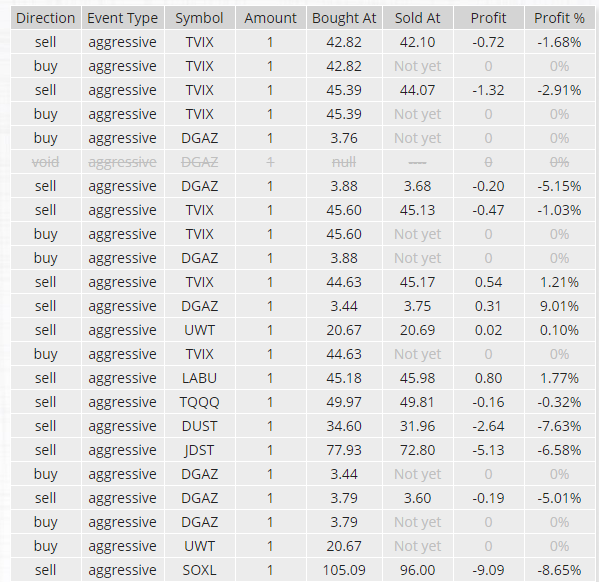

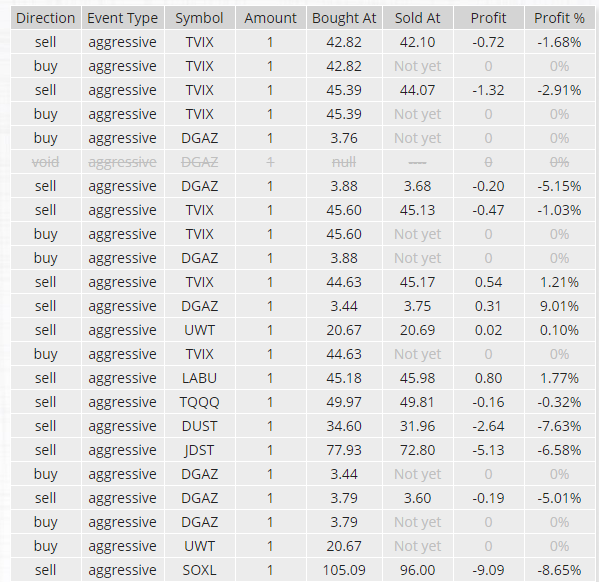

I’m implementing some new rules for us with regards to eliminating mistakes I have noticed with the new system. First, I have been not using the system correctly in that I have all trades listed as Aggressive and not utilizing the Moderate or Conservative columns with built in profit goals and stops. We were up 5% in LABU and 9% in DGAZ and those should have been auto sells of half shares minimum. Second, holding any ETF that is NOT green on the weekly is a recipe for disaster and will be stopped. I just have to get us out of the current DGAZ trade once more (which should have been sold for 9% and not taken home). Another thing that makes no sense is to be stubborn about where I think the market will go next, rather than trade what is in front of us with the charts.

Economic Data For Tomorrow

No market moving data tomorrow.

http://www.investing.com/economic-calendar/

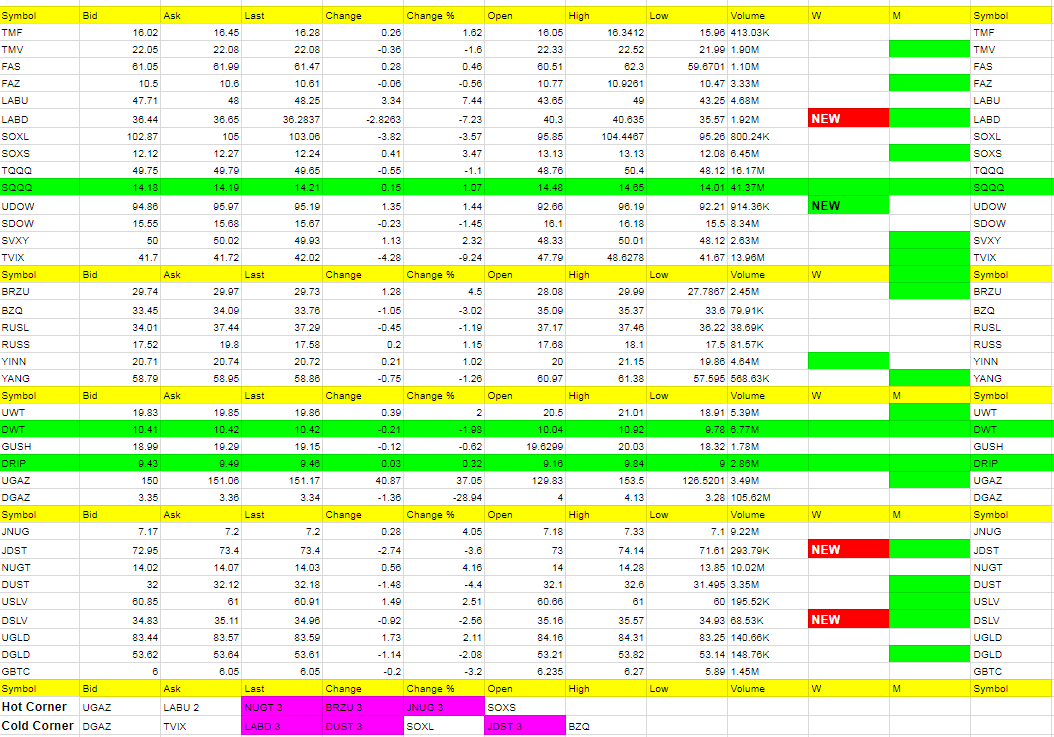

Stock market got a boost mid-day on Trump’s comments that pushed us to 2740’s but still can’t break 2750. Until it does, that resistance is shortable, but we should get our answers soon if we break below 2700 or above 2750. The range is going to be broken this week and we’ll trade that direction and be more cautious in between.

Foreign Markets

These ETFs will follow U.S. markets higher or lower. They may even lead U.S. markets, so watch YINN and YANG for moves and see if U.S. doesn’t follow. BRZU 3 days in the Hot Corner so keep an eye on BZQ.

Interest Rates

TMF will be the call if we fall and vice versa for TMV if we rise.

Nat gas has opened higher and looks to still have strength as the East Coast prepares for a record low temperature Thanksgiving. We will have to get ourselves out of the current trade and per chance get a push lower to do so like last week. It’s 4.60 now after hitting over 4.70 at the open. Need to see if we can get it falling to under 4 again. There is a warm up I see starting after Thanksgiving. I prefer to be out of the trade and then trade the charts. Might have to take that hit and regroup here. Never saw such wildness with an ETF.

Oil should move up if the markets are going to move up. We should look long for a bit.

Precious Metals and Mining

Miners have 3 days in the hot corner and if the dollar is positive Monday, most likely DUST and JDST can be rebought.