ETF Trading Research 4/4/2017

Today’s Trades

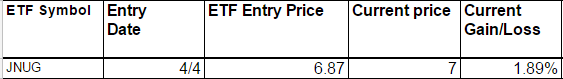

I don’t know about you, but I was getting frustrated of late and I made the comment that I wasn’t happy we weren’t getting some runners. My associate Chris let me know that every day doesn’t have to be epic, lol. I do want every day to be epic though. I want to make the best calls possible for you. But I have to be careful sometimes and wait for the trades to come to us. We finally settled in after some back and forth with JNUG and JDST but it took UGLD to trigger to settle me down on direction. By the end of the day we got that direction along with a falling dollar from the highs. We now need gold to push through $1,260. See more on gold below.

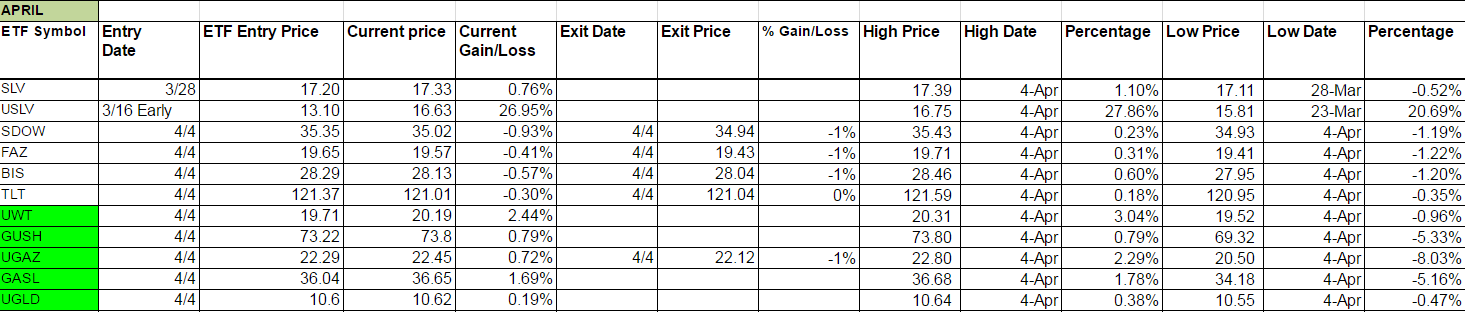

UWT we got in early and it triggered green on the weekly for us. We’ll now try and get more out of it and 22 is a real possibility. GUSH triggered too and we are up on it but expect a little more volatility.

We took a small loss on DGAZ before UGAZ turned green on the weekly. I don’t have a good feeling about UGAZ staying green on the weekly long though. It had a good run and as I said, I rarely see an ETF turn red on the weekly and the next day move up 10%. Look for DGAZ in the next 48 hours to begin what I think will be a 10% to 20% run for us.

GASL triggered too and we are up on it. GASL is a thinly traded ETF but one that if played right can be quite lucrative, so I pay attention to it when it triggers. Just understand your risk with it.

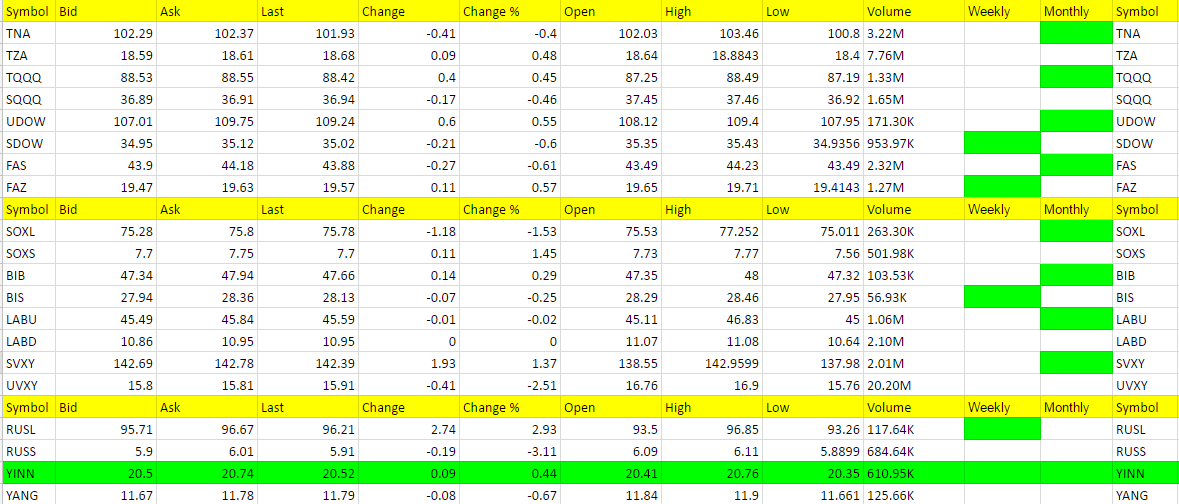

We did stop out of some short the market ETFs today simply because there is too much Trump going on. He is meeting with the Chinese leader the next 2 days and I have to think the markets will view this as a positive for the U.S. and China. Look at YINN which triggered green on the weekly and is the only ETF green across the board right now. All in one day. We will look to go short again soon is my guess. Because of the data in the morning and FOMC minutes tomorrow, I am ok with sitting out and waiting for the market to dictate at this point.

