ETF Trading Research 1/27/2019

We have the Fed this week and should get a move up in the markets into the Fed and from there we have to look south.

The Fed is rumored from a WSJ article on Friday to ease up on the reduction of their balance sheet or quantitative tightening. This sparked the market higher as well as gold, for now.

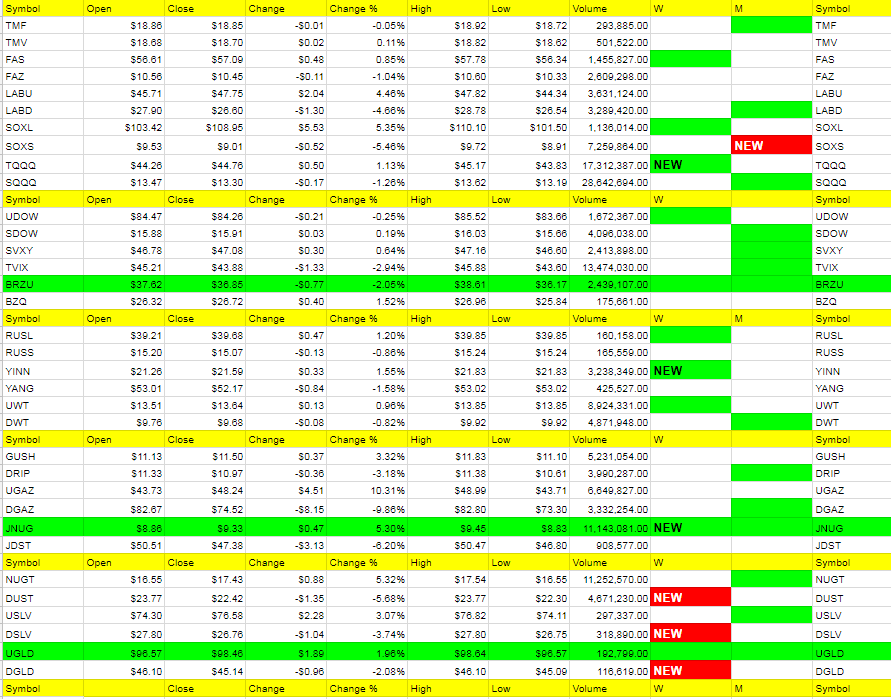

We should get the move higher on Monday in the above areas and lean long those in the pre-market. We do have gold futures up 3.05 already to 1301.15 and S&P futures down -4.25 to 2659.25.

Oil is flat and should still move with the markets.

Nat gas is down 19 cents even though most of what I read about the weather shows a cold front is still upon much of Central and East coast territory. But we do see a warming trend towards next weekend and that must be what this move down is pricing in.

Bigger picture for the markets this week is any move down should be bought at that is where the trend is now.

Gold we had signs of strength on Friday but that was news driven and has thrown us off track. Any move up from here most likely will be shorted.

Nat gas neutral for right now.

Oil we have DWT with a great chart so we’ll keep an eye on it between now and the Fed. By Wednesday it will be “sell the news” for markets and oil and most likely gold.