ETF Trading Research 11/15/2018

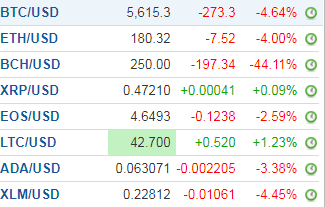

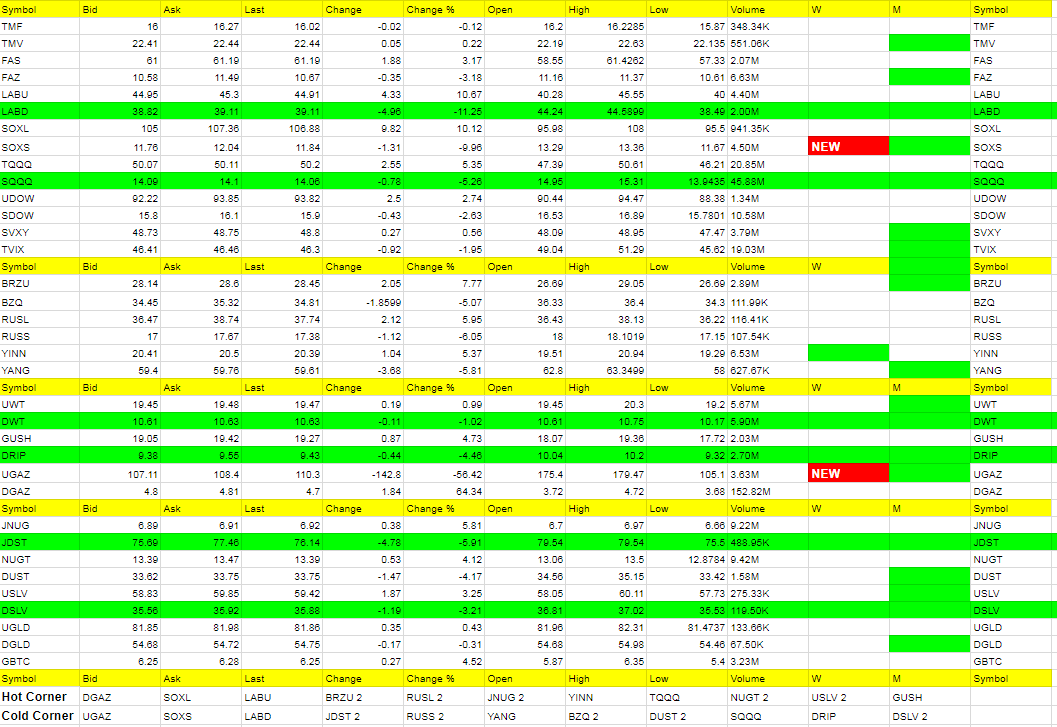

It was a good comeback for us today in DGAZ. We sold near the top on the run up, waited for a reversal to take hold and then traded in and out successfully to get some of that loss back from the madness known as yesterday. What really sucks though is nat gas is back at the price it was but DGAZ we couldn’t recoup all the losses. Not happy about that but we learn from this that it makes ZERO sense to hold ANY ETF long term and expect anything from it in a way of a rebound. I have learned this lesson as well. A day or two or a week WITH the trend, fine. But NEVER against. We must keep stops. There was nothing we could do with the DGAZ trade after falling so much so quickly, so we had to work our way out of it. We actually worked our way out of it yesterday but didn’t sell flat. With the rebound today, I had to make the decision at that first support area to sell or not and we did. Then got back in for 14.88% of our loss back.

Meanwhile we had a comeback in our longs and got our first signal with SOXL, which we did lock in a couple percent early and missed more because of the flaw in my system I am working on, which seems to be fixed as I was able to buy it again without issues. We have a little profit going in TQQQ and LABU had a nice comeback today but we are still down a hair on it. Over 2750 is what we need on /ES and I think we can run a bit higher with these longs. 10% minimum is what I am looking for.

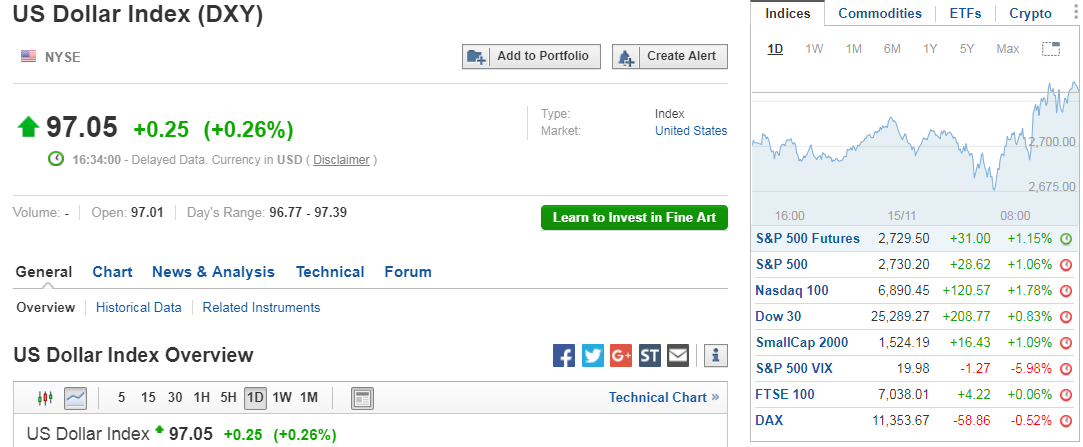

Lastly we got long miner shorts and I like our odds on this as the dollar was up today but miners didn’t look over their shoulder to recognize it.

Economic Data For Tomorrow

Data was flat and bad today.

http://www.investing.com/economic-calendar/