ETF Trading Research 2/24/2019

Futures open on Sunday and we have them hitting the 2800 mark they fell short of last week. Ironically, just before futures opened we had President Trump Tweeting about how great things were going with China. Of course all I read leading up to those Tweets was how things weren’t going that good as far as the Friday currency news confirmation and anything else outside of some soybean deals. Really. Nothing is negotiated as of yet.

It’s tough to sit through this kind of a move up but whether it is this week or next, or whenever, we are getting the move down to 2650 and will be able to get out of these trades.

Before this Tweet, the reality is these moves up are built on nothing of substance and we’ll get a decent decline out of it. Wherever we top out I still have us hitting 2650 minimum. From there it is a matter of whether we break 2600 before a move up to 3000 or just reverse and move up from 2650. We will sell at 2650 no matter where we are and readjust. It doesn’t make sense to sell at this juncture, but on a reversal. I have a ton of other data that supports this pullback, hence my stubbornness here.

Meanwhile, nat gas up 3 cents and oil about flat.

Metals and miners should continue south after that attempt up on Friday but will most likely follow the dollar inversely, so look to it for clues. Dollar down 2 cents right now.

First confirmation of market bearishness is break of 2790 followed by that a break of 2764 area I have used (2765/2770 from last week as we didn’t break 2764). VIX should begin to shoot up to 14, then 15 and 16 during this run. I prefer the dump to start now but it might wait till some more dumb money (it sure won’t be smart money at this point) flows in after the open on Monday. I expect a 3 day pullback minimum to see where it takes us.

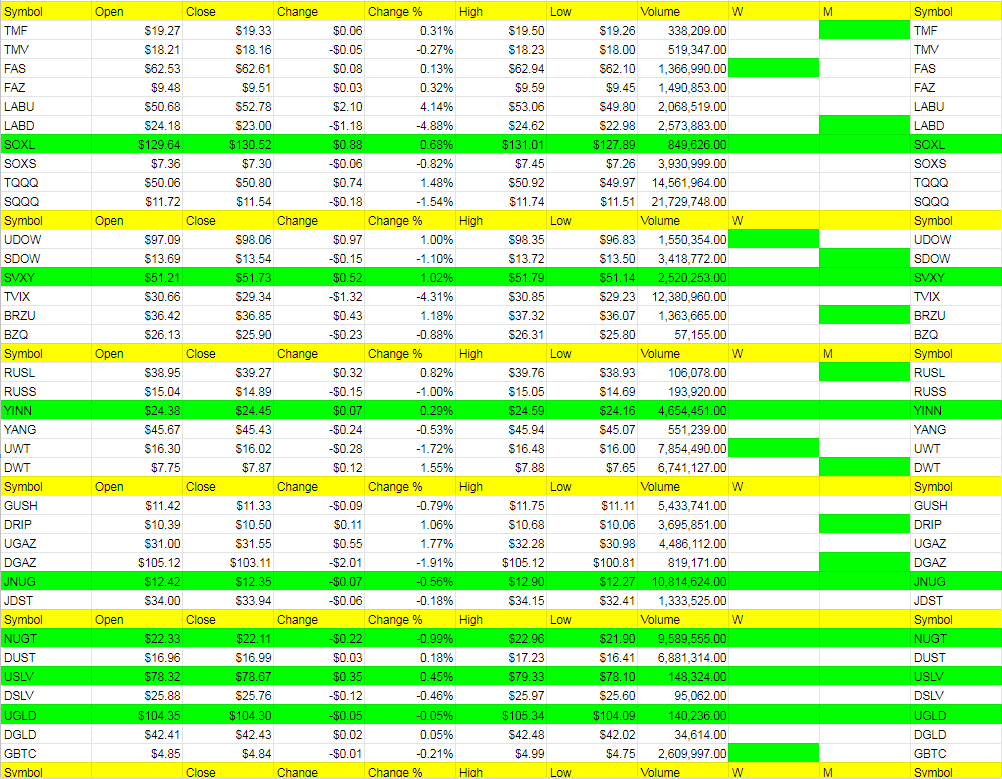

We have no new green buys and no new sells but the last 3 sells were long the market ETFs. Like to see FAS, UDOW, SOXL and SVXY go to sells here Monday/Tuesday and see what momentum we can get south for the market.