ETF Trading Research 7/2/2018

Happy 84th Birthday Dad!

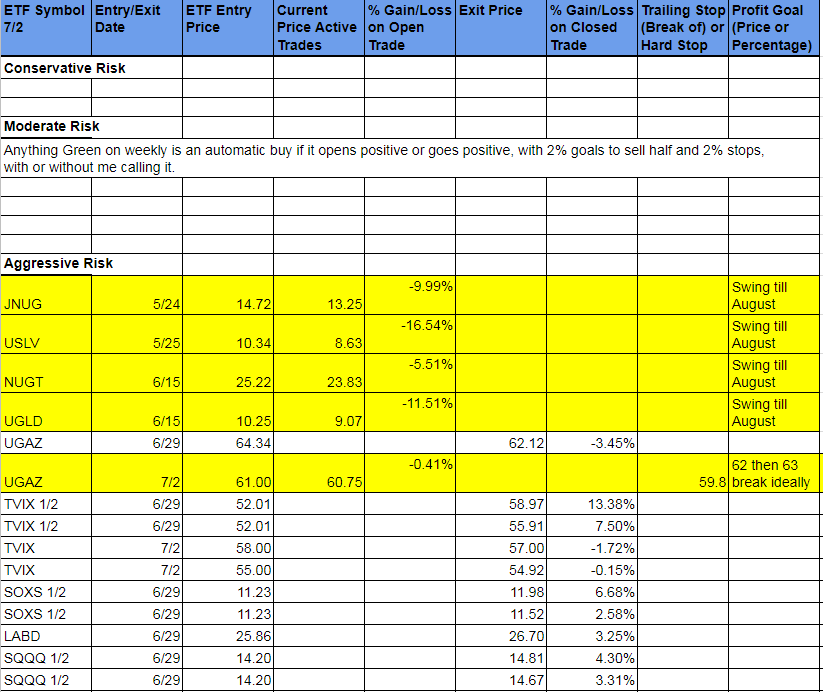

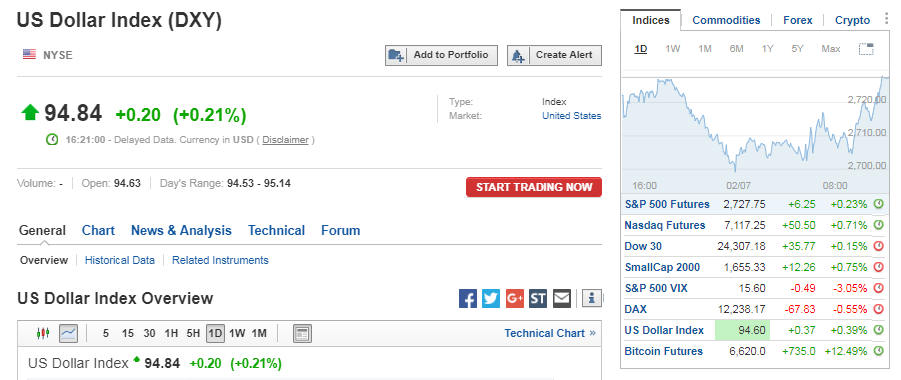

We woke up to mostly great news with the markets lower, and sold half shares into that news, then timed the sell on the other half at the open to maximize as much as we could out of the trade. I then said if aggressive you could buy into 1/2 shares of some ETFs that are long the market, but didn’t expect that big a move off the lows, from /ES 2700. This is the second time where /ES has bounced although we didn’t break as low as the last time. There is no doubt in my mind central banks are involved in the market. Trying to read them goes like this, so far: buy the dip anytime we break lower at support levels, with stops. But the longer this type of fake market moves higher goes on, the more we are setting ourselves up for a bigger decline. YINN was down big today and BRZU with RUSL lower. Foreign markets aren’t liking the stronger dollar. It’s just a matter of time it seems that either A. we get a dollar decline that will help all markets U.S. and foreign rise along with metals, or B., we get a mini crash of sorts. I will lean short the market for now, and we’ll try and get at least one more short trade in below 2700 in /ES and from there, debate on where to go long. If we break 2700, it may be an ugly time for the markets. I am happy to trade both sides still. But lean short. Maybe tomorrow we get TVIX at 50 or lower. I’ll call it live, unless pre-market gets us an opportunity. However, tomorrow is a short trading day, so all the action will occur early and we may want to go home flat as we close 1:00pm PDT.

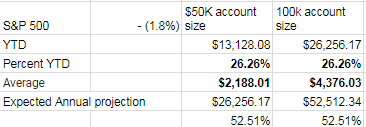

July Results

7/2 – 16.80% on closed trades

The numbers are in for the first half and we are up 26.26% so far this year (52.51% annualized) and if we did one thing that we should make automatic and not keep a -5% stop on closed trades, we would be up 41.54% and 83.07% annualized. Note to Doug; Keep stops! The automated service will do this automatically. No questions asked. And it will also improve the upside.

For new subscribers, I keep a running total to keep me in check. Just know that we don’t normally hold ETFs for losses like with metals and miners as we are now, but sentiment is where typically they bounce and bounce hard. Holding till end of August most likely.

