More in a few minutes.

For those of you new here, I most of the time have the ETF Trading Research report out by 8PM PDT, and it comes by an RSS feed, but you can look at the report here sometimes before you get it in your mailbox; https://illusionsofwealth.com/category/etf-blogs/ This is also the same link if there are any technical difficulties.

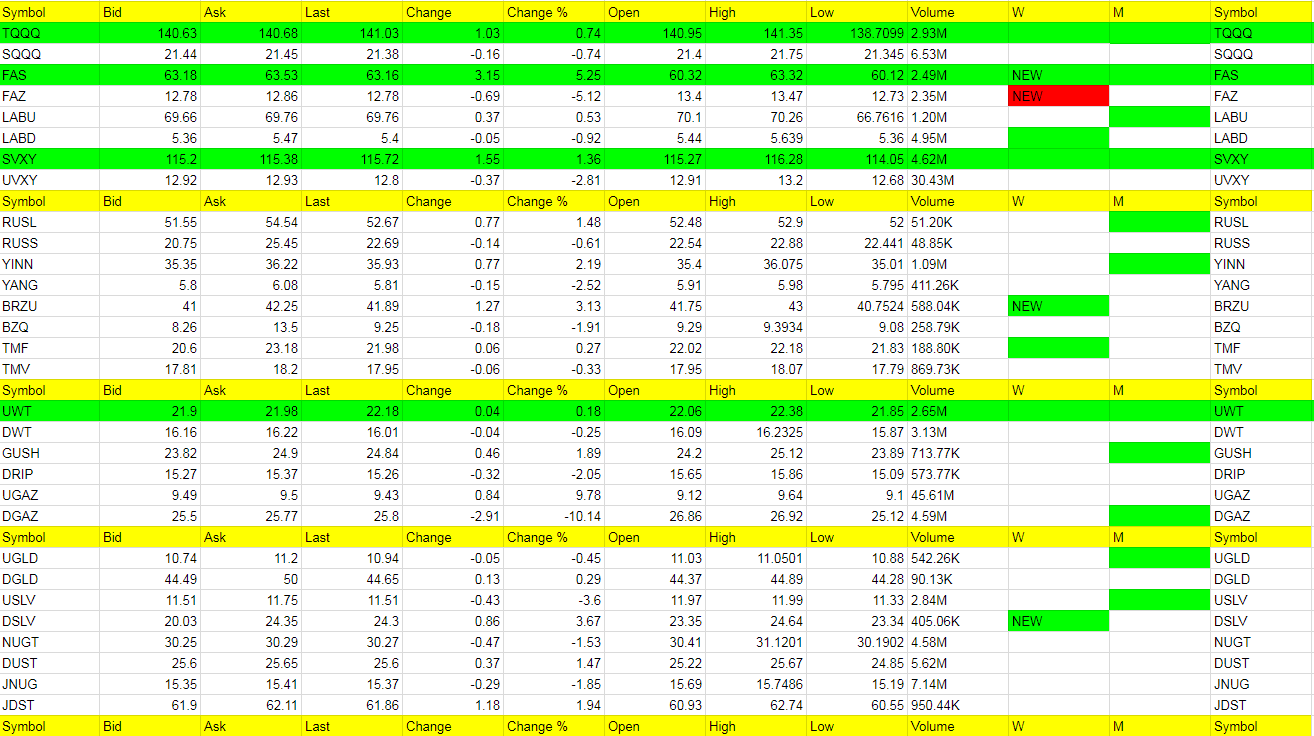

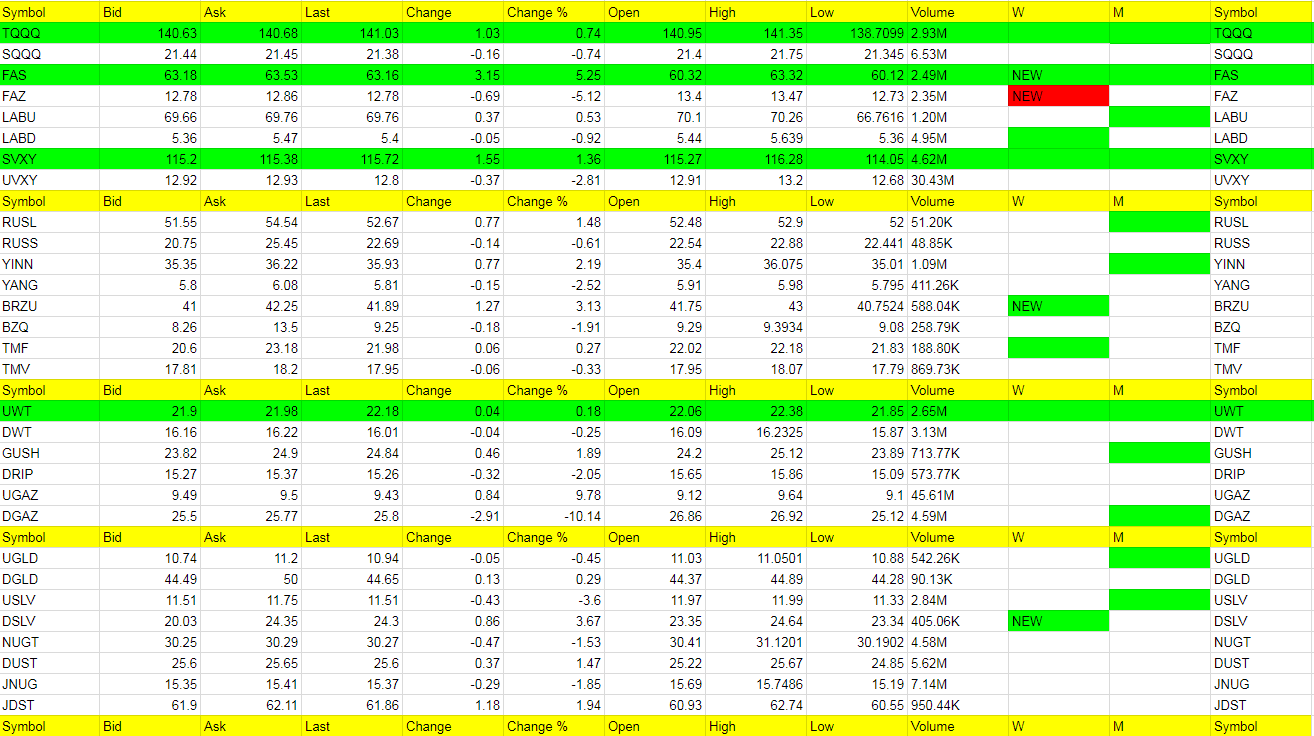

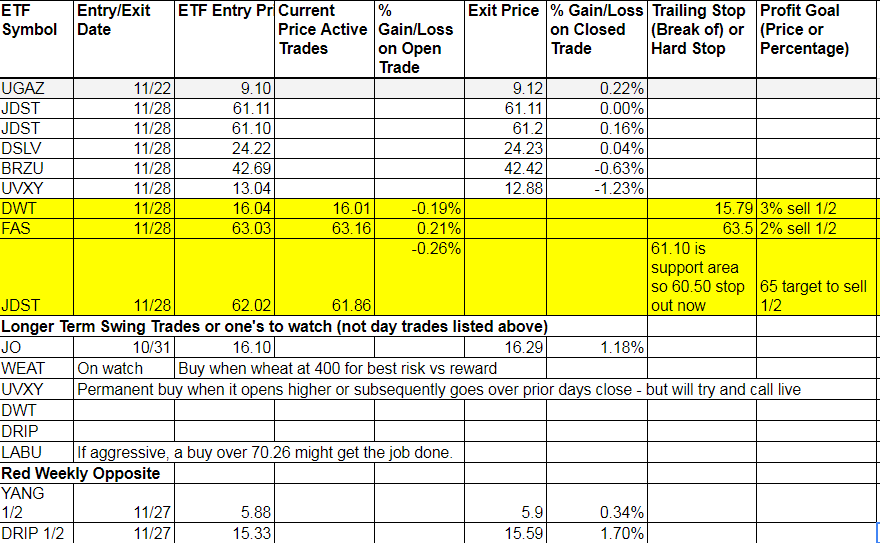

Today’s Trades and Current Positions (highlighted in yellow):

Happy to work our way out of UGAZ. My confidence was a little too much in it, but we did not lose on the trade. Some of you did profit as well. My new system has it so I won’t put us in that situation again.

We had many small victories today and the Red Weekly Opposite we came out with two more profitable trades. We have over the last 14 trading days gone 21 winners (some decent over the 2% mark) and 3 losers (only one at -2%) and net each of the 14 days a winner using the Red Weekly Opposite Strategy.

