that protect our downside more and read the info under Today’s Trades below for more. Please read the part I put in bold now and will leave in bold under the green weekly section. I put that here in the report every night as a reminder, but will put this in bold now to keep reminding us.

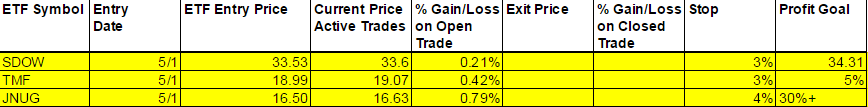

Today’s Trades

This is the day that I should have just went flat everything from the opening bell with it being Fed week and with the budget coming through to be voted on for the end of September. I said my mistake was in going against green weekly’s but in reality it was not looking ahead on Friday by end of day to what lies ahead the next week. Fed weeks being volatile in and of themselves and with us not having a clear direction on a green weekly trade, I could have saved a lot of trouble from the beginning of the day. Then not just selling from the get go and dealing with the reverse splits it would have been good to just refresh then instead of later in the day. Sorry about that and will try not to repeat. I’ll leave it at that. Below are what we are in and I lessened the amount of ETFs and stuck with JNUG only because I think we get a complete reversal tomorrow through the Fed on Wednesday.

This kind of day has happened twice before and each time was followed by some good trading so I expect nothing less than that.

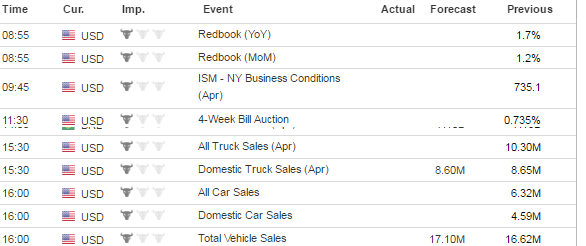

Economic Data For Tomorrow

Zero market moving data tomorrow. Markets will be eyeing the Fed on Wednesday and tomorrow I do expect a reversal of today’s move rather than a continuance. The lack of fear in this market is pretty close to unprecedented. Wednesday though we have a lot of heavy data so it makes sense to go home flat before Wednesday’s data.

NOTE: We have the Fed meeting this week and normally it means more volatility. My guess is confusion for most traders rather than volatility but we’ll see what the Fed does and if anything lean short market and long gold afterwards.

