ETF Trading Research 9/28/2016

I notice some of you with Yahoo email have not switched to Gmail yet. I wrote this yesterday; Please note: Yahoo users for some reason seem to be getting delayed alerts from our email distribution company. I do suggest a switch to gmail. Notify us of the new email address and we’ll switch you over so you can receive the quotes faster.

Please review the Trading Rules – I am always evolving the Trading Rules and will do so when I notice there is something I think needs more explaining. I receive feedback and I want to eliminate all mistakes in trading, including my own. I’ve been doing this long enough to know we get caught up in our own thinking and stay in a trade longer than we are supposed to when it goes against us. While waiting for the SWING trades to take effect, the other trade potentials that come in are a little more risky, so we have to manage that risk.

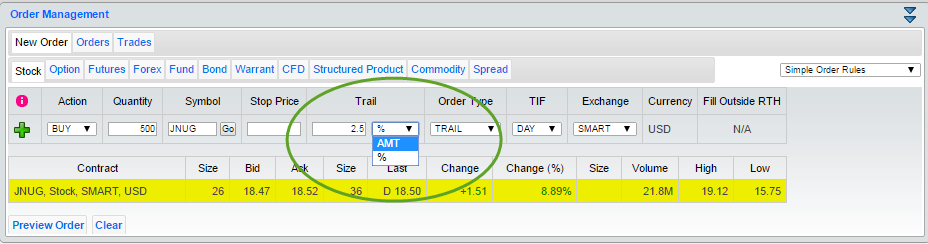

First and foremost I want anyone new to this service to know that I am not perfect with the trading calls. I am consistent with my overall track record though and that’s why my subscriber base continues to grow. These rules below are a must for you and keeping a stop you will see me say over and over is a must. It is you that has to keep a stop as I can’t do it for you. The best way to do this is to have a Trailing Stop for EVERY trade BEFORE you make the trade. You have a little time to get into a trade but you should have your trading platform set up where you just have to put in the symbol and click buy. Your trailing stop percentage or dollar amount should already be set up. You can’t get hurt too much if you do this and you can lock in profit on moves higher and adjust your trailing stop after you get into the trade if necessary. This is the BEST way to use this service. News can knock these leveraged ETFs down quickly and without any protection on the downside, you will get hurt.

The following graphic shows you can set this up rather easily with each trade. You can choose % and put in 2.5 as your desired trailing stop or click AMT (in blue below) and choose a 50 cent or whatever amount you are willing to risk with each trade. Because it is a trailing stop, once it moves up .50 if you selected .50 as your trailing stop, you cannot lose on the trade. You can always change this % or AMT once you are in profit or if you want to become more conservative and guarantee profit on a volatile day for example. This, again, is your key to success.

Any questions on this, let me know. The above was from Interactive Brokers. Your online broker will be setup similar to this.