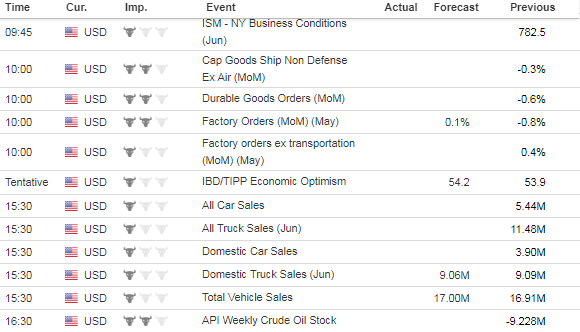

Economic Data For Tomorrow

Durable Goods Orders tomorrow. Won’t mean much.

http://www.investing.com/economic-calendar/

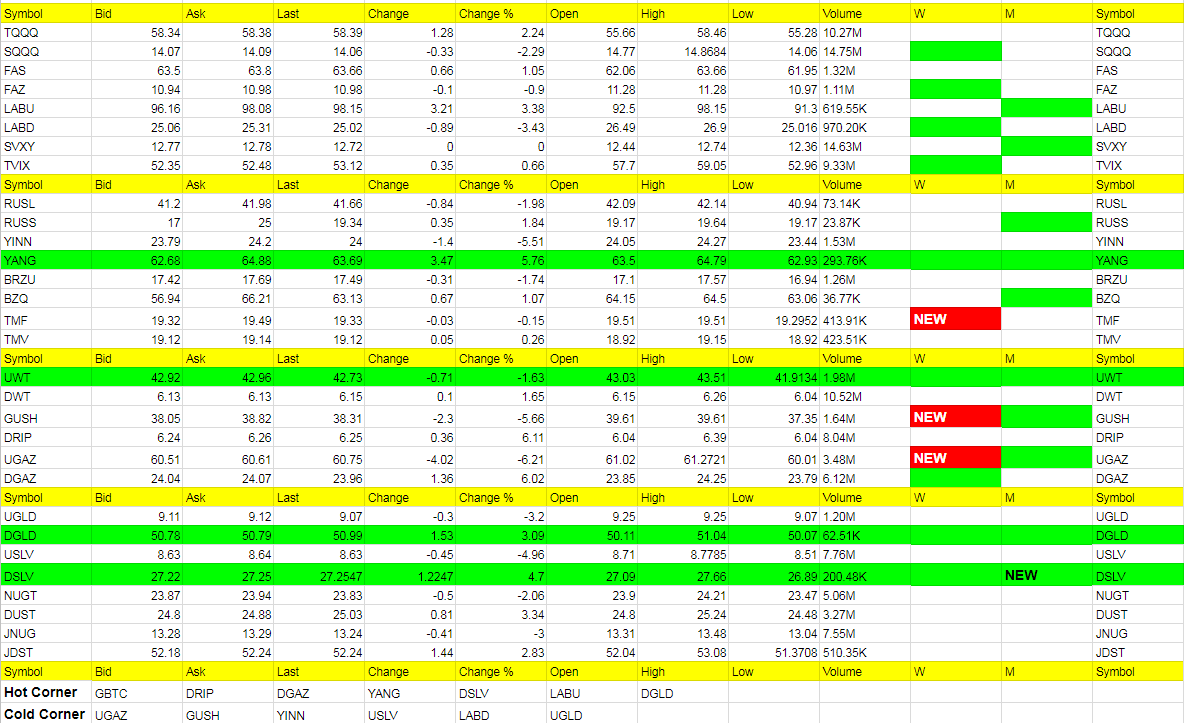

These are the ETFs that have turned green on the weekly and show a trend has developed. Your best way to profit with the service is stick with the green weekly trend each day and take profit while using a trailing stops. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long. This will be tracked more when we automate the service.

Sell half shares on a spike up on any ETF you are long, even if goal is higher. Spikes higher are almost always followed by moves in the opposite direction. Try and get out with a market order quickly before the quick move back lower. Lock in that profit!

New way to trade beaten down ETFs; The way that trade would work, and I really think it should be a rule from now on NOT to trade anything trending down until it reverses, is we would buy at the open if it is POSITIVE or GOES POSITIVE during the day. Then we would look to profit on 1/2 shares over and over, day after day until we get the red weekly signal on the opposite trade that could turn into bigger profits. The stop would be if it goes negative for the day. The rule of keeping a stop if it goes negative for the day is a must. Lastly for this type of trading we need to not be afraid to get back in if it goes positive once again. Sometimes market makers will take an ETF negative and then reverse it right higher again because they know if it goes negative many exit. So we have to be willing to risk a few in and outs when it does this up and down move around that potential stop out area so we don’t miss the ride back up. That’s just part of trading and not a big deal. But no matter what, if it breaks to yet another lower low because you didn’t get out after giving it a little more wiggle room, you are more than likely further from the original stop out when it went negative and you are out, waiting for it to go positive again before you get back in. You are simply buying into strength.

For those of you new here, I most of the time have the ETF Trading Research report out by 8PM PDT, and it comes by an RSS feed, but you can look at the report here sometimes before you get it in your mailbox; https://illusionsofwealth.com/category/etf-blogs/ This is also the same link if there are any technical difficulties.