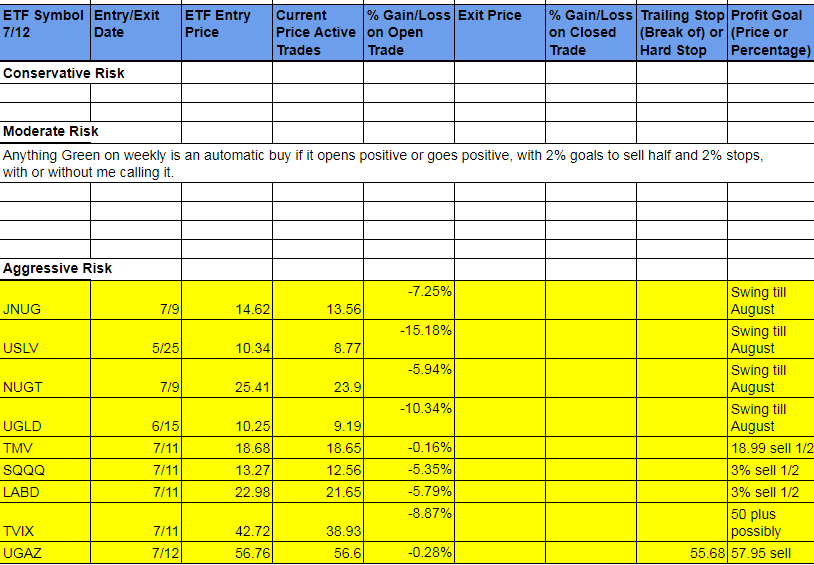

ETF Trading Research 7/12/2018

July Results (closed trades)

7/2 16.80%

7/3 3.04%

7/5 4.45%

7/6 -12.75

7/9 – 8.76

7/10 -2.75

7/11 11.88

7/12 ——

Running Total: 11.91%

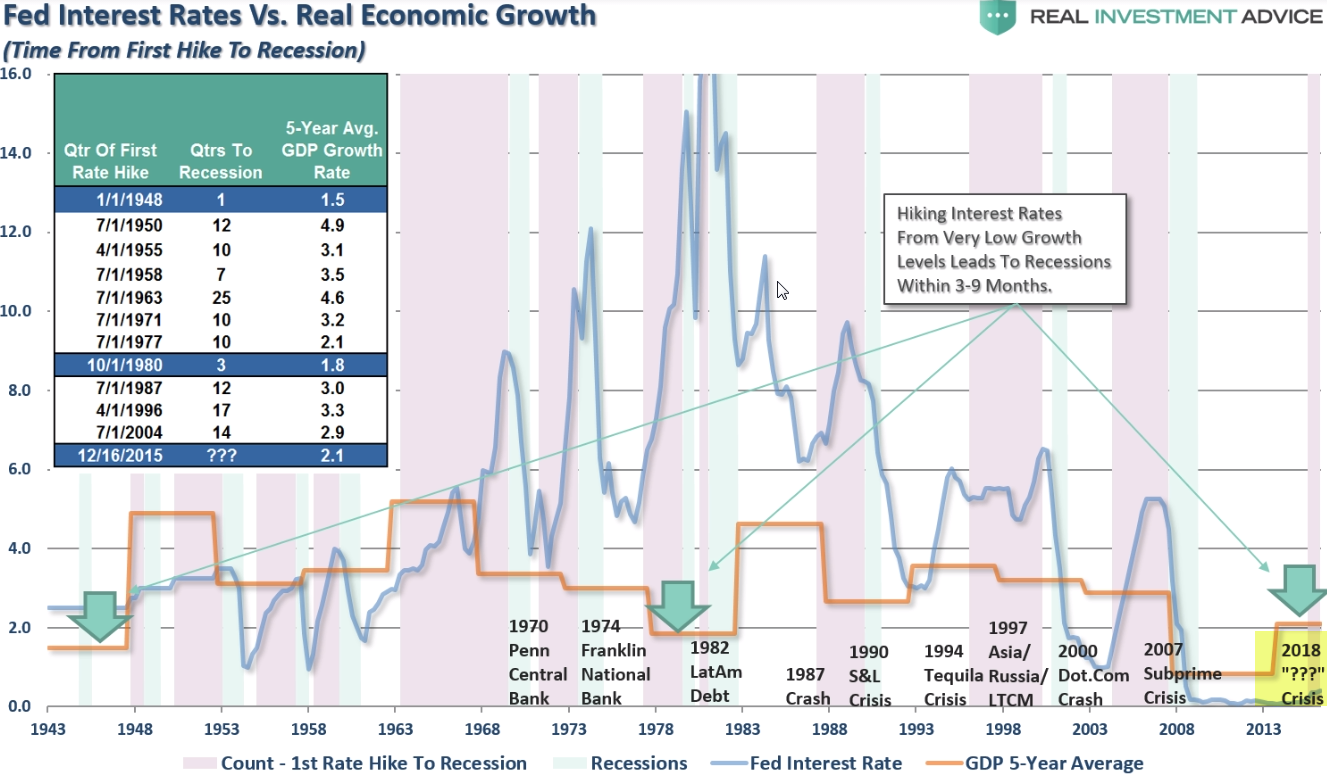

Yesterday I said that I am banking on the Fed reduction coming to push the markets lower and that with our current positions short the market, I might be a hair early. Still in that camp obviously.

