ETF Trading Research 5/2/2017

Today’s Trades

Today was a good step towards making up for yesterday where I think an alien took over my body or something. But from it I think I came to some more good conclusions for the service and will be revamping the Trading Rules this week because of it.

We took some good profit from LABD today as well as some from TZA. JNUG we could have got more but got a little greedy. Actually with gold and silver as well as the dollar not cooperating fully, in hind sight we should have grabbed the decent profit when I first mentioned that. DGAZ as the new green weekly started off with a little bit of a scare but the stop was set perfectly and we rebounded to so far a 4.39% gain. We may gap up tomorrow more than the 21.52 mark or 5% for 1/2 profit and I would take that profit in the morning on 1/2 shares. Being that it is green on the weekly, remember it still could have a ways to run, but you know I like locking in profit along the way.

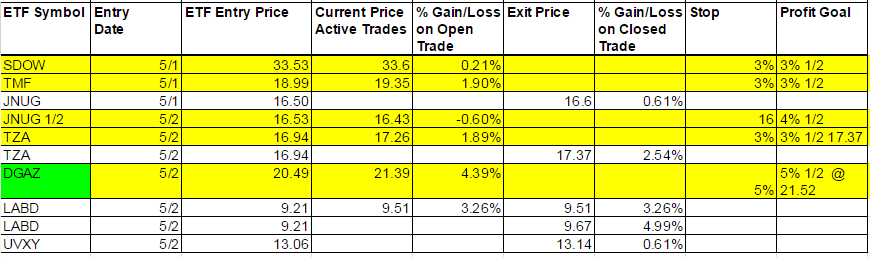

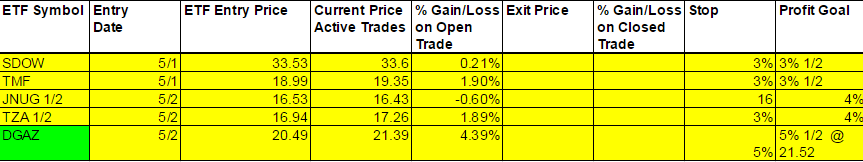

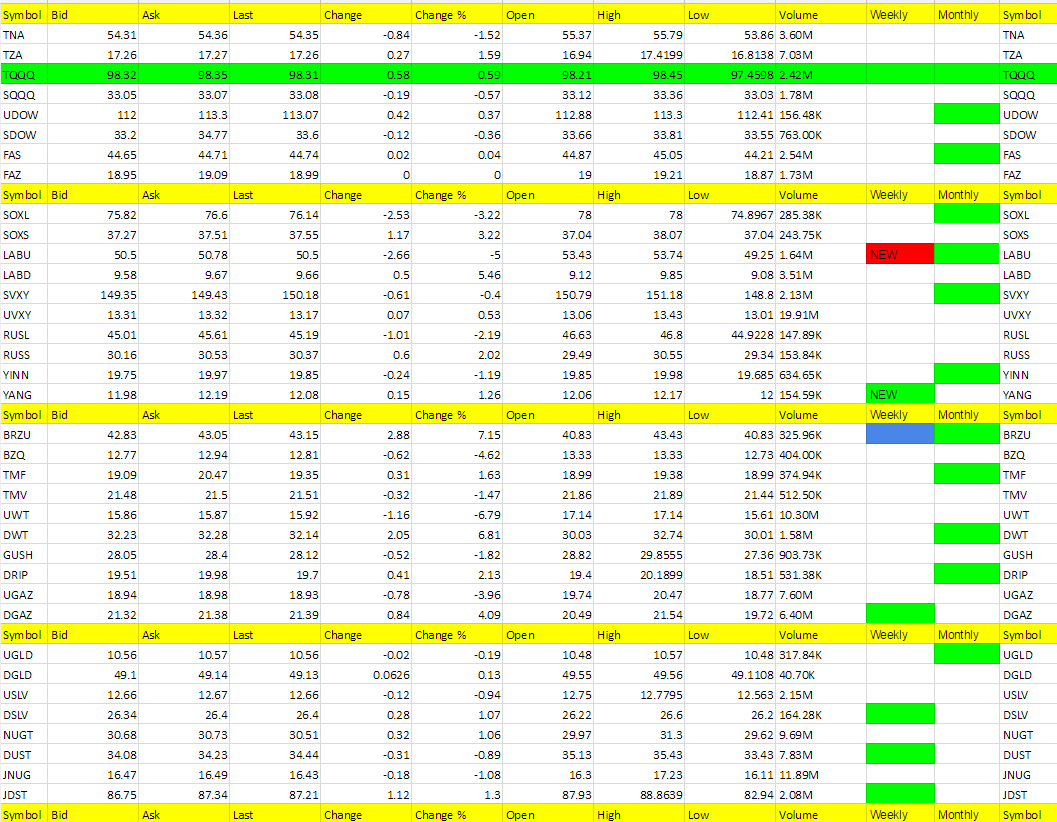

Today’s Trades – The one’s in yellow below are the one’s we are still long.

