ETF Trading Research 1/7/2019

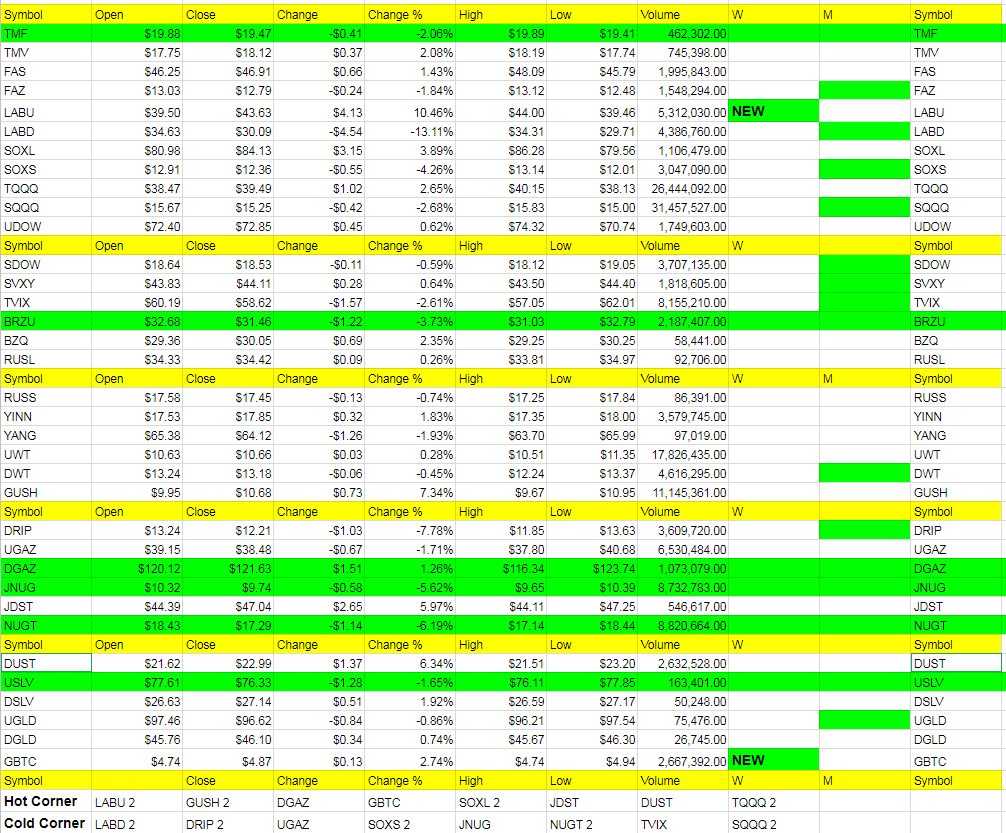

Outside of the overnight hold in UGAZ it was primarily a flat day overall. We are taking UGAZ home again and taking that risk as we are closer now to the 2.90 support area that should hold. Also took GBTC home. We leaned long all day and scalped some longs but then market started topping out so I just had us sell which was decent timing. We tried a short a little too late in TVIX and DWT end of day as there was no follow through and out with small losses.

Expect more tomorrow and either way we bottom out wherever we bottom here in the low 2500’s or even where we are now at 2550 and are headed to 2600 and possibly more, so we are in buy the dip mode now. Especially now that we have our first long in LABU trigger.

Miners have sold off two days in a row now. Thought they would get the immediate reversal up today but alas the stronger market is having people leave gold/miners. However, dollar was down today and I thought they would rebound again after starting up higher, but did not. Still think it was the right trade as they have not gone red on the weekly.

Willing to concentrate on UWT, GUSH and UGAZ long and all we are waiting on the UGAZ long is a push past 3.00 again for confirmation that a minimum 3.10 is coming. Then we look for 3.30/3.50 potential to get long DGAZ again.

Oil targets are 55 to 60 so a potential of a lot more higher right now. GUSH will follow the market higher.