ETF Trading Research 9/1/2016

Trading Rules https://illusionsofwealth.com/etf-trading-rules/

Suggestions for Improvement

I’m always looking for ways to improve the service and will take any of them under consideration. Feel free to email info@illusionsofwealth.com

Market Synopsis Today

I’m being a little stubborn on the short the market ETFs and the main reason is I have seen this beginning of a reversal trend change many times before and whenever I bail early, the next day it reverses back up. The main reason for this is market makers know the turning points as well as anyone, and they love to profit and get paid to profit and I have to play their game. It won’t always work but everything we have seen has led up to exactly where we are today and it’s not pretty for the markets. In the meantime as we wait to profit from these trades we are currently in, I do realize that the market can reverse tomorrow on a good jobs report and we’ll be stopped out. I hate actually the fact we are going into a long holiday weekend as the market typically performs well heading into it (not conspiracy theory that the market gods want everyone to talk positively about the markets, but just an observation).

With that in mind, I’ll take the risk this time as everything seems to point to the short direction. See stops below in case the report is good and conservative/new traders wait for the next call.

Today’s Trade Alert and Trade Updates

If new to the service, get used to how things work and make sure you understand the Trading Rules above. Not all calls will be winners and the number one rule is to keep a stop.

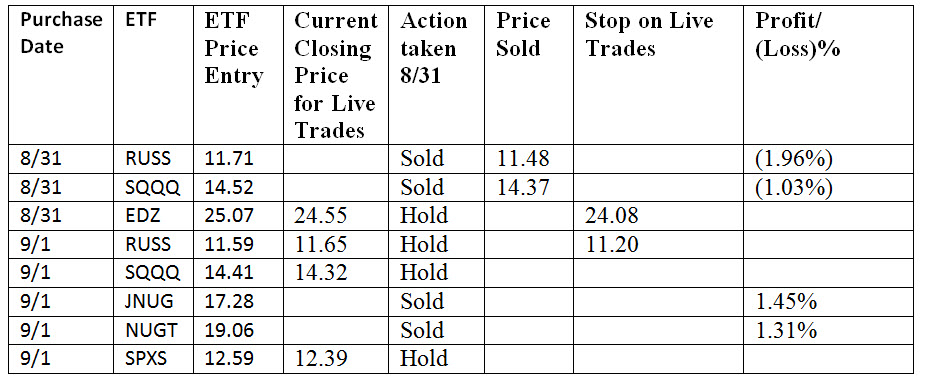

We had some stops hit today, new trades and re-entries today as well as two scalps. Perhaps I over-traded today, so even with that I have to keep myself in check. No real damage though overall and that’s ok as we go for some double digit returns which we have had each week with the service.

After hours we had some of these bounce up a few cents and that’s good. Futures are still weak at 2166.25. 2152.75 is our next target to break below and then the fun can begin. I hope a strong unemployment report doesn’t get in our way. Yes, I said the word hope, but the trend is definitely taking hold here.

You can find the live Unemployment report come through here: http://www.investing.com/economic-calendar/

Stock Market

We did get a lower low in the markets today, but the trend came to an end and we couldn’t get back to a further decline. I think investors were hesitant to carry shorts into the unemployment report tomorrow.