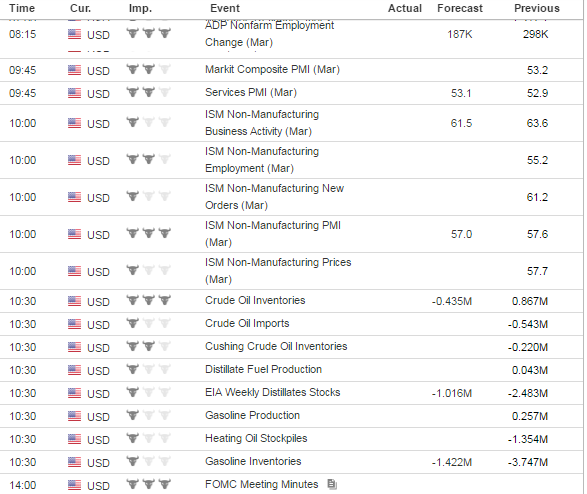

Economic Data For Tomorrow

Lots of important data tomorrow. Most important being ADP Nonfarm Employment Change at 8:15, ISM Non-Manufacturing PMI at 10:00 and FOMC Meeting Minutes at 2pm EDT.

http://www.investing.com/economic-calendar/

Stock Market

I am neutral on the market for the next 24 hours but within 48 hours I think we’ll have our trades to more than likely go short. I think we give Trump too much credit for things when he makes comments and the markets love it at first but then have issues. The market should have serious issues from my standpoint, but this Trump effect is something I can’t ignore. Will be interesting to see how the next 2 days confirm this after his meeting with the Chinese leader.

Foreign Markets

YINN is up with the assumption thing will turn out well with the upcoming meeting the next 2 days. It should continue higher tomorrow and we’ll be buying at the open per the rules.

Interest Rates

Neutral at present. Lean TLT still though.

Energy

We got our trade in oil long and now we have to see if we can do as well with UWT and GUSH as we recently did a few times with DWT and DRIP. I expect a 10% move here in UWT to 22 minimum.

Precious Metals and Mining Stocks

We do take JNUG, a non-green weekly ETF home quite a bit but overall we do better with it. When it finally triggers, it has some real catching up to do with gold. I am almost at the point of saying it owes us!

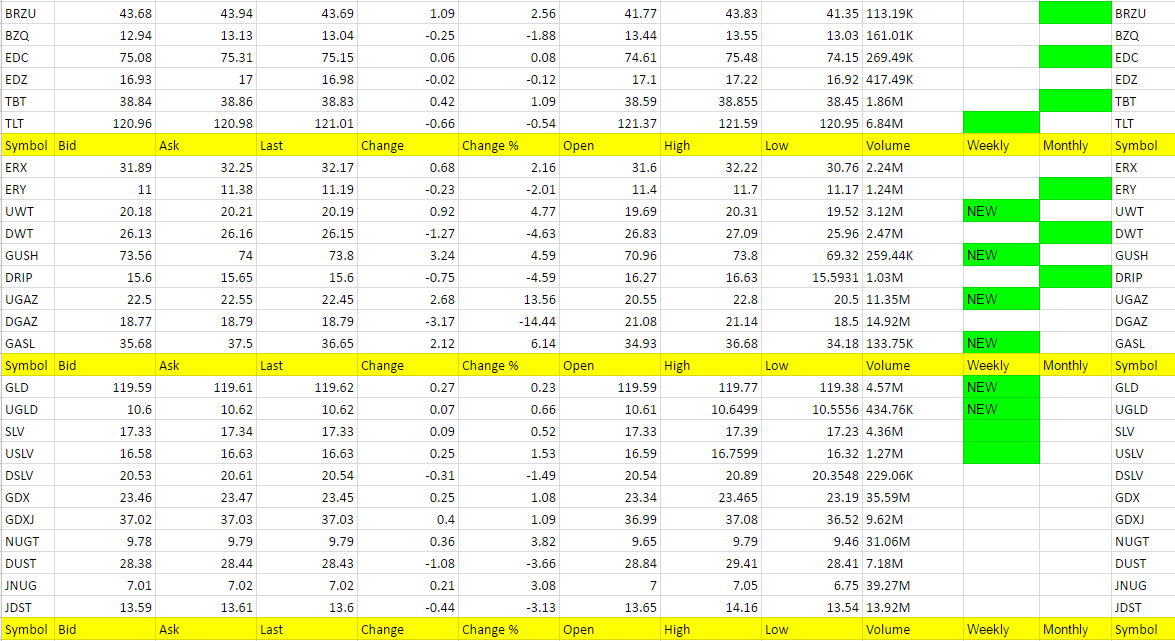

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

UGAZ, GASL, UWT, GUSH, NUGT, RUSL, (UWT, GUSH, UGAZ, GLD, UGLD, GASL new green on the weekly’s) – NUGT 3rd day in hot corner)

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

DGAZ, DWT, DRIP, DUST, RUSS (DUST 3rd day in hot corner)

Current Trades (Non-Green – Bought/Sold/Hold)

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. It is also used for tracking the percentage from high to keep a stop on remaining shares. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out before typically well before they start to fall again. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities too. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

My goal at times is to protect the downside based on what I see. I did that with the new green weekly ETFs from yesterday.