ETF Trading Research 2/10/2019

We have a good start to futures after an up day on Friday to that 2700/2710 area I said we might hit. We bought our last half shares there for LABD and TVIX and we’ll see if we can head to 2675 now minimum. If we break 2640 then it won’t be a home run but a grand slam potential. That’s where I lean, but we’ll trade what the charts tell us once/if we get there. Wherever we do bottom out though, a move to over 2800 is next and yes, we will trade with the market.

There is the possibility we move above 2710 and if so, may stop us out and re-load, but the move above 2710 I see as minimal. It would have to be supplemented I think at this point with some sort of tariff agreement, even though we haven’t seen anything like that for some time now.

Gold is down a hair as I type and expect a move below 1300 to commence. It has been a little stubborn and an outside chance at a double top but not looking for that to occur with the dollar so strong of late.

Nat gas is up 4 cents carrying on what it started on Friday where we took nice profit. I am neutral for now though.

Oil down with the market and should break below 51 as the market falls.

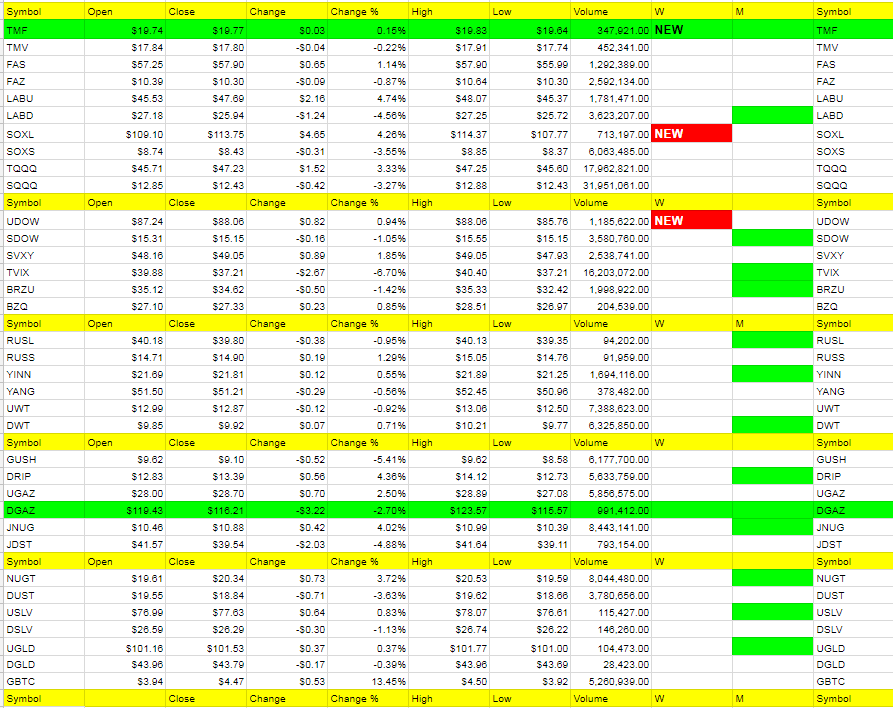

Everything with all the new red weeklies has us looking south in the markets. Maybe some green weeklies in the ETFs we are in will begin to appear and keep us short longer. I’ll keep an eye out for the signs if my signals hit.

Let’s make it a great week!