ETF Trading Research 6/13/2019

Why am I short right now, end of day? Because a little bounce up at the end of the day doesn’t change the facts;

-

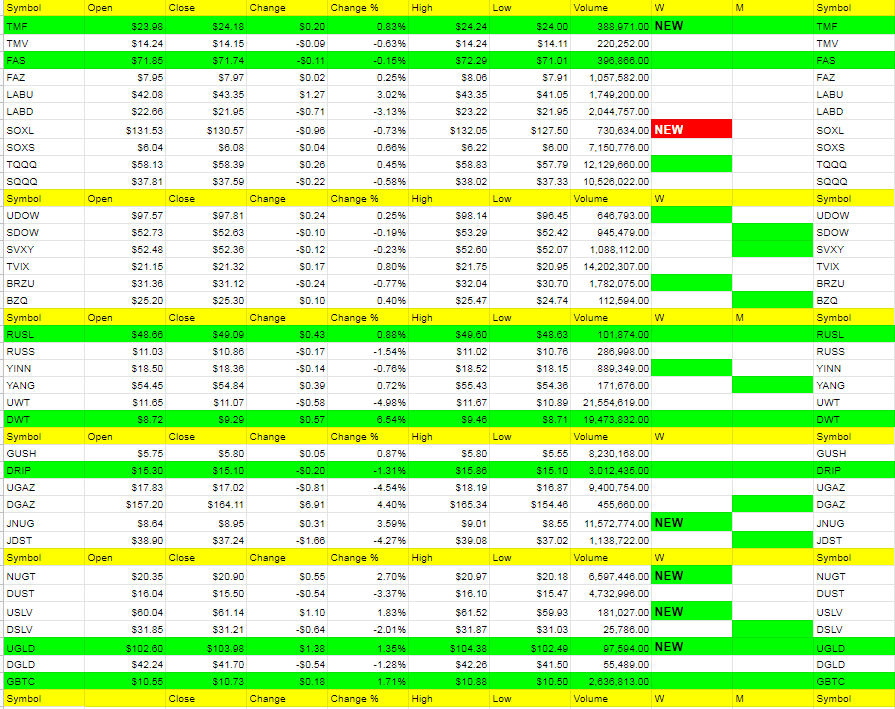

- TMF signaled a long in the nightly report. I don’t ignore TMF’s signals.

- TVIX is showing resilience and I believe suppressed right now.

- My nightly report never had SVXY become a long. First time all year. Normally it leads the rest of the market to get long.

- DWT was moving up big time yesterday and is only being hit now because of the tanker being shot up and Pompeo’s response. Could be something there or nothing at all since Japan’s not happy. I think overall the data for oil says sell oil here and buy DWT and oil moving lower will get DWT moving higher. UWT well off its highs.

- SOXL triggered a sell today on the 2 moves up by SOXS.

- I have us falling potentially till mid July post Fed and I see selling into the Fed. Any price movement up here we will short more most likely and hopefully get some sell further sell signals like we got with SOXL.

- /ES topped out at 2911.50 and hasn’t come close to breaking micro resistance of 2897 till end of day in what I see as a fake move with all the above.

- Pompeo rhetoric is keeping me out of DWT but market didn’t like it when it heard it. More could come.

- USD/JPY is in the red and couldn’t get going to help the market today. Seems exhausted. Below 108 is confirmation of a bigger bear move taking place.

- Tariff issues not resolved with China who has their hands full with the people in Hong Kong demonstrating and not wanting extradition agreements. This could get worse too. Plus Taiwan is always an issue.

- Fed is going to lower rates most likely, which is already priced in to this market. And if they don’t lower rates, market will tank. I don’t think they lower by .50 to give Trump the glory he wants in telling the Fed what to do.

Will look for /VX to begin rising here. A nice move down should be bought up for the run to 3000. I don’t see that run happening now. Only question I have is where we bottom out to buy that run. Hopefully we will get some doubles, triples and home runs here soon into the Fed.

What is the bullish case for the market?

- /ES price moving up

- Fed talking up lower rates.

- Trump sometimes saying things that investors believe.

- Our nightly report shows buys still in many long the market ETFs.

- Central banks buying tech stocks to support the market.

- Oil move up is somewhat bullish for market, but was triggered by a negative event.

There isn’t much that makes the bull case right now versus the bear case. So we are halfway short on most ETFs.

UGAZ broke to 16.87 today and nat gas hit a 2.321 low with a 52 week low of 2.305. We break that low and 2.00 is on deck possibly. When will we get long nat gas? When we hit the 2.00 area or when DGAZ goes to a sell. The last signal was a false one but I think the next one in a DGAZ sell, will be one to hold onto through thick and thin.

Miners we did well with while waiting for the market to give us a clue. Silver too. We easily could go higher there, especially with my signals below, but want to see if we can get a better trade setups short into the Fed. Miners and gold would get hit like the long the market ETFs if the Fed disappoints.