Trades Today

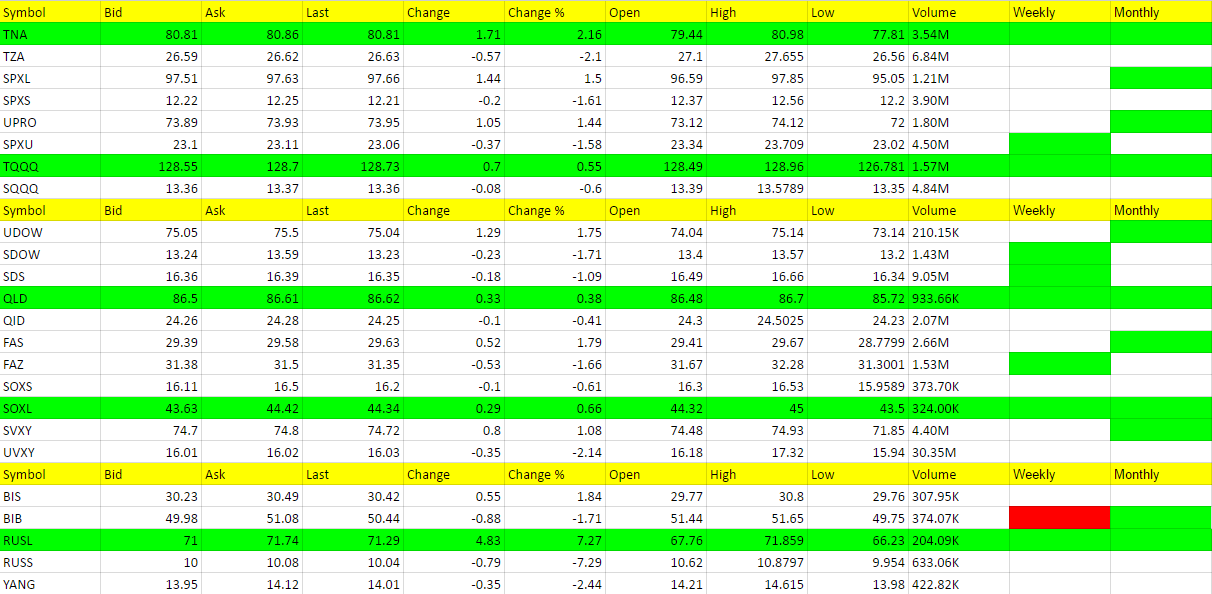

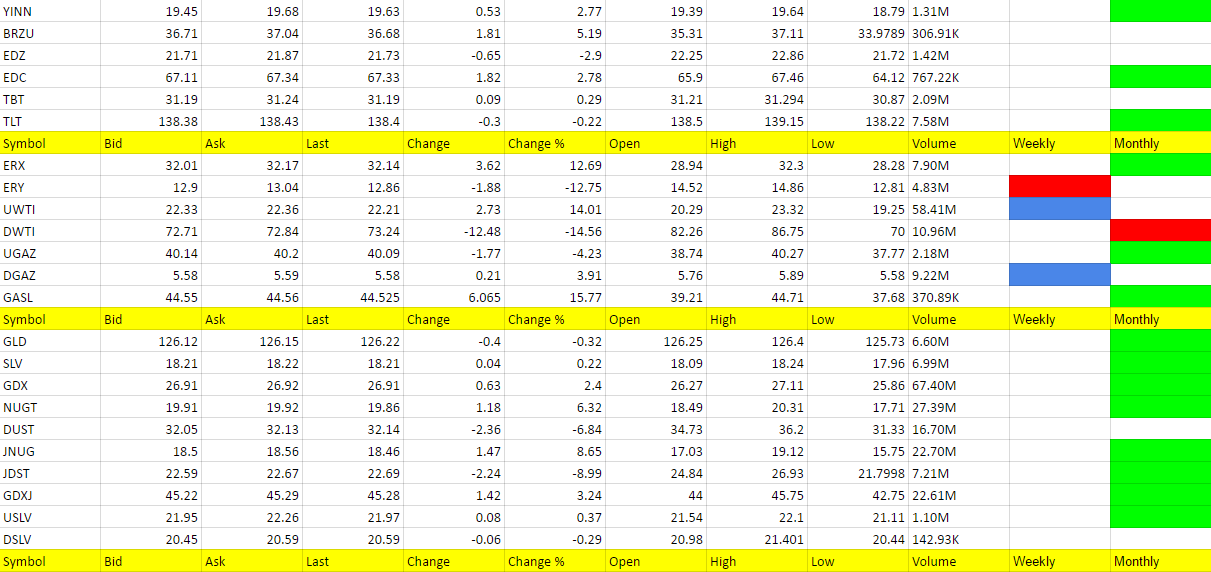

Today offered some trades for scalps and I had said from the beginning I would scalp trades today with both OPEC meeting and Yellen testifying. I’m not sure how you are reading my many alerts to you, but I hope I am clear on what I see. Today I was calling it a professionals day and it sure was until the OPEC news came out. But even before that I said that after Yellen spoke I expected a spike up and we got that. Once futures hit 2155, I said they could go to 2163-2165 and they did. They then fell, moved up to that level again, then fell and now are sitting at 2162.75 after hours. If you look at a chart of oil, futures and oil are trading together. JDST was a potential early on, and while I was still concentrating on it and telling you that market makers could take it negative, JNUG became a scalp potential too. JDST did fall to those lows and went lower but rebounded 80 cents at end of day. The exit calls on JNUG were close enough to the highs and for now I would rather be on the sidelines as the trend is not clear. DGAZ only moved up 10 cents at the max and we were out flat at the minimum. TBT we got out about 5 cents from flat as it never took off. Some other ETFs may have got you something or stopped out, I don’t know. Wasn’t the easiest day to trade and again, I tried to point that out from the beginning and to know your risk. I added the above to the Trading Rules to help control the only thing that can hurt you, holding onto losers. Believe me when I say the SWING trades will come. We just have to wait out the range bound moves.

Economic Data for Tomorrow

Thursday we have a few market movers, GDP QoQ for Q2 expected to grow to 1.3% at 8:30am EDT, Initial Jobless Claims expected to be 260k at the same time and at 10am Pending Home Sales expected to be 0.3%. Friday we have overnight China’s Caixin Manufacturing PMI (Sep) and in the morning Core PCE Price Index (MoM) and (YoY) as well as U.S. Baker Hughes Oil Rig Count.

It’s always important to look for market moving data that may come out the next morning pre-market that can possibly effect any overnight holds and the liquidity that they normally have pre-market. You don’t want to be in a thinly traded ETF pre-market that goes against you because of some data. Of course the data could be in your favor too, if the trend is working in your favor. I typically prefer only called SWING trades on overnight holds.

Stock Market

You’ll see some bullishness entering the market now and if we continue higher with oil we’ll jump on this. GDP data is good, go long any of the following; TNA, TQQQ, QLD, SOXL for U.S. and RUSL. If not good, we need to at the same time look at oil being stronger, dollar weaker and confirm entry into TZA, SQQQ, SOXS, for U.S. and RUSS.

One thing you will notice however, is the nightly report greens do correspond with the overall market trend despite the day to day things market makers and news do to the markets. TNA, TQQQ, QLD, and RUSL were all green on the weekly and monthly and were up the last few days. BIB was the only exception today. The only thing that gets in the way of that analysis is my own overworked brain. Keep in mind that this signifies a stronger trend. If these that are weekly and monthly long (green) are ever down for the day and turn positive that same day, they are a long. Have a list next to you with these ETFs each day. This is another rule I am adding to the Trading Rules. For tomorrow they are TNA, TQQQ, QLD, SOXL, RUSL

Foreign Markets

See above.

Interest Rates

Going to wait for a better trend but TBT will go higher with the market tomorrow if GDP is good and a conservative play.

Energy

OPEC finally came to conclusions and it was bullish for oil I had a subscriber call it last Friday but playing oil was still tough prior to the announcement. We have to lean long oil now, but it does conflict with other things I see. If I see a higher high in DWTI while positive for the day, I will trade it long in a nano second.

DGAZ I had been leaning long but the price movement happened mostly before open and it was not easy to squeeze profit from it. No trend right now and will keep an eye on it.

Precious Metals and Mining Stocks

Both sides of miners were trades today and obviously that’s not a trend and it makes for more difficult trading. But the dollar started to decline and if you traded with it you had one leaning indicator go your way. When the OPEC news came out, miners rose with the overall market. There should be some follow through with this tomorrow.