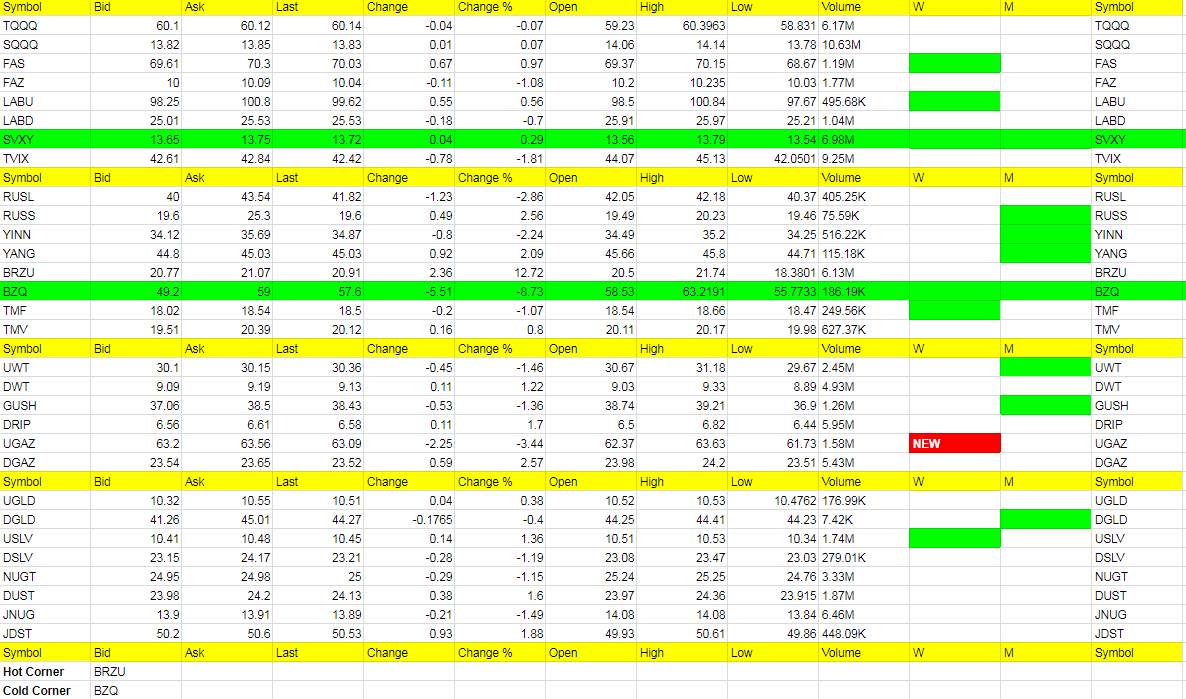

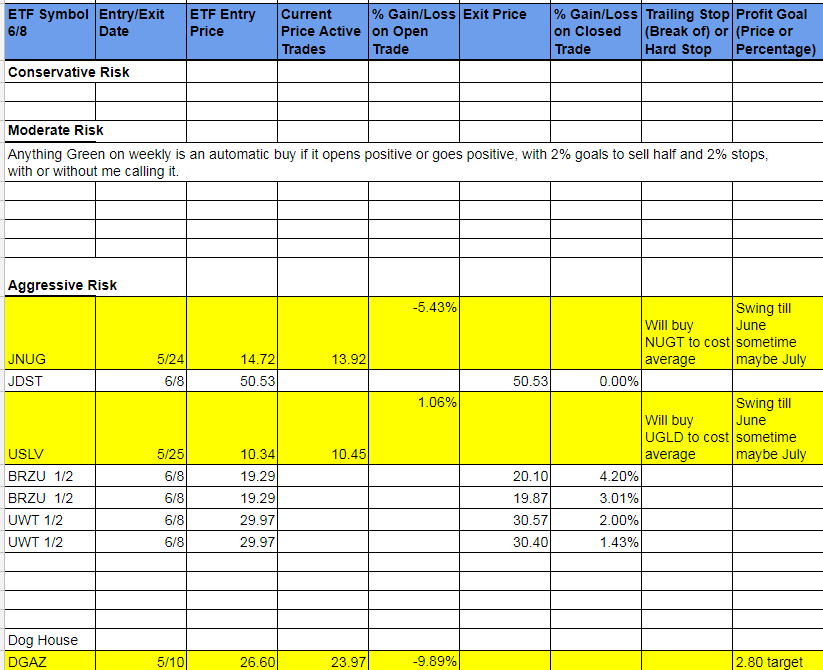

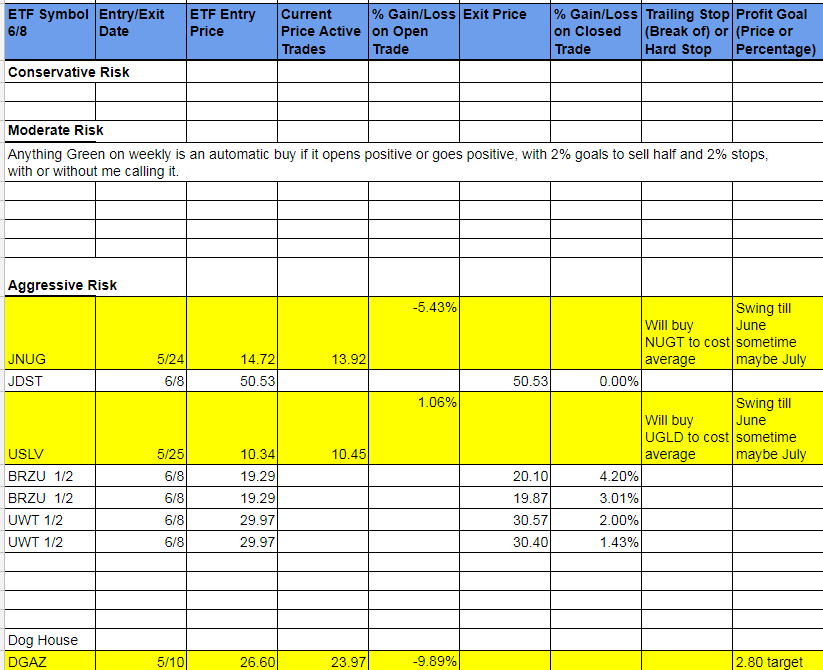

We were patient on Friday and came out with good trades all around. We got more of UWT back and still working on that for bigger profit. We got a chunk of BRZU back too and will continue to monitor. JDST closed exactly flat so no losses for the day. We stayed away from reading the markets up or down as they trended higher all day after a morning push lower. Read more about metals and miners and markets below.

Goal for end of Month – Closed trades; 35% more.

5.32% on Friday.

29.68% left to go.

It’s Fed week. Expect some volatility in everything!

Economic Data For Tomorrow

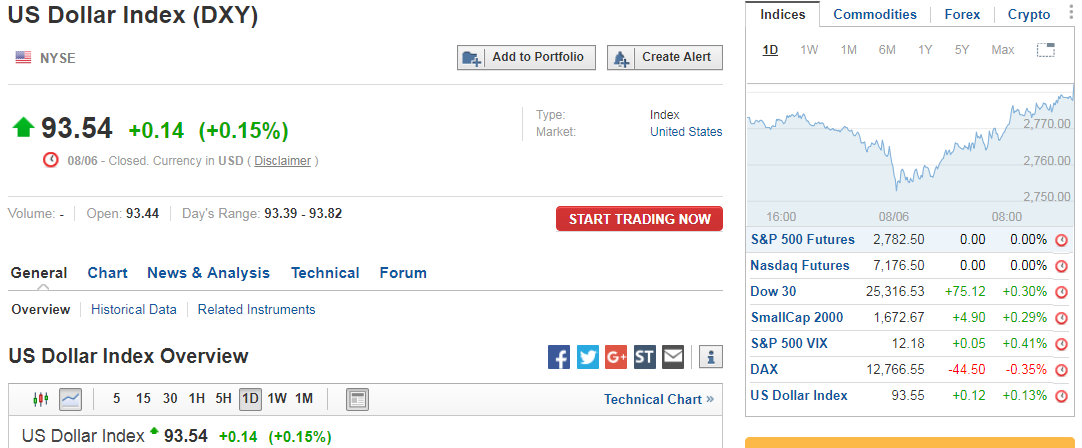

No data tomorrow. But it is Fed interest rate decision on Wednesday. If conservative in your trading, tread lightly, quicker profits, tighter stops until after Fed. Then direction becomes clearer. See below for further analysis. CPI, PPI also this week.

http://www.investing.com/economic-calendar/

While we were neutral on Friday with no trades or conviction, the main reason was we had the G7 going on and as volatile as Trump is with his no filter Tweets, didn’t want to just guess what Monday would bring. I did want us lower because of his potential for rhetoric, and I don’t think he disappointed as he decided not to agree with the final G7 statement, retracting his endorsement. This was preceded late Friday for Trump’s call of Russia to be reinstated to G-7.

The photo below captured what went on perfectly. Merkel staring down a defiant Trump and Shinzo Abe seemingly disgusted with the whole thing. Trump went after Macron from France and Canada’s Prime Minister Justin Trudeau on Twitter.

Futures haven’t opened yet at the time of this writing, but I am hoping for a big move lower. Let’s welcome it as we still want to get long this market. The plan will be 1/2 shares at a time as what most don’t see to get about what Trump does, is he blows smoke and relents. By pushing what he wants to the extreme, he settles on something less but still gets some of what he wants. That seems to be his mantra from what I have read and evidently what he has written about in his books (whether he wrote them or not).

