ETF Trading Research 3/11/2019

We started out today being patient for the right time to go short and if anyone had any carryovers long from the Friday reversal to sell half shares at a time, including BRZU and DGAZ which I said might head higher and did. Was conservative Friday and Monday as this market is a little iffy on direction and stopped out of the half share trades without too much damage. We can make that up in a heartbeat, but would have preferred 2800 to hit durin gmarket hours to attempt a short again but it is happening around 1am EDT. Perhaps we move higher still and can get short but either way, leaning short on any further moves up.

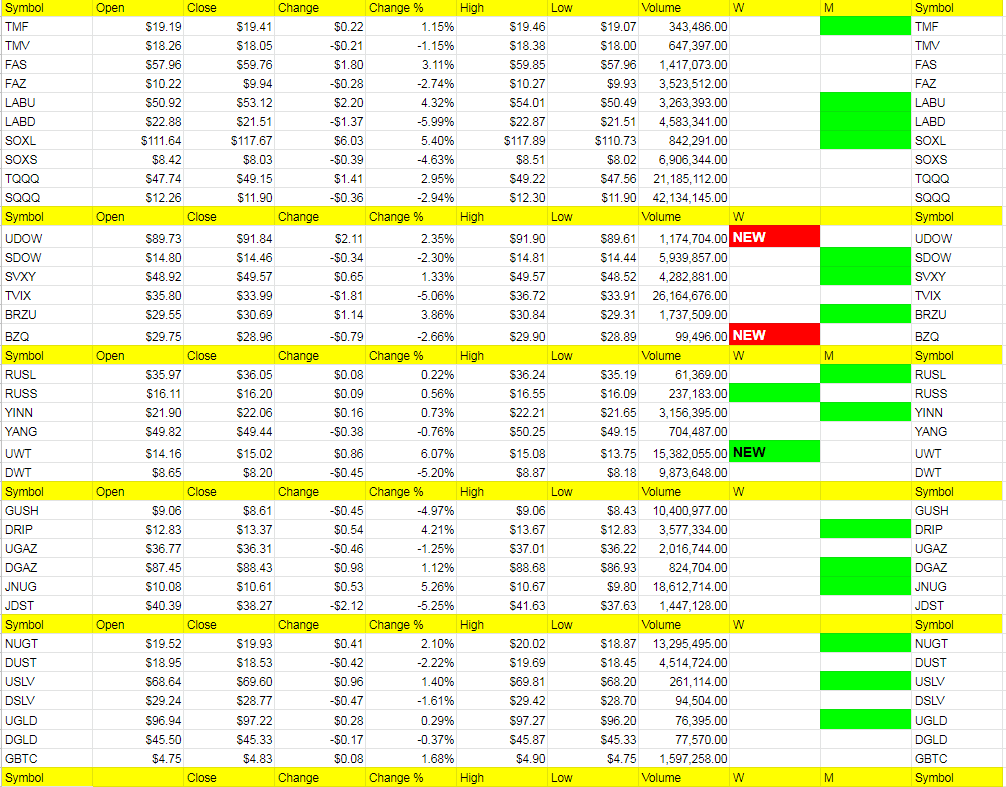

I had two signals go off today that were bullish in BZQ going red and even said I didn’t like that and should have got out then with our shorts but gave it a chance. Then UWT turned more bullish and lastly had another signal in TVIX that told me to exit. Now we have to see if we can get a big move down to 2730 area which is 70 points and a great short for us if we can get some negativity going tomorrow.

Nat gas still like to buy the dips in DGAZ when allowed tomorrow morning.

Gold still think heads up and JNUG gives us still something to trade after the reversal Friday.

Will most likely be a little more aggressive short Tuesday with some decent signals to do so.