DWT and FAS are up after hours below.

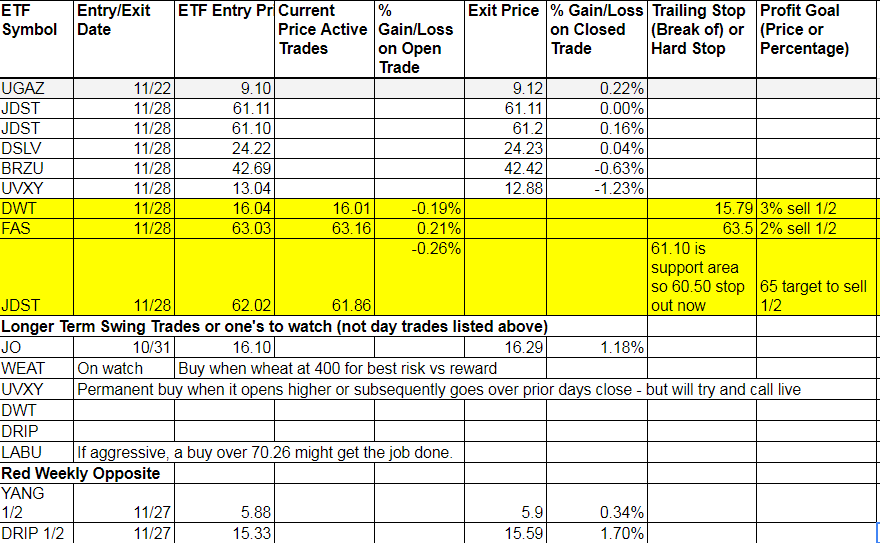

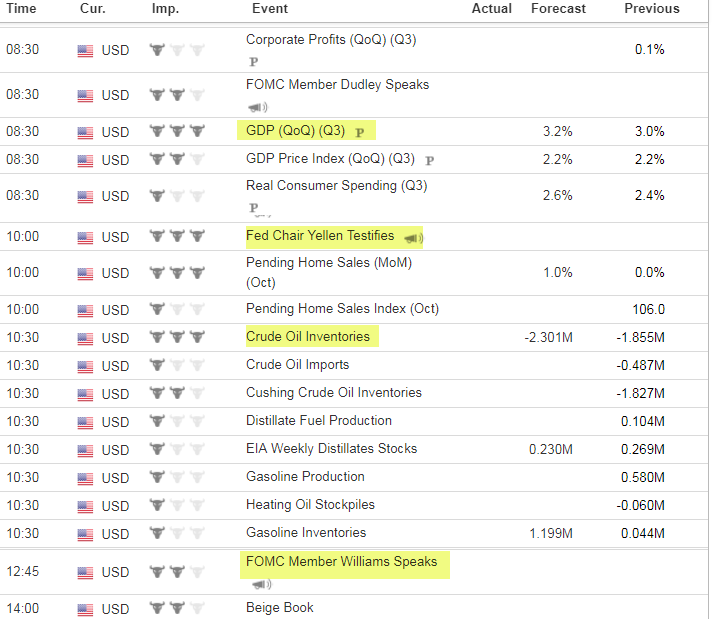

Economic Data For Tomorrow

http://www.investing.com/economic-calendar/

Yesterday I said; “We have to be under the impression that the tax reform will be passed and markets still have a leg up.” Today the tax reform was pushed to the Senate and even a North Korean missile launch had the market fall only temporarily. Would have liked to had caught more of it but FAZ had triggered yesterday and it really didn’t offer a trade till late today in FAS when it triggered. We are up slightly with it. Also, SQQQ disappointed today too as FANG stocks just don’t seem to want to move higher. Neutral on markets with a lean bullish still and one eye always on UVXY which also had a move short lived. Tomorrow, Yellen will be grilled.

Foreign Markets

YANG we were in one day and the next day we are out. Didn’t offer us much but even as a new Red Weekly Opposite yesterday, I didn’t trust it and locked in 1.19% and sold the rest this morning for 0.34%. Profit is profit though. YANG ended the day -2.52%. BRZU we were long but got caught up in the North Korean missile launch and I decided to bail on it. We got out with a small loss at 42.42 and it closed lower at 41.69. We should keep an eye on it tomorrow. Also RUSS because of lower oil may be good.