If you want to understand visually what will occur this week with the markets, liken it to a wild stallion with the early part of the week volatile, leading into the Fed, and then up to higher highs once the stallion is broken in.

In playing devil’s advocate with this philosophy, we can look at it another way come Wednesday;

1. if rates are raised, the perception would be from the Fed the economy is fine and business as usual. Market should move up after an initial stutter.

2. if rates are not raised, the perception would be from the Fed we are moving too fast and don’t want to hurt the economy and need to stop raising for now and the markets would move up because lower rates are bullish for businesses and individuals.

I will work on these 2 concepts as we go clower to Wednesday and see where we can buy into the fact that both come out bullish in my book. Metals might be a little different at initial reaction and I’ll address them below.

Foreign Markets

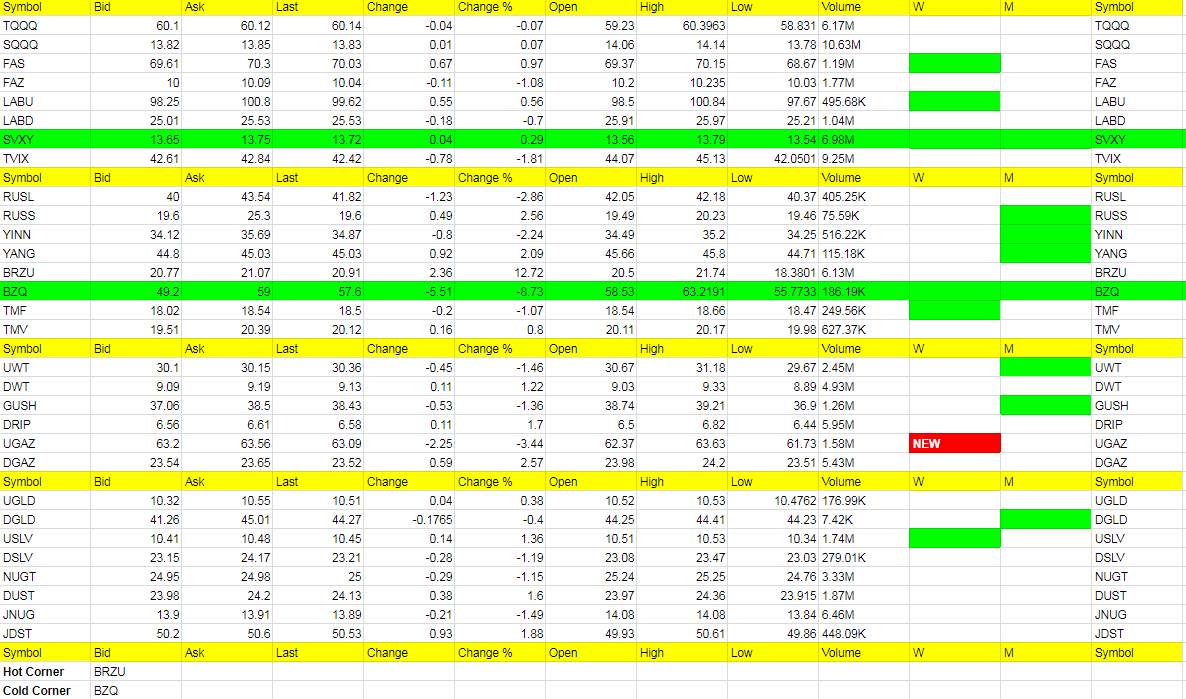

BRZU was 3 days in the cold corner and we bought into the first dip of the day and profited. With G7 going on I wanted to be flat but I think there can be some good profit on the dips in RUSL and YINN and was tempted on Friday but RUSL had just turned red on the weekly so ignored. Could have got 2% but sticking to the rules. The more I do that, the more we overall profit on a risk vs reward basis. I may start concentrating a little more here though as I think we might get bigger profit from these, especially if the dollar declines.

Interest Rates

No interest in trading these now but TMF has the slight edge moving forward.

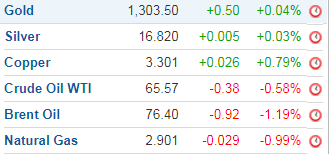

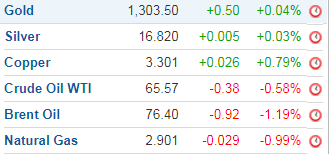

Got some profit from UWT and end of day fell more. Pretty volatile trade right now but still calling higher into the summer and would absolutely love a move to 62’s to establish a long for the ride to over 70. Anyone holding through thick and thin to 70’s has to tame this horse too, but it will be tamed.