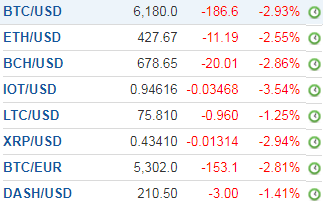

One thing that is showing up is bitcoin falling and a sign of liquidity drying up. This might be a leading indicator as the markets get ready for a pretty decent fall. October I see the bigger fall but after the micro fall into next week, run to 3000+ and crash thereafter.

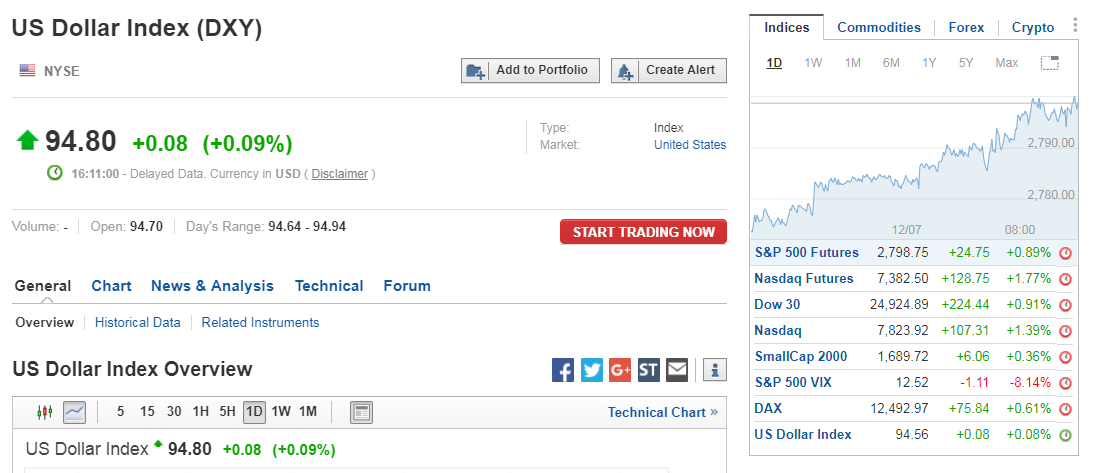

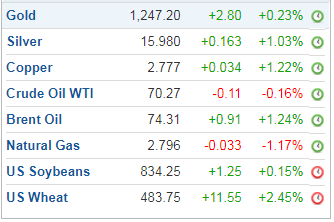

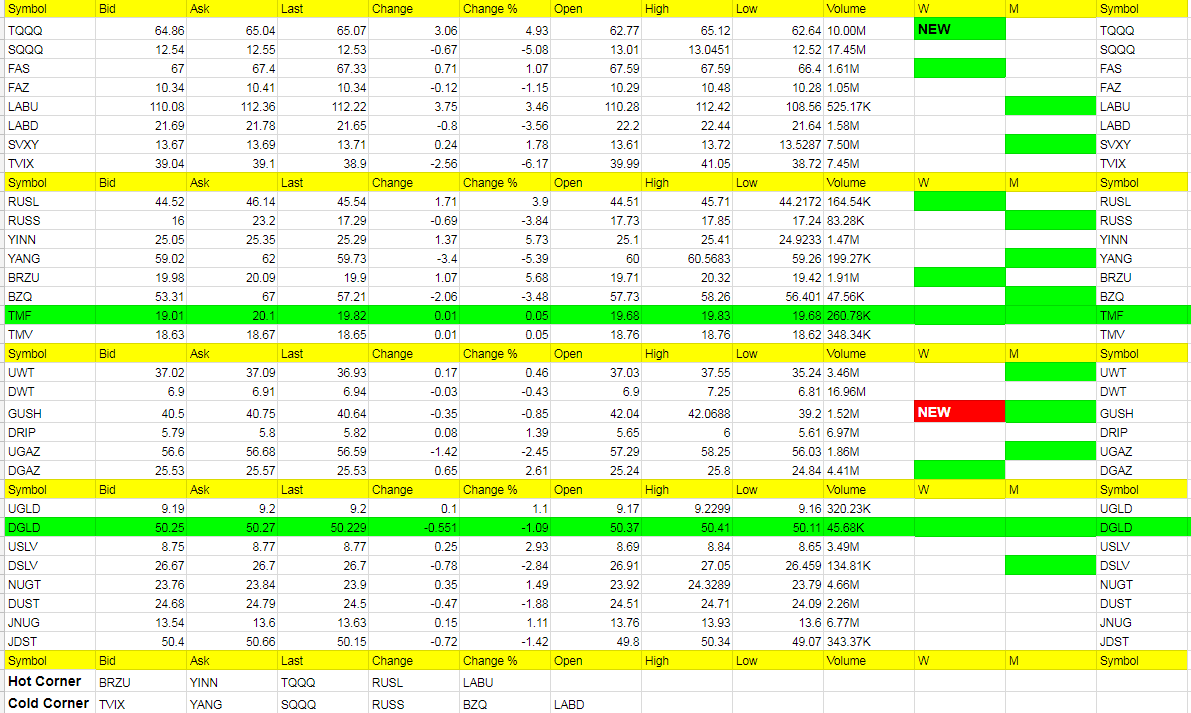

NOTE: We did hit a lower low in TVIX which I said we might as we approach or surpass 2800 in /ES or just simply because that is what market makers do. We did not however see a corresponding blow off top in /ES that may or may not still be coming. I have not added personally to my TVIX holdings buy will on any weakness tomorrow. /ES got to 2801 and USD/JPY only hovered around 112.50 all day. Below 112.45 then 112.35 and that should push markets lower. Then hopefully below 111. /ES down to 2756 area and make a decision if we fall further into the end of the month like last two months and where that might bottom out to get long for the BIGGER move up than what we have seen. TQQQ finally turned green on the weekly today, but don’t think it lasts long. FAS or TQQQ goes red on the weekly it will confirm the move down that should have already started. Notice also oil is weaker and the more it falls the more the market should follow suit and buying the dip in DWT and DRIP should pay out now that GUSH has hit a red on the weekly. Watch that USD/JPY closely for market clues still.

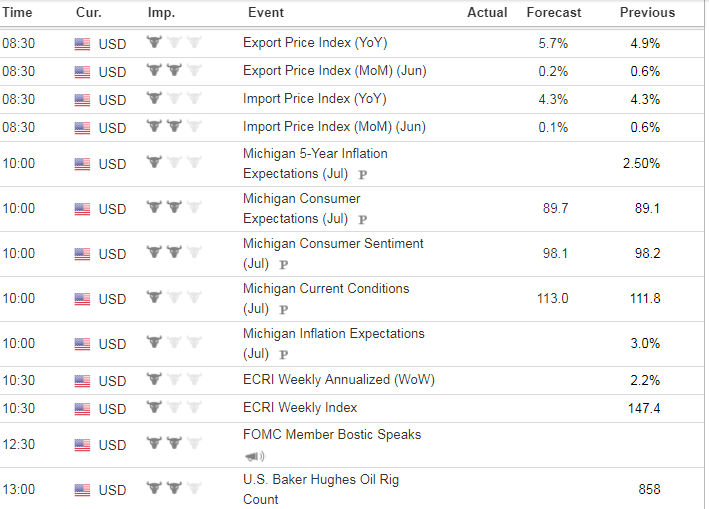

Economic Data For Tomorrow

Not a lot of data form tomorrow that is market moving too much.

http://www.investing.com/economic-calendar/

These are the ETFs that have turned green on the weekly and show a trend has developed. Your best way to profit with the service is stick with the green weekly trend each day and take profit while using a trailing stops. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long. This will be tracked more when we automate the service.

