ETF Trading Research 10/2/2016

Please review the Trading Rules

Trades Friday

Friday offered a few good opportunities for us as we switched sides from looking negative to positive after the U.S. data all came out pretty good. Even despite the good data, the gold mining stocks were weaker with lower gold and higher dollar prices, and we got JDST/DUST trades and DGAZ might have got some a little profit. Called the end of day well with a range bound market and we got a last few minute decline. Futures are opening 3.5 points higher but I don’t think we have too much of another bull move underway this week. Should be a great week of trading. Was tempted to hold some shorts over the weekend, but not after a day up like we had.

Economic Data for Tomorrow

Germany, China and South Korea all have holiday’s tomorrow. For the U.S., tomorrow is all about ISM Manufacturing PMI data that comes out at 10AM EDT offering us a potential trade and move of the market. But even before the market opens we may get data from Germany and GB on their own manufacturing. This will give us a pulse of the market at least for the day. For Tuesday we have China with another holiday and not much major market moving data coming in the U.S.

Stock Market

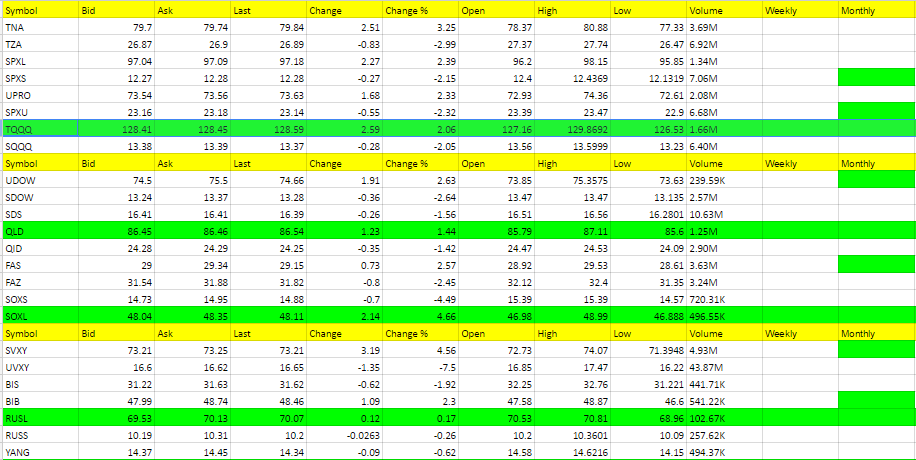

After Friday’s data came out positive and we rode it higher with some trades, I am looking for a pullback to still occur in the markets. We’re not getting clear direction as you can see from the lack of weekly/monthly trends in the table below. As a trader we have to be patient and wait for these trades when the weekly/monthly market hit, and that is when the nice profits are made. In the meantime, we do the best we can to jump on more micro moves. I really want to see how the Deutsche Bank situation plays out and whether there will be more repercussions from it with other banks. We’re already seeing some Wells Fargo type lawsuits developing.

Foreign Markets

Still going to be leaning towards RUSS, EDZ and YANG but will see what Monday brings.

Interest Rates

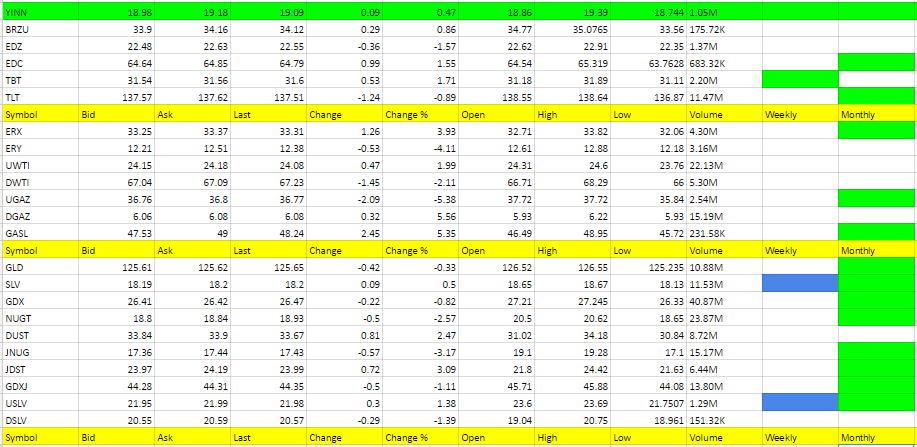

TBT moved higher with the market again and these both simply are moving with the markets. If we have clear direction, then these are easy trades.

Energy

UWTI also moved up with the market but I’m not confident in what strength it really has yet. OPEC wasn’t set in stone and we’ve seen this game play out way too many times. I will look to get a good trade for us in DWTI soon enough.

DGAZ just can’t seem to do much once it opens green. No call here but open to a reversal in UGAZ.

Precious Metals and Mining Stocks

Loved the strength in JDST and DUST on an up day for the market as these should be moving with gold and the dollar and finally did on Friday. Will try and look for some continuation on Monday. Dollar though is down 5 cents to start trading in Asia. Gold up $2 and silver down a penny while all other metals are lower.