ETF Trading Research 3/15/2018

ANNOUNCEMENT; The updated for 2018 version of Buy Gold and Silver Safely is available on Amazon.com. In it I provide an updated view on the economy and where we are headed, along with fresh data and analysis on the gold market. I think you’ll appreciate it and get a better understanding of why and how gold fits into a diversified portfolio. Feel free to post this link to social media or send by email to others. You’ll be doing them and you a good service as the more who know about what’s going on, the more who will discover precious metals investing and drive prices for us higher in the long run.

Go to this link: http://buygoldandsilversafely.com/the-book-buy-gold-and-silver-safely-2018-update-announcement/

Also, if you do purchase it, please be so kind to leave a review. It would be greatly appreciated. Thank you in advance.

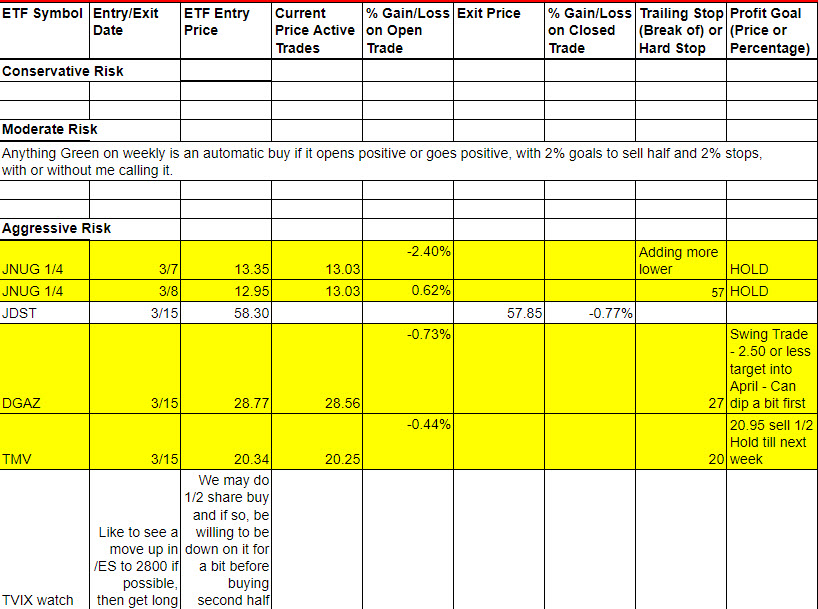

Today’s Trades and Current Positions (highlighted in yellow):

Today was a day to cut back on trading and we saw TVIX for example, start off going lower, move to come close to yesterday’s high, trap longs and they brought it to a new low. Then news came out and they moved it up and then it fell to the lows again by the end of the day into after hours trading. I think we go lower tomorrow and then have to make a hard decision on possibly buying that dip towards the afternoon.

JDST got me shaken out and I wish I made it a simple swing trade with DGAZ. I still might. I think we can get our JNUG lower still in the 11-12 range.

TMV I think can be confident in this trade for a few days. 2% to 4% potential.

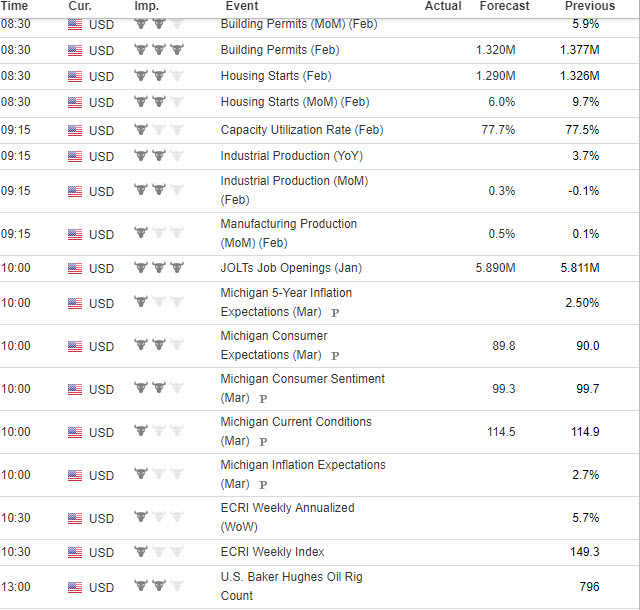

Economic Data For Tomorrow

Lots of data tomorrow. Let’s see if we get another bad housing number.

http://www.investing.com/economic-calendar/

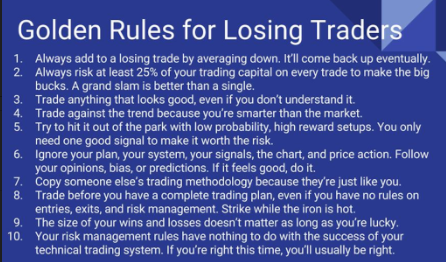

These are the ETFs that have turned green on the weekly and show a trend has developed. Your best way to profit with the service is stick with the green weekly trend each day and take profit while using a trailing stops. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long. This will be tracked more when we automate the service.

Sell half shares on a spike up on any ETF you are long, even if goal is higher. Spikes higher are almost always followed by moves in the opposite direction. Try and get out with a market order quickly before the quick move back lower. Lock in that profit!

New way to trade beaten down ETFs; The way that trade would work, and I really think it should be a rule from now on NOT to trade anything trending down until it reverses, is we would buy at the open if it is POSITIVE or GOES POSITIVE during the day. Then we would look to profit on 1/2 shares over and over, day after day until we get the red weekly signal on the opposite trade that could turn into bigger profits. The stop would be if it goes negative for the day. The rule of keeping a stop if it goes negative for the day is a must. Lastly for this type of trading we need to not be afraid to get back in if it goes positive once again. Sometimes market makers will take an ETF negative and then reverse it right higher again because they know if it goes negative many exit. So we have to be willing to risk a few in and outs when it does this up and down move around that potential stop out area so we don’t miss the ride back up. That’s just part of trading and not a big deal. But no matter what, if it breaks to yet another lower low because you didn’t get out after giving it a little more wiggle room, you are more than likely further from the original stop out when it went negative and you are out, waiting for it to go positive again before you get back in. You are simply buying into strength.

For those of you new here, I most of the time have the ETF Trading Research report out by 8PM PDT, and it comes by an RSS feed, but you can look at the report here sometimes before you get it in your mailbox; https://illusionsofwealth.com/category/etf-blogs/ This is also the same link if there are any technical difficulties.