Nat gas is actually looking better right now. Any dips in DGAZ I think is a safer play. It is getting closer and closer to getting out of the Dog House. Under 2.80 in nat gas and we are well on our way to some good profit.

Precious Metals and Mining Stocks

With the turmoil of G7 and Trump over the weekend, I can’t see this as dollar bullish. I don’t see a reason to fear a lower low in metals, except for Fed action which I believe would be temporary. Metals and miners are moving higher and silver seems to be leading the way breaking out first.

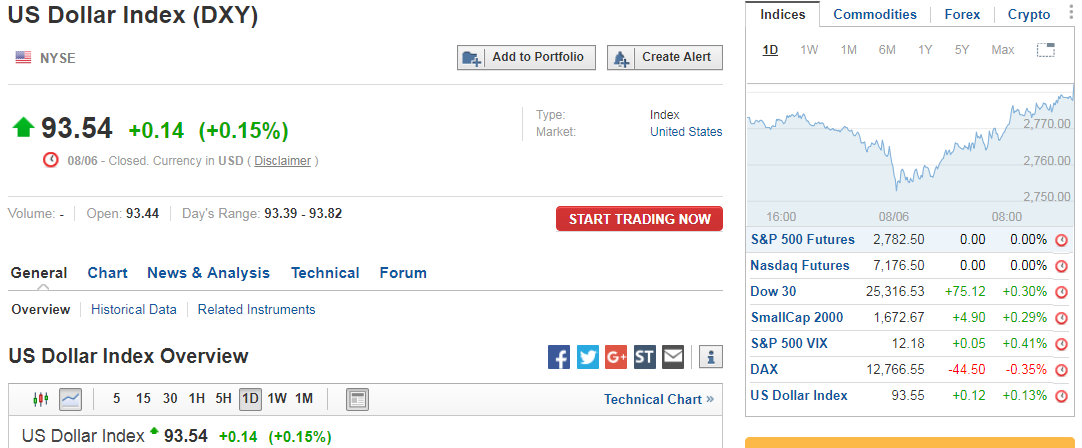

The last 2 Fed meetings gold has moved up with miners. Market makers can try to push gold down to the 1270/1280 mark which would be the absolute bottom in my book, so your dilemma is quite simple if long; Are you worried about a fall to 1270/1280 first on the way to 1377 break and then 1400? Can you buy some more shares if we fall lower? That’s it. A little bit of fear perhaps with Fed doing what they do but downside is limited and upside is quite large right now. The dollar of course is the key. Trump as I said above isn’t doing it any favors with his Tweets and G7 non-endorsement, and we should head below 93 on the dollar this week. Watch for it and some peace of mind. 92 is a support area where day or even swing traders may take some profit, but good shot of breaking 90 into the summer.

What the Fed does on Wednesday, or market makers before Wednesday, shouldn’t matter. We will get long NUGT and UGLD if we dip. Or if you have extra cash, add to the JNUG position. More confidence in this than I do most everything else into the summer. But markets higher is right there too. I just think the springboard will bounce your profits higher in metals and miners into the summer.

Green Weekly’s

These are the ETFs that have turned green on the weekly and show a trend has developed. Your best way to profit with the service is stick with the green weekly trend each day and take profit while using a trailing stops. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long. This will be tracked more when we automate the service.

Sell half shares on a spike up on any ETF you are long, even if goal is higher. Spikes higher are almost always followed by moves in the opposite direction. Try and get out with a market order quickly before the quick move back lower. Lock in that profit!

Wait for the sign of a positive day to go long anything beaten down, I think the odds swing to your favor.

New way to trade beaten down ETFs; The way that trade would work, and I really think it should be a rule from now on NOT to trade anything trending down until it reverses, is we would buy at the open if it is POSITIVE or GOES POSITIVE during the day. Then we would look to profit on 1/2 shares over and over, day after day until we get the red weekly signal on the opposite trade that could turn into bigger profits. The stop would be if it goes negative for the day. The rule of keeping a stop if it goes negative for the day is a must. Lastly for this type of trading we need to not be afraid to get back in if it goes positive once again. Sometimes market makers will take an ETF negative and then reverse it right higher again because they know if it goes negative many exit. So we have to be willing to risk a few in and outs when it does this up and down move around that potential stop out area so we don’t miss the ride back up. That’s just part of trading and not a big deal. But no matter what, if it breaks to yet another lower low because you didn’t get out after giving it a little more wiggle room, you are more than likely further from the original stop out when it went negative and you are out, waiting for it to go positive again before you get back in. You are simply buying into strength.

For those of you new here, I most of the time have the ETF Trading Research report out by 8PM PDT, and it comes by an RSS feed, but you can look at the report here sometimes before you get it in your mailbox; https://illusionsofwealth.com/category/etf-blogs/ This is also the same link if there are any technical difficulties.