ETF Trading Research 3/10/2019

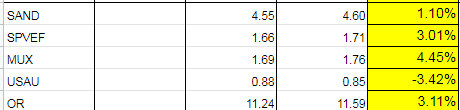

I realize it has taken awhile, but we exited the positions we were in and can now get back to live trading again. There was no way I would have expected this market to take off like it did when Powell flipped that Friday long ago, and that should have been reason enough to exit, but even worse, going against the green weekly on an overnight hold simply can’t be tolerated and it a new rule implemented. We twice had the market tease shorts to keep us in them and twice they failed. But this 3rd time we did get some follow through, and even though we didn’t hit the target of 2650 yet, which I do believe we will still hit, it was time to exit the trades and concentrate on getting short again here soon on any further move up towards 2800. Would be the perfect scenario to touch 2800 and then pullback, but I will let my system dictate when to get short. I also think we still have BRZU as somewhat of a leading indicator and we should keep a close eye on DWT to get going further south with the markets.

You can see there are only a few green weekly trends right now related to the markets and that should have us cautious just a hair, until UDOW goes to a sell. Then we should see 2650 after the break of 2700. 2730 is up first though for bears to regain control from the small move up off the lows on Friday.

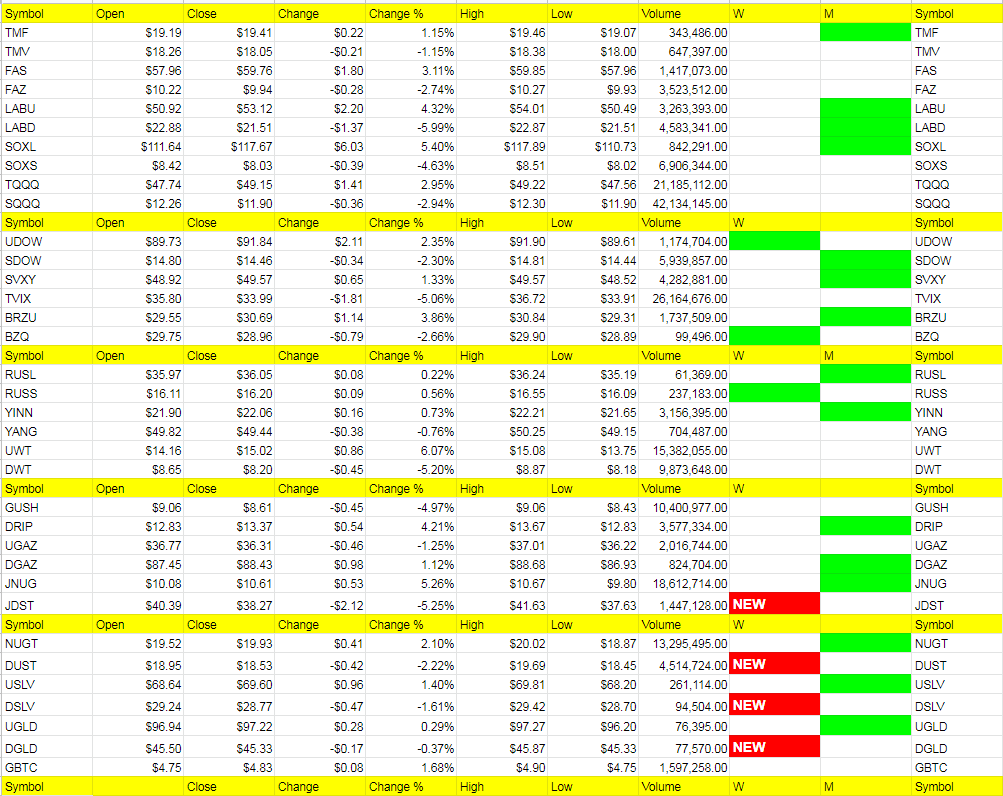

Metals turned and we timed JNUG well with a purchase but exited too early. I did send out a handful of miners one may have bought and recorded there prices a few minutes after doing so. The results collectively was just over 8%. We should see a continuation move up in miners and metals and if not in any miners, Friday I gave the signal to start nibbling again. I have said before that physical gold one should be long 50% and we should continue to buy on any dips that always seem to come. I’ll try and guide the best I can.

Nat gas we got some from DGAZ and should be able to get more this week.

I look forward to a good week and to trade with the market.