ETF Trading Research 9/29/2016

Please review the Trading Rules

Trades Today

Today offered mostly good trades and the correct market direction overall (down) and one that might have caught some traders after the natural gas report with UGAZ, albeit I did say it was volatile at the time. I did point out the volatility to begin the day but we settled down after the spike up and you might have caught a few trades like UVXY, JDST and DWTI (but small profit). UWTI also gave us a trade early on. I suggested to go home flat but wouldn’t mind if we kept some exposure for a lower move. But Yellen was speaking at 7pm EST and didn’t want to chance it.

Economic Data for Tomorrow

Friday we have overnight China’s Caixin Manufacturing PMI (Sep) and in the morning Core PCE Price Index (MoM) and (YoY) as well as U.S. Baker Hughes Oil Rig Count.

Stock Market

Today I showed you some scalping ideas with the futures that I use. It’s a way for you to have confirmation of a trade you make because futures typically move in the direction of the ETFs you play long or short. We don’t want to invest blindly, but our job each day is to figure out patterns that work together. Sometimes we can use the dollar. Sometimes we can use oil. But not always. That’s why we keep stops when what used to work doesn’t any longer. The market, as you know, is never wrong, just us.

I was leaning short the market and finally we broke down today after some good data early. Many of our normal short the market ETFs that I mentioned yesterday, became plays once futures broke down. There was one bounce and we didn’t break to lower lows, but we are still weak. Tomorrow and Monday should be more clear for us and I expect us to continue south.

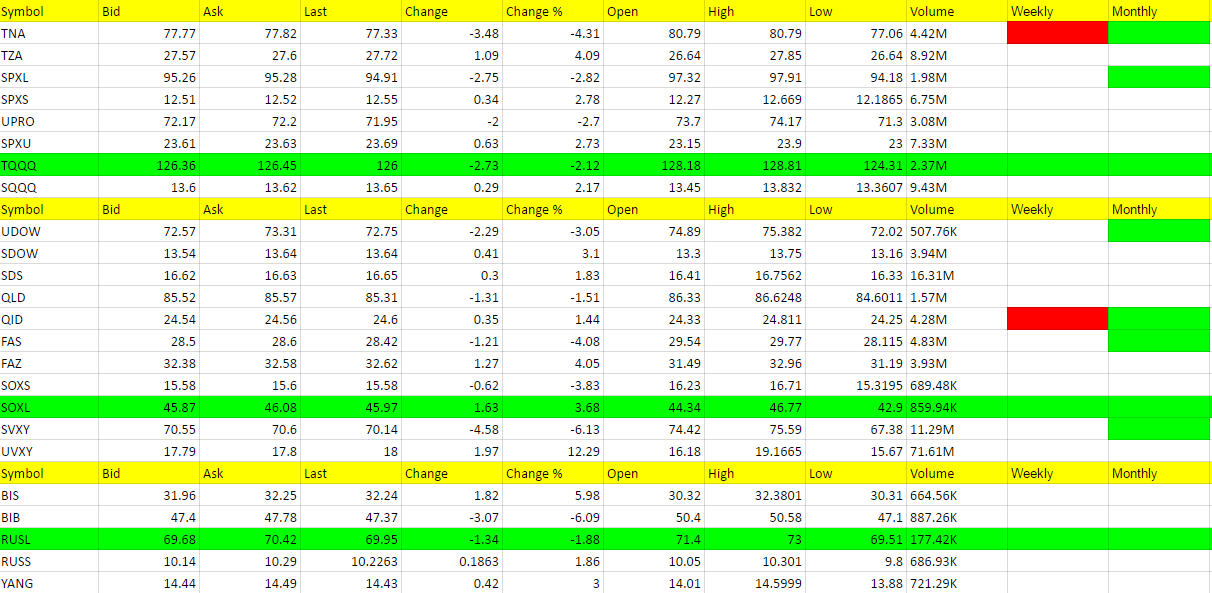

We see this in that we had a few more of our longs turn red today. This is a sign of a reversal at hand and the next thing we need is to have some of these short the market ETFs turn green on the weekly which I fully expect them to do tomorrow or Monday, and maybe the data is weak out of China to kick start.

Foreign Markets

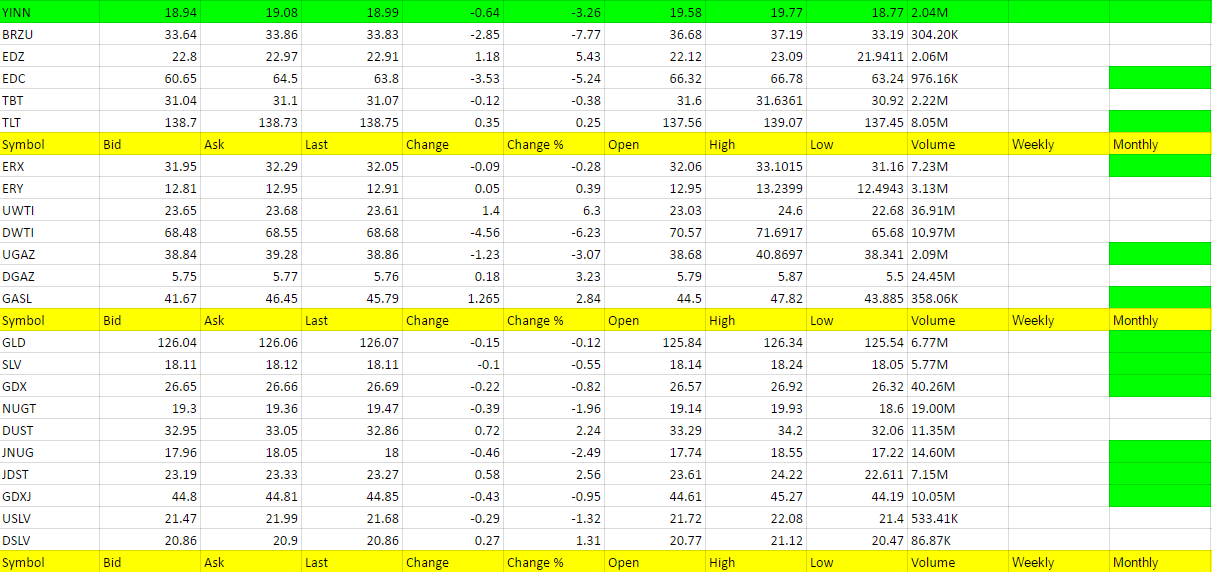

Leaning RUSS, EDZ and YANG now. But will see what data out of China says.

Interest Rates

TBT did go higher then fell with the market. If we continue south, TLT is still the play.

Energy

UWTI gave us a trade long today after the first attempt and we came out ok. Then even got a little out of DWTI. Flat right now.

Natural Gas storage today was lower than expected and positive for UGAZ, but UGAZ only shot up quickly then fell quickly. Was a tough go with market makers having fun, not traders who expected a move higher with UGAZ.

Precious Metals and Mining Stocks

JDST stayed high all day and gave us a little love. Waiting patiently for $1,300 to be broken in silver but we need the dollar higher. The dollar was a bit higher today but so was gold so this trade was not fully with us.