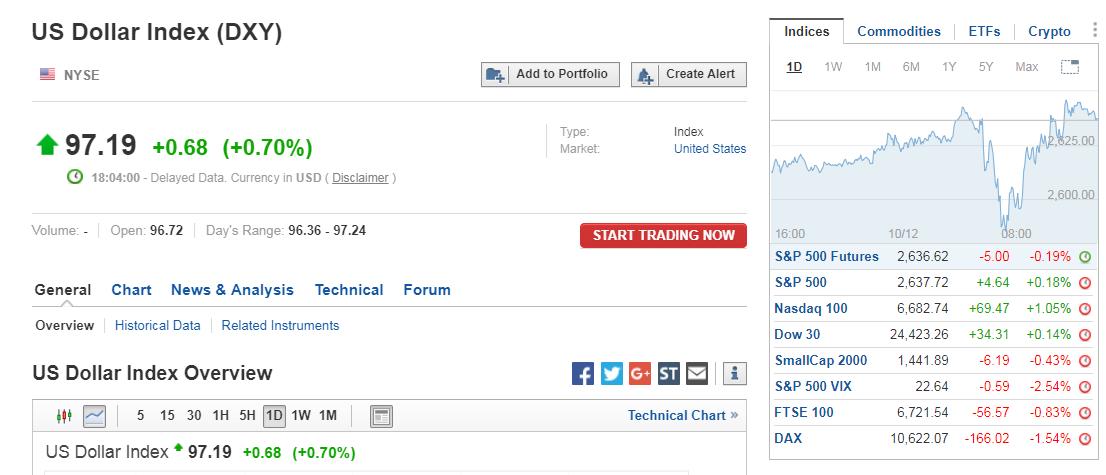

Last night I said; “Monday I am concentrating right now on LONG the markets, short nat gas, long oil (which fits with long the markets) and neutral on gold till I see what prices do and the dollar does.”

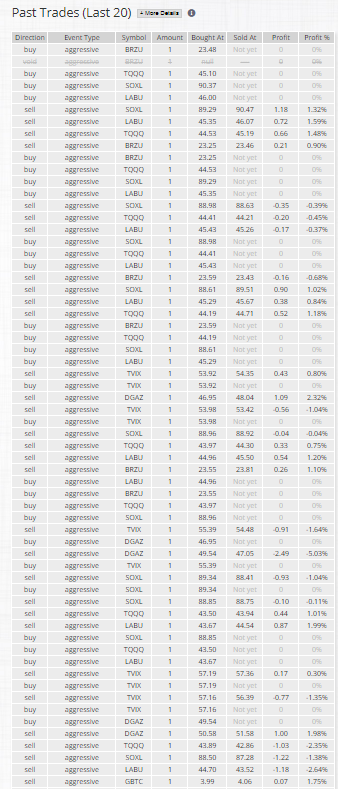

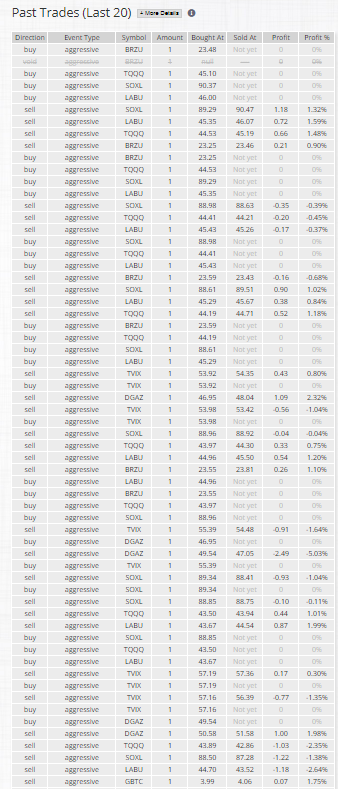

In the end, markets were higher, gold lower, nat gas lower but oil was a dog again today. But what happened before the final bell rang was anything but easy. I am adding TVIX to my list to watch every day to trade now as I just miss too many trades in it when my system provides a signal. If I am stuck watching the other side, how can I do long TVIX? We still climbed out of the morning hole but I kept saying, we can’t get out of the hole the market has dug until oil does.

