ETF Trading Research 9/7/2017

For those of you new here, I most of the time have the ETF Trading Research report out by 8PM PDT, and it comes by an RSS feed, but you can look at the report here sometimes before you get it in your mailbox; https://illusionsofwealth.com/category/etf-blogs/

This is also the same link if there are any technical difficulties.

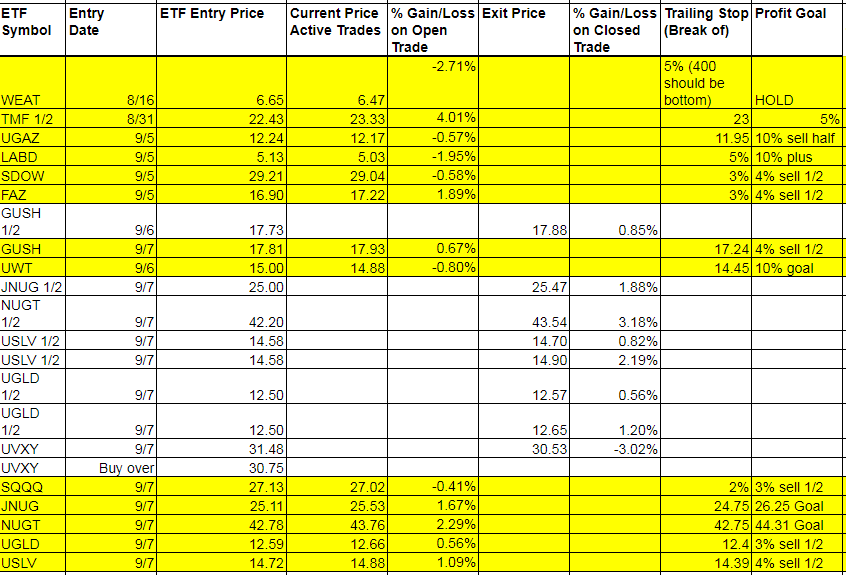

Today’s Trades and Current Positions (highlighted in yellow):

Was a fun day overall. Still long UGAZ, GUSH, UWT, and a few short the market ETFs, of which FAZ and TMF are only ones in profit. GUSH we had stopped out last half with profit before the smackdown, and bought back in and over 18 here could take off. UWT stopped out but bought back in same price and are only down 12 cents.

Metals and miners we rode higher in the AM, sold off 1/2 near the top on the big spike down in USD/JPY, bought back those half shares after the Trump comments on the debt ceiling and are sitting on decent profit.

Good ol President Trump wants to eliminate the debt ceiling. I do believe we have jumped the shark (to use another Fonz term).

There was a saying I saw today regarding the need for inflation. “Determine what is best for the government and know that is what the powers are working to make happen. Inflation is what is best for a government with enormous debt.”

Ever stop and ask yourself why the Fed wants 2% inflation? Why does anyone want to pay more for things? Why is deflation viewed as bad and someone like former Fed Chairman Ben Bernanke going so far as to write a paper on how deflation won’t ever happen here? Wouldn’t you like to pay less for things? Nope. That’s not what keeps the game going for the Fed and government in their ponzi scheme. As long as you can keep adding money to the pile, just like Bernie Madoff, the game can continue. Until it doesn’t. But while the likes of Rickards, Ron Paul, Peter Schiff and more keep pounding the table on dollar death, they have and will miss out on great opportunities which we traders capitalize on. As traders we don’t have to discuss inflation and deflation and what’s going to happen next. We trade with the market and take our profit. The glass is half full or half empty? I don’t know. I drink what’s in the glass and ask for another from the bartender as we celebrate our profits in trading. I wrote the “Make Trading Fun Again” email to re-frame the thinking of most when it comes to growing one’s wealth. We are taught one way to think about investing, buy and hold, but in our schools never taught to think for ourselves about investing if we were taught anything at all. That’s why I wrote my Illusions of Wealth book. One must take control moving forward, or be left in the dust in saving for retirement or maintaining wealth in retirement.

Rickards, Schiff and the other’s will eventually be right. They can then take credit for being right. Who cares? I personally try not to be one sided, but help traders profit. I have a niche that not too many have and a set of rules that work. I had a new subscriber write this today; I am extremely happy with your service. “Your trading rules have taught me to get out of bad habits. And I have been profiting from Day 1 of signing up for your service.” That’s what it’s all about. That is the music to my ears.

If only someone taught me 19 years ago the best way to trade, I wouldn’t be sitting here typing. I have made every mistake possible, lol. I make fewer and fewer but still human and realize losses are a part of trading. Every loss I look to get back, not in the same ETF I lost in, but one that is going in my favor. Sitting on a loss and expecting a good outcome isn’t how to win at this game. Taking profit and catching trends in your direction is, with stops if wrong.

