ETF Trading Research 5/29/2017

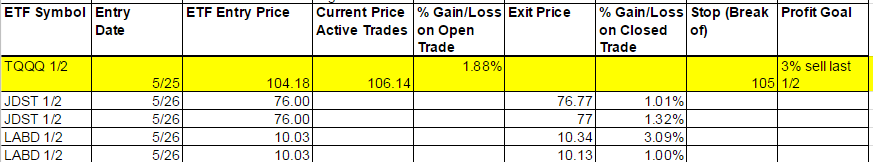

Current Positions and Today’s Trades

We had a couple trades profitable for us on Friday where we played it conservative with market makers taking off early and leaving the market to just be range bound most of the day. LABD did get us finally 3% on the remaining shares so those who stuck around a bit longer were rewarded. Gold was up overnight Thursday heading into Friday but we profited from JDST rather than chase JNUG higher. More on metals below. Trade of the week might be DWT again.

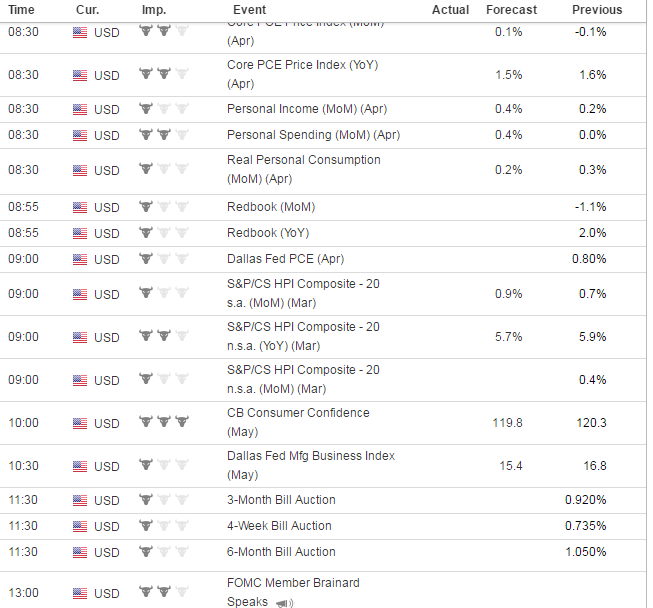

A bit of data tomorrow highlighted by CB Consumer Confidence at 9AM.

Interest Rates

TMF up a hair again. Longer term I like TMF since I think rates will head lower.

Energy

In Nat Gas I don’t have a favorite at present so lets have price action help us decide.

I am in favor of DWT this week where last week we got a 9% run in it on Thursday. We’ll see if oil can open lower and ride the wave further lower still after Friday’s run higher. The rig count dictates it coming in a hair higher on Friday, but we didn’t trade DWT as UWT for some reason took off higher.

Precious Metals and Mining Stocks

Gold is down a buck in Asian trading with Chinese markets closed for a holiday today and tomorrow. I still lean lower gold and want to see if it can get under 1250 taking miners lower one more time before we go long for what I think will be a great run for us.

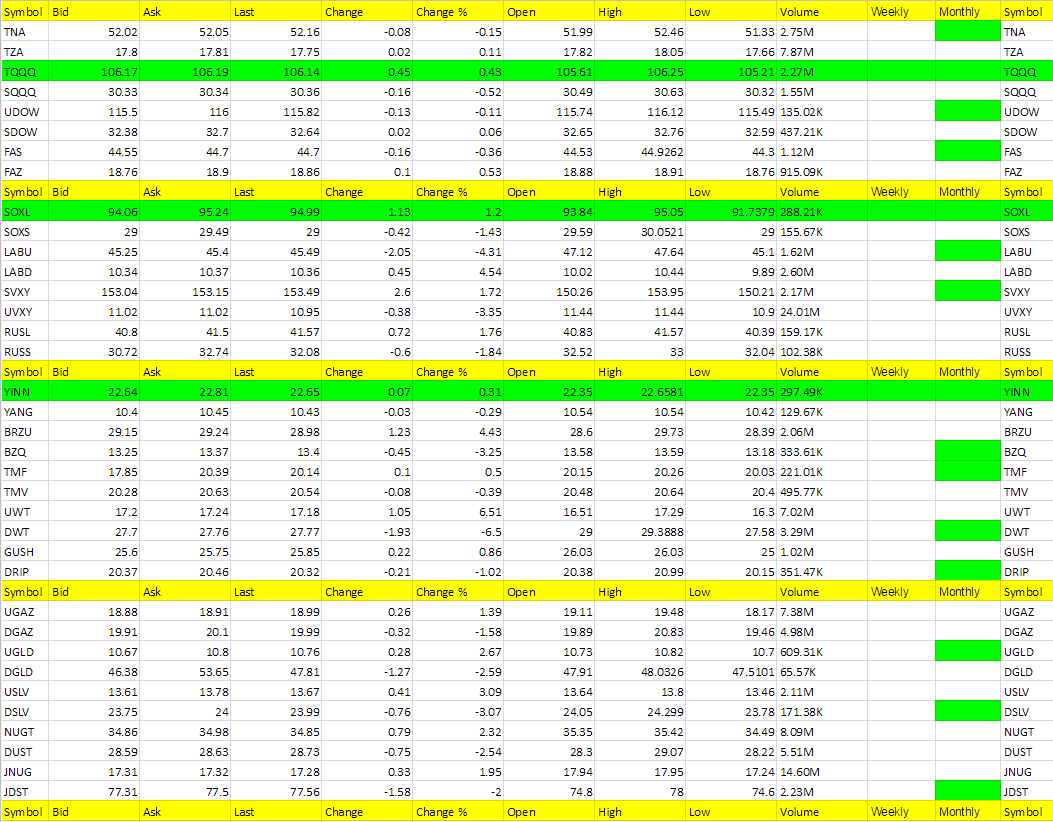

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

UWT, BRZU. LABD, USLV

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

DWT, LABU, UVXY, BZQ, DSLV

Green Weekly’s

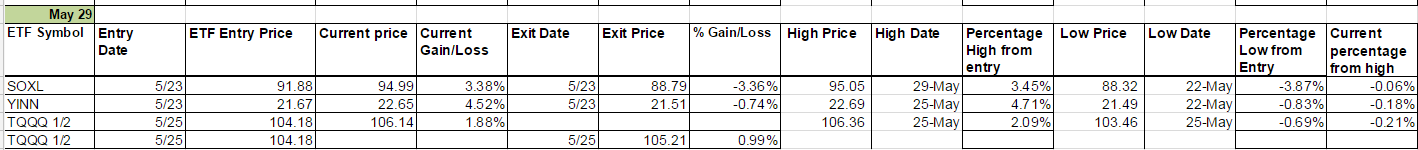

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. It is also used for tracking the percentage from high to keep a stop on remaining shares. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out before typically well before they start to fall again. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long. You’ll notice in the last column on the right it says “Current percentage from high.” This is your normal stop out for any ETF where I don’t specifically call it per the Trading Rules which lists the trailing stops for each ETF. It is a Trailing Stop percentage from the high and I have noticed the pattern that the closer it gets to 5% the sooner the ETF turns red on the weekly.