Today’s Holds

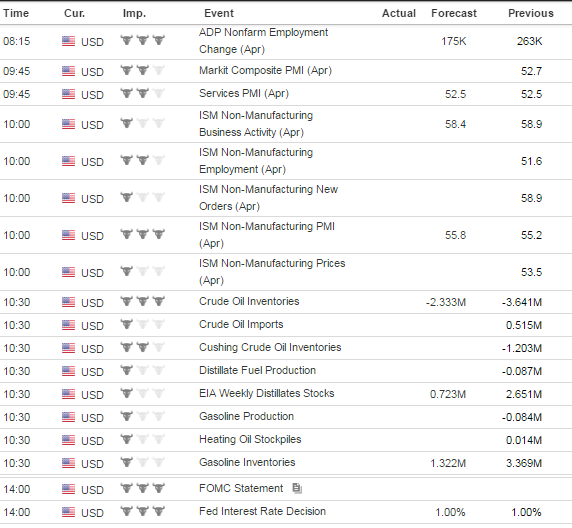

Economic Data For Tomorrow

Ton of data coming out tomorrow but none more important than not what the Fed does, as it is a given they will not raise rates tomorrow, and also what they say is what I am interested in. My guess is they will still be bullish as heck on the U.S. economy and the ADP Non-farm Employment number at 8:15 is important in that regard. But if the Fed is only looking at that data, then they are missing all the other negative data out there, including the “noisy” and lousy GDP data from Friday which was a disappointment. After the market opens ISM Non-Manufacturing PMI comes out at 10 and Crude Oil Inventories at 10:30. More on oil below. FOMC statement and Interest Rate Decision is at 2pm.

Stock Market

We did get the reversal today for the stock market, but only for the ETFs we were long, SDOW, TMF, TZA, LABD and UVXY which we profited or are in profit in all of them. We’ll take it. And maybe we get rewarded more for our risk before or after the Fed tomorrow. Because we are not green on the weekly on these, I may lock in a little profit pre-Fed just to be on the safe side. We did do that with LABU, TZA half shares and a few cents from UVXY. Apple shares moving lower should help our cause overall to accomplish more profit from these short the market ETFs tomorrow.

Foreign Markets

YANG triggered green on the weekly again. It is a buy at the open. Might want to keep an eye on RUSS now too. BRZU was up nicely today and I put it on the one to watch list. My issue though is if the markets do fall, it could take BRZU down with it.

Interest Rates

The Fed should help TMF tomorrow. Any whisper of not raising rates in JNUG will push it higher. TMF should be moving up as rates fall.

Energy

I’m proud of myself as I immediately took UWT buy off this morning. It crashed. Yes, DWT was the call as I said yesterday, but I think the tide will turn now and be confirmed with the data tomorrow. UWT was up in after hours.

Precious Metals and Mining Stocks

The dollar took a nice little tumble which got us back in JNUG, but gold and silver sure are stubborn. We will still be cautious on them and wait for the day that JDST and DUST, as well as DSLV turn red on the weekly. Then we can be more aggressive with our longs. The dollar is right at the level it was yesterday before it bounced, so keep an eye on it. Need to basically break below 98.76 now for gold to have some fun with JNUG or NUGT. NUGT did end up for the day and I know some of you are trading half NUGT and half JNUG. Not a bad way to go. We’ll keep a close eye on this as we want to be in the better performer.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

BRZU, DWT, LABD, DGAZ, SOXS (YANG new green weekly)

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

UWT, LABU, BZQ, UGAZ, SOXL (LABU turned red on the weekly)

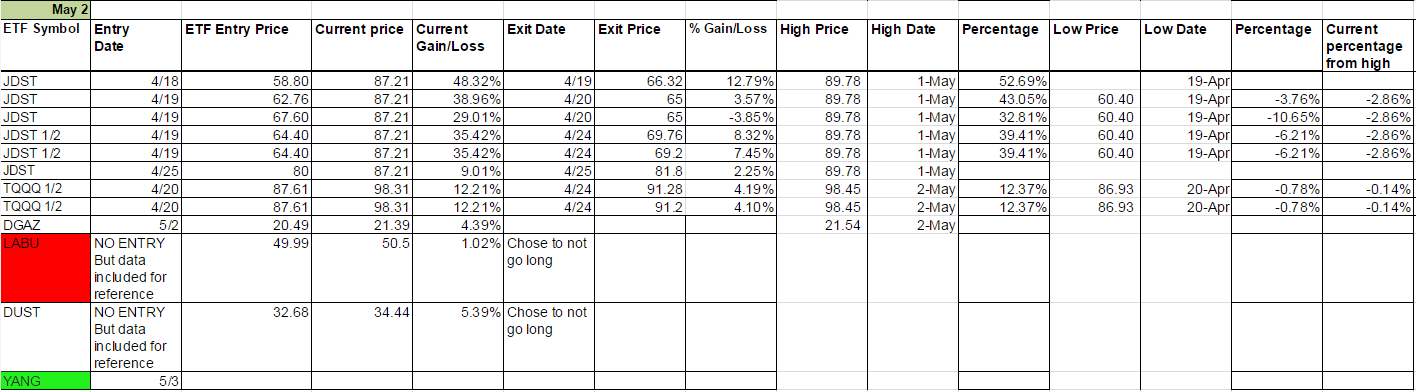

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. It is also used for tracking the percentage from high to keep a stop on remaining shares. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out before typically well before they start to fall again. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities too. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long. You’ll notice in the last column on the right it says “Current percentage from high.” This is your normal stop out for any ETF where I don’t specifically call it per the Trading Rules which lists the trailing stops for each ETF. It is a Trailing Stop percentage from the high and I have noticed the pattern that the closer it gets to 5% the sooner the ETF turns red on the weekly.