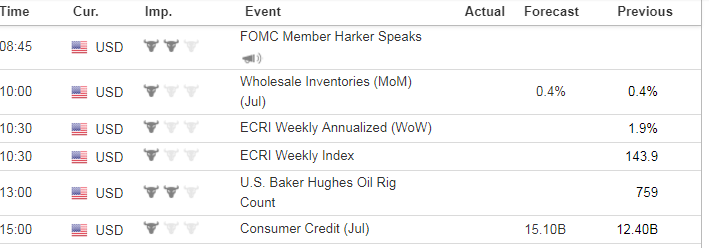

Economic Data For Tomorrow

Not a lot of data tomorrow. 5th Fed member speaking this week but no noise out of the Fed doing anything to the markets.

http://www.investing.com/economic-calendar/

GUSH we got stopped out of and it fell further, and we bought into the rise back up and it is sitting at 18 after hours. UWT still trying to figure out what it wants to do. Bullish both.

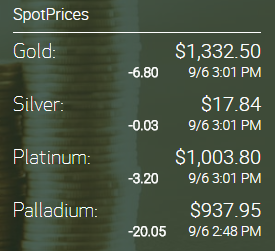

Precious Metals and Mining Stocks

We used the Trading Rules and entered metals and miners at the open and the trade has worked out fine thus far. As they move up in price I will raise the stops. We’ll see what carryover there is overnight and put our goal now at gold 1370 for this run. If we get there, great. If we don’t, we will stop out with decent profit I’m sure. Lot’s of negative things going on that make us bullish. By the way, I am always one to admit when I miss something. Last Friday and again Monday we could have used the same strategy we used today, but didn’t. The only reason I wouldn’t is because for some reason that day something entered my brain and told it to ignore my rules. I don’t know why it does that, but admit it does sometimes. While we did catch JDST for some profit, we missed some easy profit on Friday and Monday, whether we held or not. The rules work. Just have to use them. Sometimes price action tells us otherwise and that’s why we keep moving out stops up to protect profit. But as long as we are green on the weekly, it makes sense to keep on trading this move long.

Yesterday

WHEAT – Nothing changed with wheat bullishness. Took the day off.

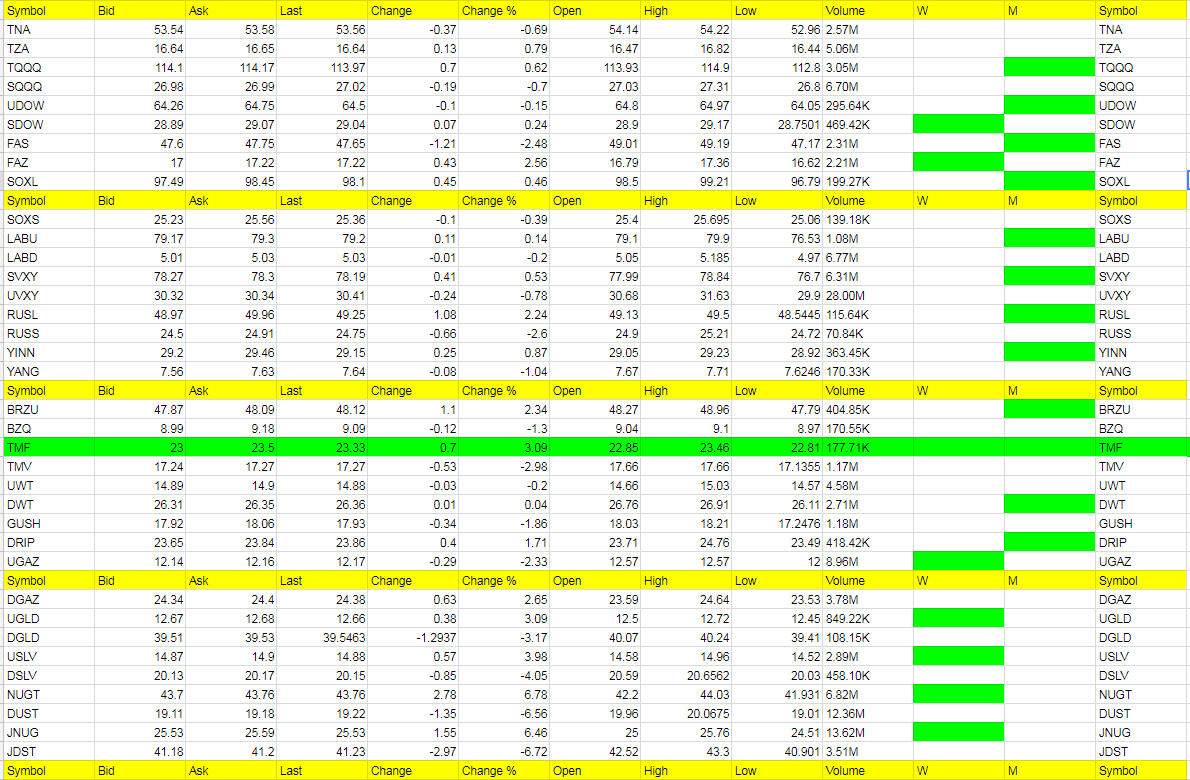

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

NUGT, JNUG, USLV, UGLD

Cold Corner (the biggest move lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

DUST, JDST, DGLD, TMV

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out typically well before they start to fall again or turn red on the weekly. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long.

Sell half shares on a spike up on any ETF you are long, even if goal is higher. Spikes higher are almost always followed by moves in the opposite direction. Try and get out with a market order quickly before the quick move back lower. Lock in that profit!