ETF Trading Research 7/10/2017

A few changes. I was surprised by SQQQ triggering with the data today as I still lean long it, but if it opens lower in the morning will sell from the mutual fund. TZA and SQQQ both seem poised to move higher and we are up nicely in TZA, so I am thinking this might be a one off false reading that extended longer because of past couple of days selling. But I won’t ignore what I “think” will occur again to what my data tells me any longer, so there it is; a red weekly. If SQQQ opens lower than tonight’s close, sell at the open and we’ll buy back another time. TZA if it opens lower than tonight’s close, sell immediately also. I am 100% not feeling good about any rallies and think we should short rallies. So any negative moves we need to lean that way still.

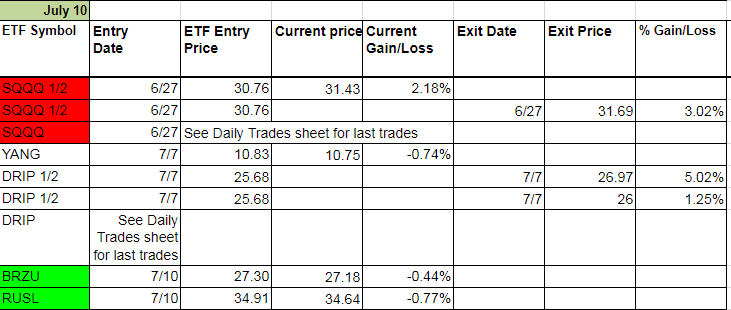

Today we tried a couple trades in DRIP which was green on the weekly and still is and DWT, but failed to move higher. Usually when an ETF opens up higher, and falls pre-market to fill the gap, it reverts back higher but it didn’t work today. DGAZ tried once and didn’t get a move there either.

But the metals and miners were the story today and after not getting shaken out we are on our way up and looks like we might have bottomed. The USD/JPY once again though was ramped up late and still over 114. We won’t be in the clear in metals and miners until we get under 114. Simple as that. But this is bottoming action. Loved what I saw today in metals and miners despite the USD/JPY fake-ness.

DWT came back today too and I think we move higher in it as we move lower in oil to low 40’s.

UVXY, SQQQ and DGAZ the new red weekly’s. If we do get one more leg down in DGAZ, then we will jump on UGAZ. New Green weekly’s are RUSL and BRZU. YANG did not get stopped out of yet. See what tomorrow brings, but a tight stop.

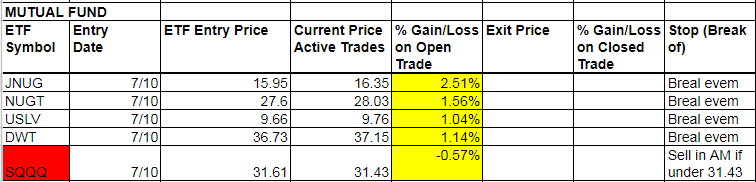

Important note on metals and miners. We had a great comeback today in NUGT and JNUG and even USLV recovered about 5% of the loss, and URA turned positive. I am going to hold these all the way down should we falter in the morning. The USD/JPY ramping up again like this is just something I will refuse to fight any longer and want to be free to play the other side in JDST/DSLV/DGLD. This includes the Mutual Fund below. If we get out in the morning with some profit on the Mutual Fund, fine. If we lose a little in NUGT and JNUG in the table below, fine. USLV and UGLD I don’t need to let fall below 1200 and lower in silver again despite what I may “think.” We got a gift today and tomorrow I am leery of simply because of one thing; USD/JPY. It is literally killing me right now. While yes, we are still bottoming, and yes, these will all soar soon enough, because we have not had the sell signal yet in JDST/DSLV/DGLD, we have to be cautious. I should have waited for that signal, which I thought would come today but after further analysis it did not, to start a Mutual Fund. If by some miracle we are up 1% and at the same losses below in NUGT and JNUG etc. below in the first table, and the USD/JPY is still where it is, 114.44, then I will call us out. It’s easy to get back in on a move higher if it comes. But right now I have to adhere to what is green weekly and obey the rules, not fight them. If we open down in JNUG and NUGT in the AM pre-market they are an automatic sell. This means JNUG below 16 and NUGT below 28. I will make the call pre-market. If we were to catch a break for a second day in a row, and these miners and metals move higher at the open, then we will sing our praises and still look to take some off the table and readjust until USD/JPY breaks 114 and/r JDST/DSLV/DGLD turn red on the weekly. Believe me, they will at some point.

Mutual Fund Started – I put a tight stop on these, 4 of the 5 of which are up more than 1%, but only because of the USD/JPY issue.

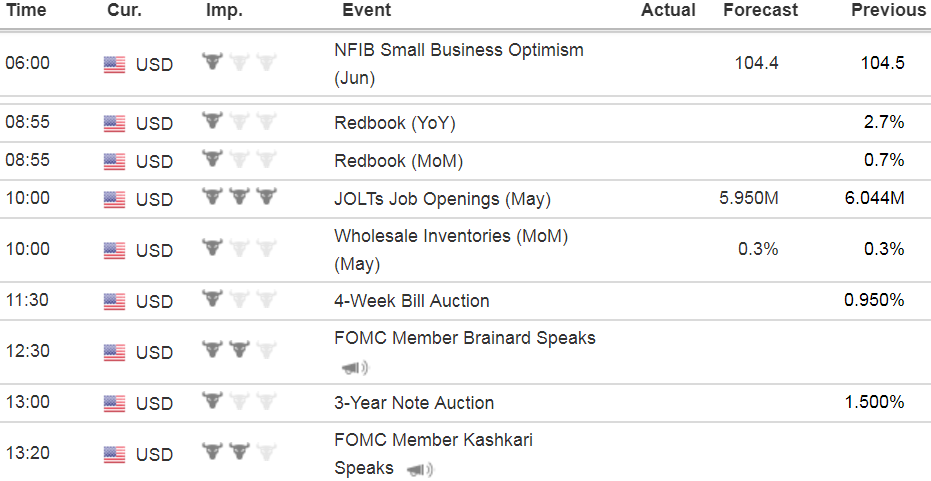

Economic Data For Tomorrow

Interest Rates

TMF I was going to add to the Mutual Fund, but will wait until TMV turns red on the weekly.