Sell half shares on a spike up on any ETF you are long, even if goal is higher. Spikes higher are almost always followed by moves in the opposite direction. Try and get out with a market order quickly before the quick move back lower. Lock in that profit!

New way to trade beaten down ETFs; The way that trade would work, and I really think it should be a rule from now on NOT to trade anything trending down until it reverses, is we would buy at the open if it is POSITIVE or GOES POSITIVE during the day. Then we would look to profit on 1/2 shares over and over, day after day until we get the red weekly signal on the opposite trade that could turn into bigger profits. The stop would be if it goes negative for the day. The rule of keeping a stop if it goes negative for the day is a must. Lastly for this type of trading we need to not be afraid to get back in if it goes positive once again. Sometimes market makers will take an ETF negative and then reverse it right higher again because they know if it goes negative many exit. So we have to be willing to risk a few in and outs when it does this up and down move around that potential stop out area so we don’t miss the ride back up. That’s just part of trading and not a big deal. But no matter what, if it breaks to yet another lower low because you didn’t get out after giving it a little more wiggle room, you are more than likely further from the original stop out when it went negative and you are out, waiting for it to go positive again before you get back in. You are simply buying into strength.

For those of you new here, I most of the time have the ETF Trading Research report out by 8PM PDT, and it comes by an RSS feed, but you can look at the report here sometimes before you get it in your mailbox; https://illusionsofwealth.com/category/etf-blogs/ This is also the same link if there are any technical difficulties.