ETF Trading Research 10/3/2016

Please review the Trading Rules

Today’s Trades

We had a continuation lower in the market before the manufacturing data came out, and then we moved higher most of the day or in a range but still negative for the day. We couldn’t really take much profit shorting early on and it was difficult to trust any move higher after the data came out, so we concentrated on gold and oil trades most of the day. We tried DGAZ again but it wasn’t wanting to move higher after the initial gap up and JDST/DUST gave us some good profit. UWTI was a best a scalp and when I sent out the alert that conservative traders can take profit anytime they want, it began to immediately fall to the stop, but we still managed a little over half a percent profit after being up over 2% at its highs. The final high for JDST was close to 8% profit but we took profit early on half and at a 5%+ clip on the next 1/4. All in all, a good day for it.

Economic Data for Tomorrow

I fear for Germany’s market tomorrow and will see how low Deutsche Bank opens and whether there is continued selling that can start to affect other markets. It is for this reason that I am still leaning negative U.S. markets. China is still on holiday and Germany comes back from one to what will I’m sure be a mess. I’m not sure Asian markets can trade too high on this so we’ll have to see. Not much U.S. data tomorrow so we’ll have to see how any of what comes out of Germany can be spun bullish. I find it hard to fathom.

Stock Market

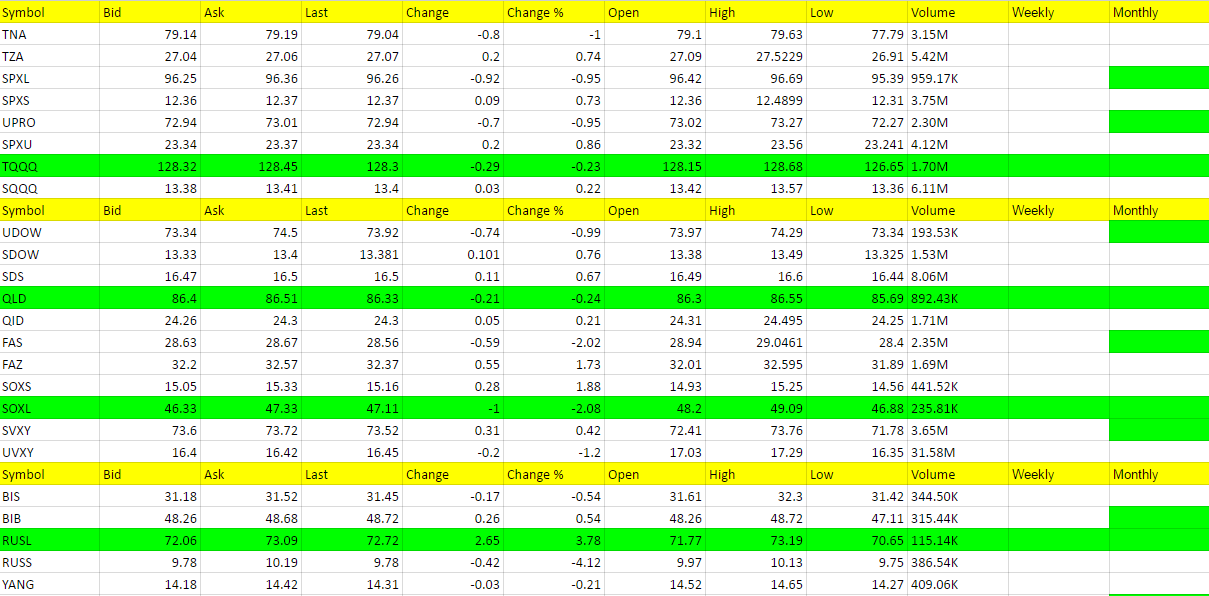

Last nights report I said; “I am looking for a pullback to still occur in the markets. We’re not getting clear direction as you can see from the lack of weekly/monthly trends in the table below. As a trader we have to be patient and wait for these trades when the weekly/monthly market hit, and that is when the nice profits are made. In the meantime, we do the best we can to jump on more micro moves. I really want to see how the Deutsche Bank situation plays out and whether there will be more repercussions from it with other banks.” Nothing has changed here after today’s data, which was bullish, still met with selling. Let’s see if the selling picks up tomorrow. It will soon enough.

Foreign Markets

RUSL was bullish all day even early on when the market was falling. I prefer the foreign trades to be in sync so will hold off on these for now.

Interest Rates

TBT took over for TLT despite the market being lower. No trade at present but taking note of that.

Energy

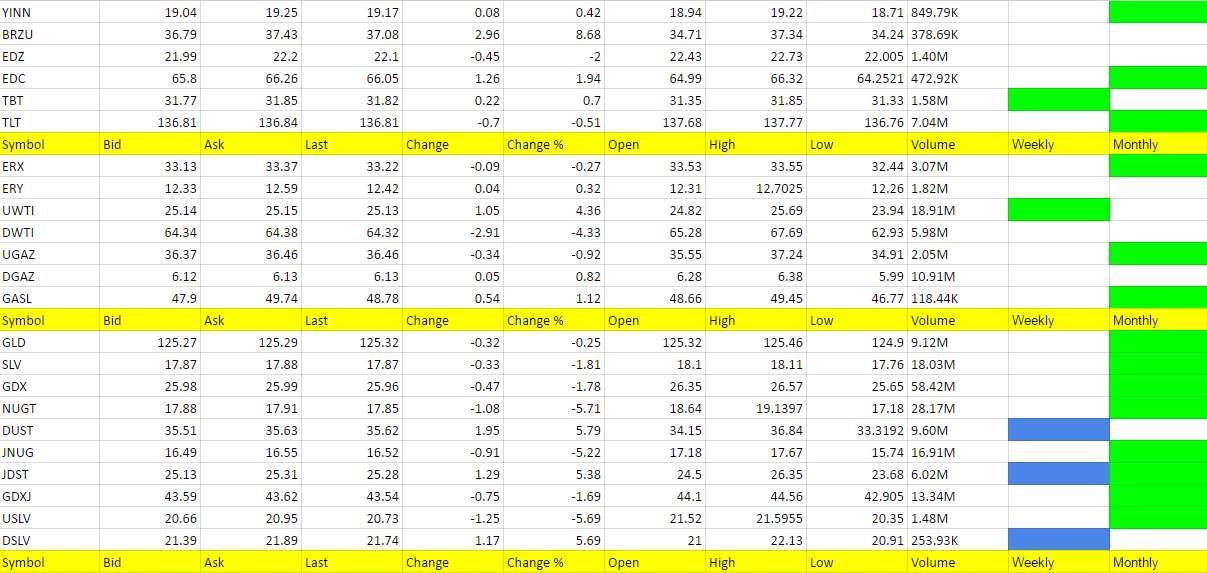

UWTI finally hit green on the weekly and we have to see if it has any follow through. If it opens red (down) tomorrow, and goes green (higher), then I would be a buyer with a trailing stop. If it opens green, I would be a buyer but watch for market makers to take out the lows on a reversal as it has been a kind of wild ride with this one. Have to lean bullish, but starting to salivate a bit on DWTI. We did trade DWTI today for only a little over a point or out flat, then jumped ship to UWTI.

DGAZ just can’t seem to do much once it opens green. No call here but open to a reversal in UGAZ.

Precious Metals and Mining Stocks

We are very close to breaking down in gold and silver, but just need the push, not a bounce off of support. I am not opposed to jumping ship if price movement dictates, but I want to see some lower prices first. Will lean towards JDST, DUST and DSLV and see if we can’t bust through $1,300 this week and get the dollar higher with all that is going on in Europe.