Energy

While DRIP is still green on the weekly, DWT has not confirmed this just yet. We will lean slightly negative on oil at the present time. Presently it is up 30 cents to 44.70.

Nat Gas we are neutral right now with DGAZ having turned red on the weekly. This typically means we get a move in the opposite direction. Was expecting one more low in Nat Gas though but now that has to be questioned. Would still like to see 2.80 breached and now have to just be a little cautious both ways till we get a green weekly confirmation.

Precious Metals and Mining Stocks

This is just getting ridiculous for the USD/JPY now. You can see how close we came to breaking down and each time the 114 level was supported. And overnight once again we get a pop higher to 114.41 at present. Where will this stop? How hard and fast will it crash? What can be done to stop it? Gold is down -2.60 and Silver -0.09. While we did have a great bounce today, We absolutely have to get the USD/JPY to fall at this point. It puts in jeopardy the rally if it does’t, as well as the mutual fund. Everything was lined up for the bounce today, but the last thing I want to do is head down again because of one indicator that is NOT cooperating. Real tough situation to be in once again after such a great turnaround today. Will monitor tomorrow.

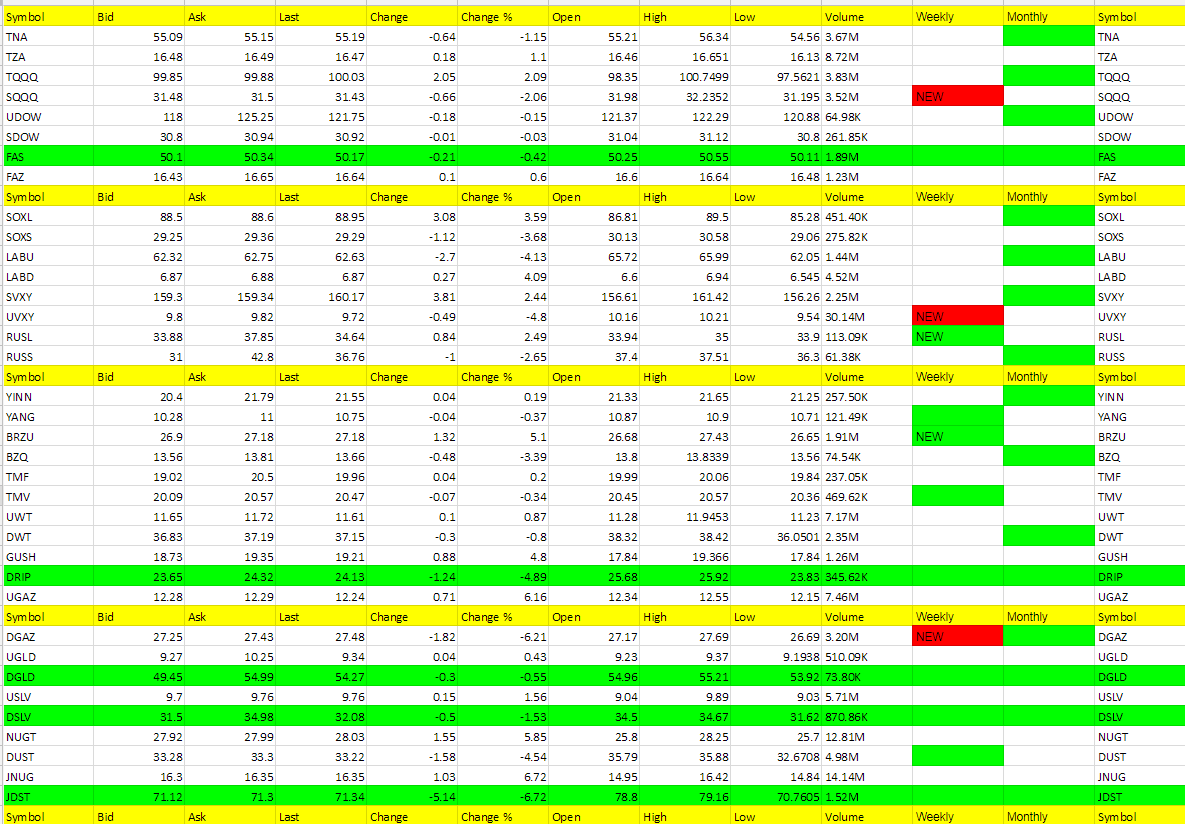

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

JNUG, UGAZ, NUGT, BRZU, GUSH, LABD, SOXL (RUSL, BRZU new green on the weekly)

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

JDST, DGAZ, DRIP, UVXY, DUST, LABu, SOXS, BZQ (SQQQ, UVXY, DGAZ new red on the weekly)

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out typically well before they start to fall again or turn red on the weekly. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long.