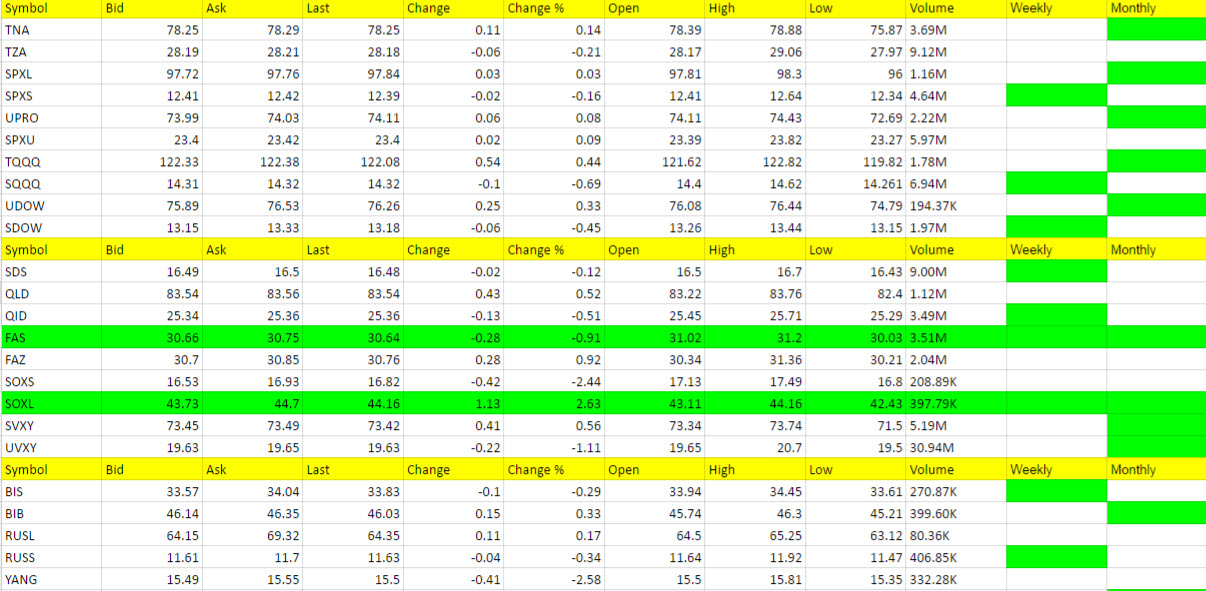

The bullish case: Please note we still need FAZ and SOXS to turn red on the weekly for me to be even more bearish. But more triggered green on the weekly today with that dip so we have to lean bearish into tomorrows data.

Call: Same as yesterday despite the whipsaw effect. We got a little more proof of market weakness and made a few trades to that regard with tight a little looser stops. If the unemployment data is good I will want to exit all trades and regroup after the holiday. I have to question though that if the data is good now, does it matter if the trend is lower? The jury is out, but if the jobs data is good and the market moves higher, but then for some reverses, I may re-enter once again as I can clearly see this trend lower developing. We are fighting a very big bull market as you can see from the chart and it will take a bit more to shake off the bulls and get some selling going.

If we can get to the 2100 level, that would be first resistance when we zoom out a bit.

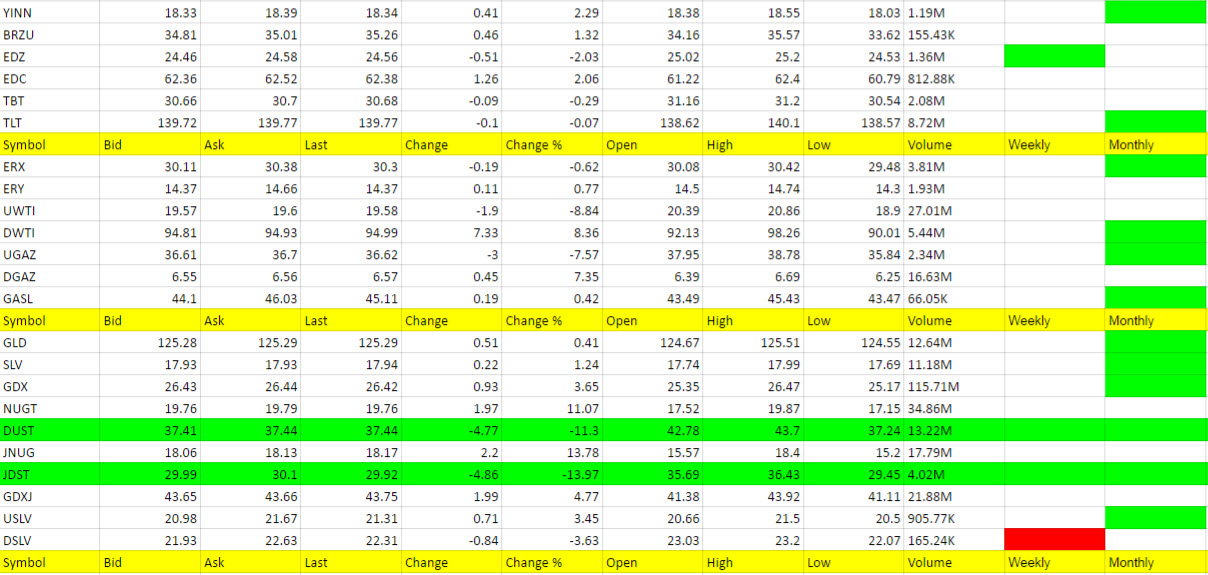

Foreign Markets

RUSS and EDZ need YANG to join the picture if we are to get the 10% plus moves of the past. Right now it is a little bit of a struggle with them but I am holding on for a move still and just feel I have to give it a chance.

Interest Rates

TBT and TLT still churning and no call.

Energy

DGAZ will be the one to watch after today’s report. With the strength UGAZ has had I didn’t want to make a call and even if I did DGAZ would have done nothing after the quick run up in price.

The jobs report tomorrow should trigger something in UWTI or DWTI but will wait for the rig count first.

GASL no call as GASX was green for some of the day but gave up that gain. Again, GASX is one I watch and may trade but I don’t recommend it for most and leave it off the ETF daily analysis for that reason as it is thinly traded and difficult to profit from. I mention it here as some traders may want to take a chance if it hits a trend, but I will not officially call it.

Precious Metals and Mining Stocks

We are doing pretty good with the micro call in miners now, taking profit from both sides. On a reversal of trend however, I only scalp that trade and today we managed to do so.

No call at present but jobs report will trigger something.

Other Calls

From time to time I will be adding individual ETFs that have triggered long or short based on market trends. These may or may not be leveraged. These types of trades will be more for longer term swing trades for IRA’s where we can catch a good directional rise. I care not what the overall market is doing with these calls and will provide entry and exit strategies.