TMF and TMV trading places still. No call. Waiting on TMF to go red though to go into TMV.

UGAZ had a second great day in a row, but after a recovery like that, of over 15%, I wanted to regroup. It did show it wanted to go higher and I gave out 3.15 as a possible top and it did top there. 3.35 next week possibly though. But every time I get bullish like that and say something, some of you hold on for it and let it fall and fall and fall. Stop that. Stop the greed to get more based on my comment and keep a stop. It can still go higher after you are out and you may get back in on a green weekly or you may get back in on a reversal buy lower. But you know these ETFs don’t just shoot straight up to longer term targets. Not even close. Take the profit on half shares at least. Always be trying to take profit. Yes, there are colder weather forecasts. I read some last night. It should have kept me in longer, but we were up 16% off the bottom in 2 days, so I didn’t want to go negative again and decided to sell. A trailing stop may have been better as we really never looked back till end of day.

DWT we got in late and I think it was a good move as we are overbought in oil. The data came out after hours and confirmed that. Tomorrow’s data may confirm it more but we may be out before the data at least 1/2 shares with more profit. Looking good at least. There was an API build, not a draw as was expected.

Precious Metals and Mining Stocks

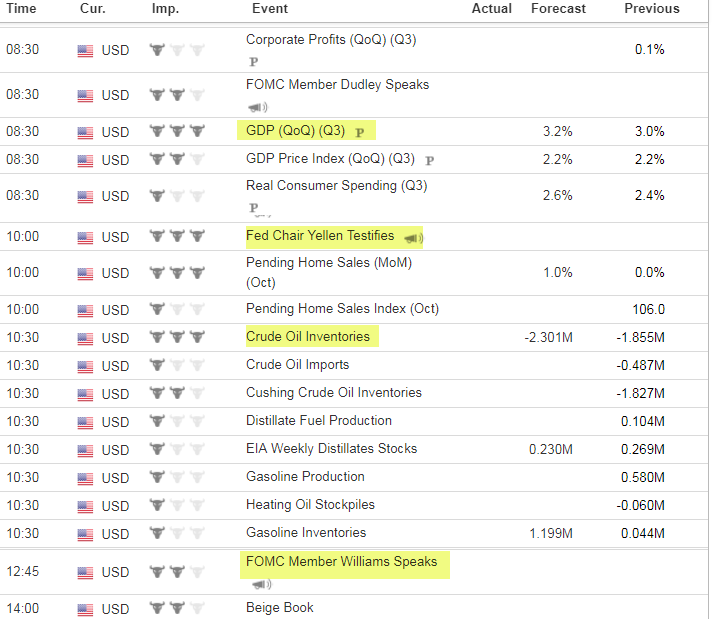

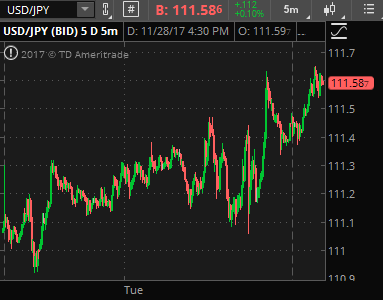

Yesterday I made the comment that I still like gold lower and JDST, “as long as there are no more North Korea rumors.” Today there wasn’t a rumor but an actual missile, the first in awhile, shot over Japan. But the real issue here was that the gold market shook it off. We’d be up a couple percent on JDST if that didn’t happen right now, but we did get back in and we’ll see if Kuroda and BoJ ramp up the USD/YEN now.

JDST you can see why I like so much because it is trying to move through its 200 day moving average represented by the green line. You can see how it has come up to it several times and pulled back, but this upward slope today might do the job because it comes in the face of a North Korean missile launch. I’d be surprised if it doesn’t move higher. The USD/JPY was moving higher all day. Dollar also went higher all day. Surprised gold isn’t down more than it is. It may come quickly.

Tuesday Afternoon Price

Monday Night Price

Friday Night Price

Wednesday Afternoon Price

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

Today’s Hot Corner: UGAZ, FAS, DSLV (FAS, BRZU, DSLV new green weekly)

Cold Corner (the biggest move lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

DGAZ, FAZ, USLV

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out typically well before they start to fall again or turn red on the weekly. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long.

Sell half shares on a spike up on any ETF you are long, even if goal is higher. Spikes higher are almost always followed by moves in the opposite direction. Try and get out with a market order quickly before the quick move back lower. Lock in that profit!