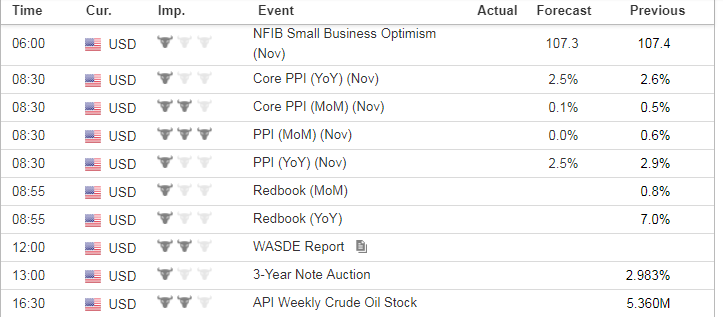

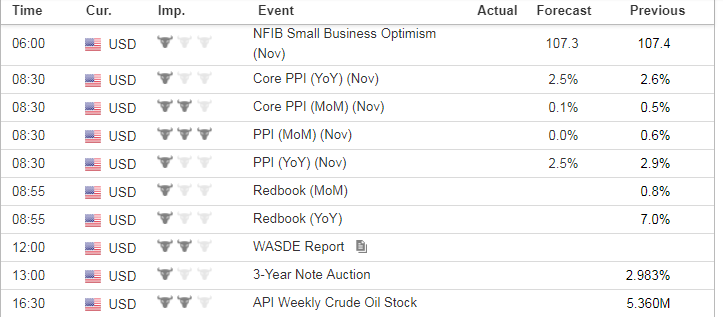

Economic Data For Tomorrow

PPI tomorrow and might push the markets and metals some.

http://www.investing.com/economic-calendar/

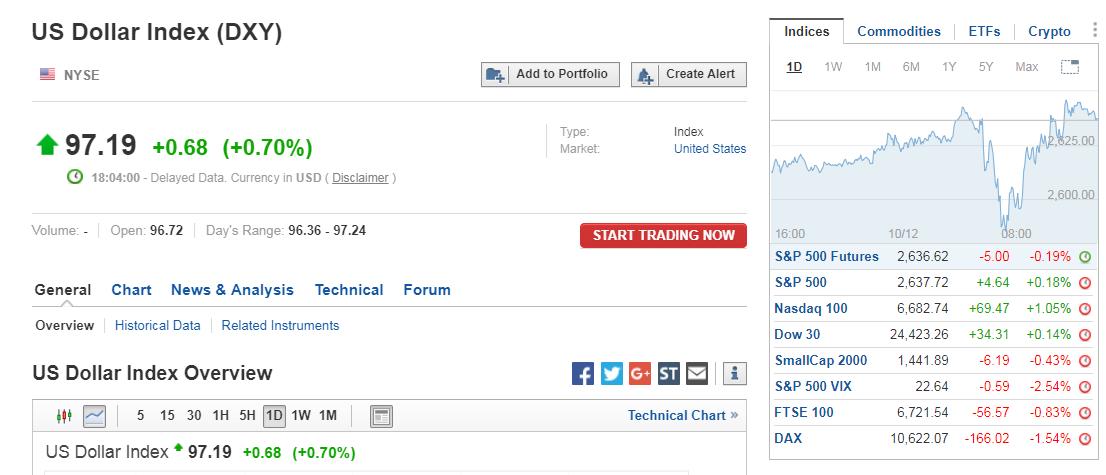

The market still has a tariff hangover and it sure has been on a bender. That said, today might have put in a bottom. But only if oil has put in a bottom. I will look first to TVIX in the morning for any new trades on weakness but monitor our longs. If we do just bounce from here overnight towards 2700 then will look to take profit on half shares and ride the rest early. Technically we are still in SOXL even though the system knocked us out after hours. Our IT guy is working on it but will have to put in a new order at our buy price of 90.37 if I can, to be accurate in the reporting.