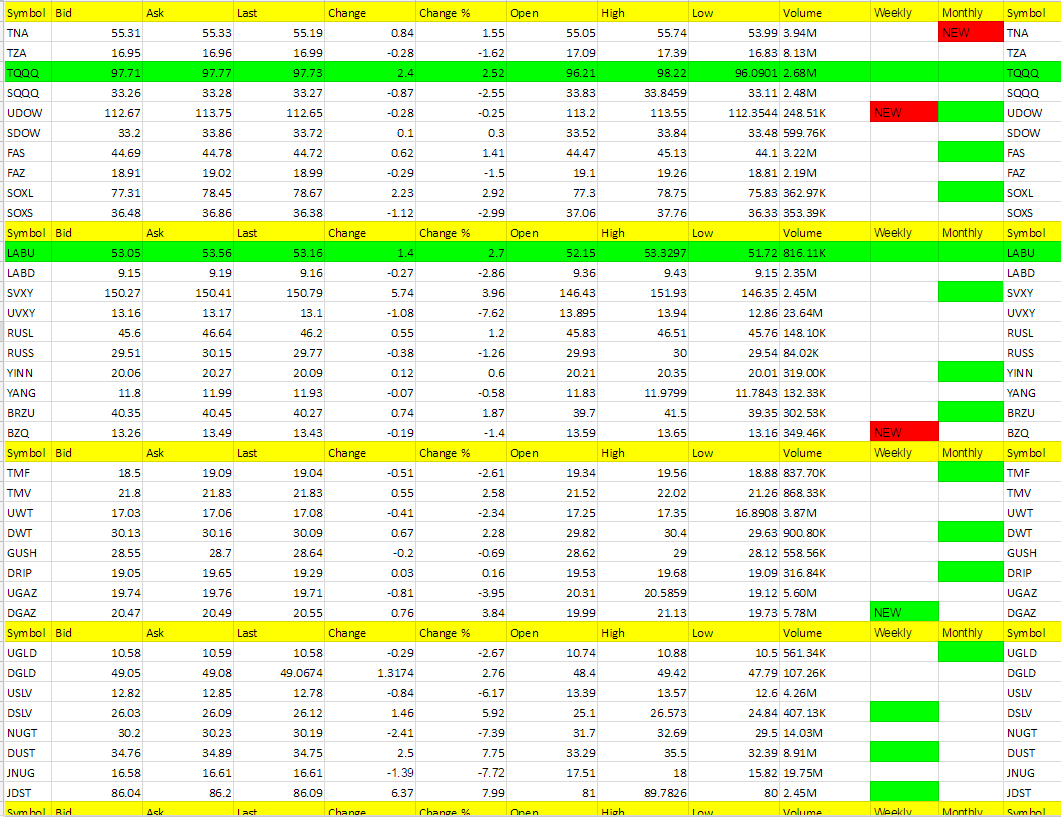

One thing we have to keep in mind as the stock market tries to figure out it is really weak overall, is the number of red weekly’s we have had trigger and now the first red monthly with TNA. TQQQ, and LABU should be next if we are going to fall.

Foreign Markets

Neutral on these right now till we get a better trend. YANG disappointed me after the lousy data out of China.

Interest Rates

We bought back into TMF as if the market can get going lower, like it seems to want to, and the Fed fails to talk up rates enough for the markets satisfaction like the market should realize, TMF should be moving up as rates fall. That’s my last stand on it.

Energy

Oil disappointed once again. I did miss the run in DWT but we will get the run in UWT back up. New rule though; only trade it if it is positive for the day.

Precious Metals and Mining Stocks

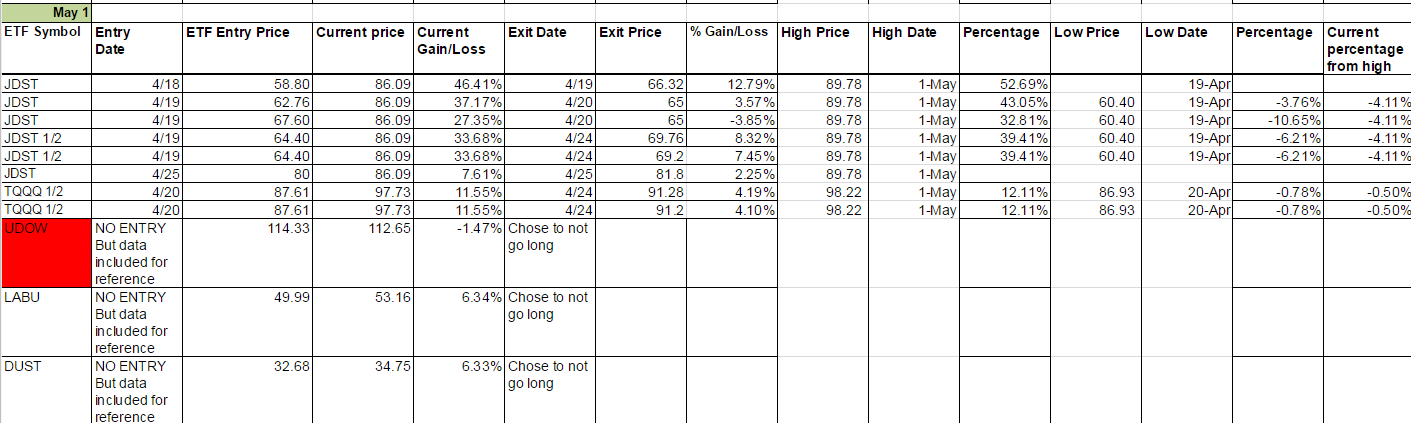

The dollar instead of breaking down broke up and that didn’t help things today. Helped JDST though. The dollar has started back down again and we’ll try and make sure it doesn’t climb over 99.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

JDST, DUST, DSLV, SVXY, DGAZ (DGAZ new green weekly)

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

JNUG, NUGT, UVXY, USLV, UGAZ, SOXS ( UDOW and BZQ turned red on the weekly and TNA red on the monthly)

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. It is also used for tracking the percentage from high to keep a stop on remaining shares. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out before typically well before they start to fall again. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities too. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long. You’ll notice in the last column on the right it says “Current percentage from high.” This is your normal stop out for any ETF where I don’t specifically call it per the Trading Rules which lists the trailing stops for each ETF. It is a Trailing Stop percentage from the high and I have noticed the pattern that the closer it gets to 5% the sooner the ETF turns red on the weekly.