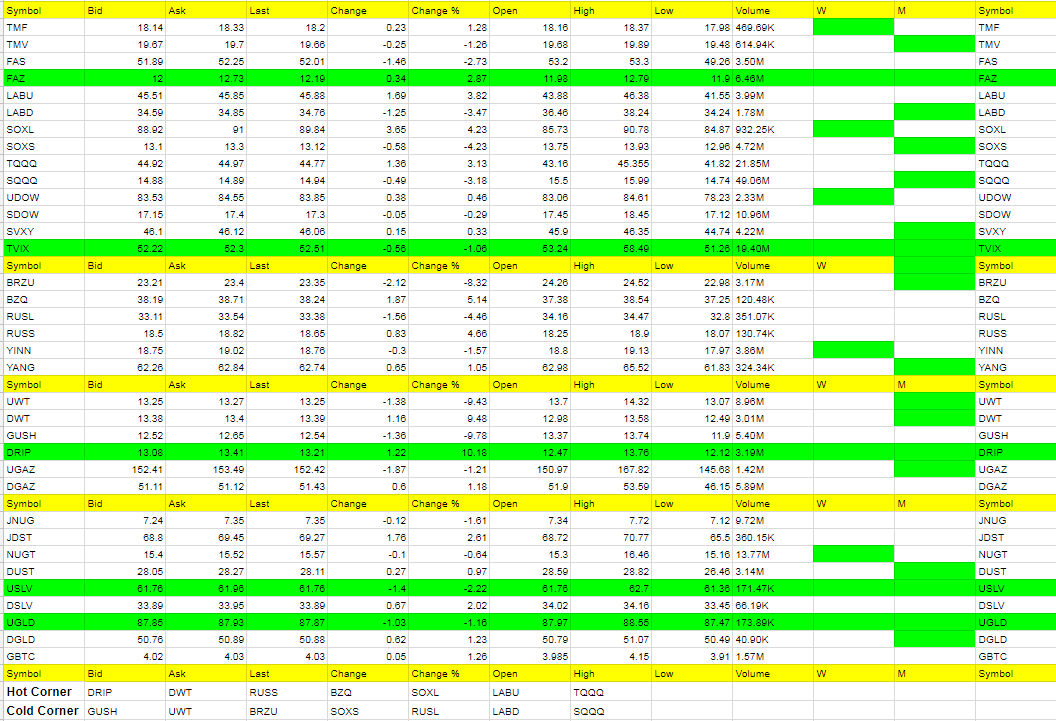

We have only two negative signals on the market right now with FAZ and TVIX. The other ETFs have not joined the group. With SOXL and UDOW still in the weekly trend, we have a slight bias higher tomorrow, especially if we get some signals. We should get some sort of a rally into the Fed’s interest rate decision.

Foreign Markets

Yesterday I said BRZU should move up with the markets as a leader and we’ll see if it leads tomorrow, assuming markets want to move higher in U.S.

Interest Rates

TMF still in charge but TMV coming around the corner on any market strength.

DGAZ we were just under flat overall today but could have had a nice overall profit if we held the last trade a bit longer.

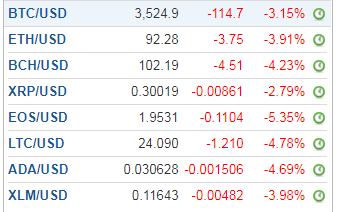

OPEC doesn’t mean a thing so far. Oil has to get some sort of a bounce here soon or something ugly starts happening. Trump needs the markets to get going into Christmas, so lean towards that and oil higher.

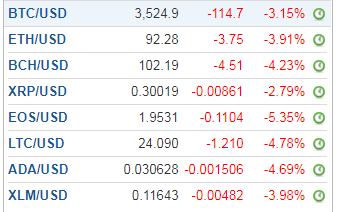

Precious Metals and Mining

Last night I said “I am more neutral than bullish right now. And will be bearish soon.” I gave a trade to go long JNUG for a scalp it went positive and missed the call on DUST from the ashes. But end of day not much of a move either way. Dollar is/was up and have to lean short if the dollar stays up and vice versa. Tomorrow if we have a reverse in any of these, I will call it.

NOTE: I am going to start picking the early morning trades and be more aggressive in them if I see a bullish sign. TVIX got a reversal after the open that we could have caught and the ones I want to concentrate on for trades are TVIX, DGAZ/UGAZ, JNUG/NUGT DUST/JDST and LABU/LABD tomorrow. I would add SOXL/SOXS but for SOXL the spread is typically too large. TQQQ and SQQQ would also be good. They all move similar to LABU/LABD but sometimes these two have minds of their own and I would rather separate them. If I do see LABU moving down with TVIX, then I’ll switch to TQQQ/SOXL, whichever is higher that day.