ETF Trading Research 7/17/2017

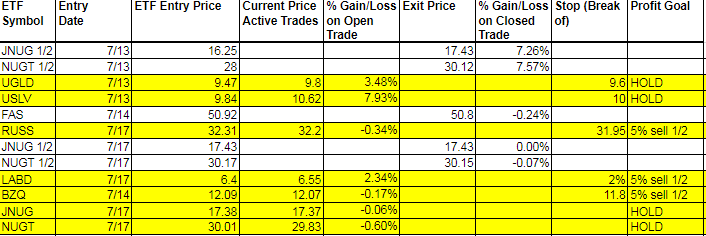

Today’s Trades and Current Positions (highlighted in yellow):

We locked in some remaining profit on JNUG and NUGT and bought back lower by a hair and at the same stop out price and prices are about flat on those trades. I don’t mind locking in profit as it gives me the potential to keep a tighter stop on any downturn at this point. Of course we can’t predict with accuracy an overnight move lower, or some silly fat finger that comes, but we are inching up in both metals and miners. UGLD is up 3.48% and USLV up 7.93% after being up almost 10% earlier in the day. USD/JPY ramped up mid day and caused us to bail. It did fall back down again but stopped at the 112.60 area where it is presently. While gold did gap up with silver today, they just didn’t take off. Need to get gold past 1240 for what will probably be the trigger to hold JNUG and NUGT for the big run.

We are down a hair in two new trades BZQ and RUSS but the charts have nice setups and they were positive today, so both good signs for a pop higher.

We also were patient and bought LABD and it was up 2.34% at the close.

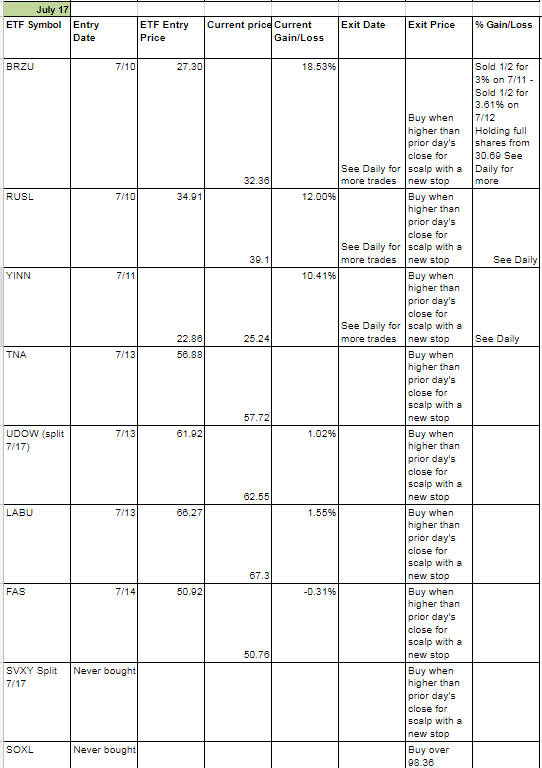

FAS we closed out with a small loss after the gap open lower. I’m ok with that despite the number of green weekly’s we have at present. More bad data today and sooner or later this market will catch up. I didn’t call SOXL at the open and while it did open higher and would have triggered long per the rules, it proceeded to fall about -1.5%, move back up to about even and ended the day -1.28%. We can still go long it now at the open if we gap up tomorrow, but with a tight stop if it goes negative on us. I would concentrate on SOXL and FAS tomorrow being the two newest green weekly’s and hold off on SVXY till I get this pricing from the reverse split accounted for.

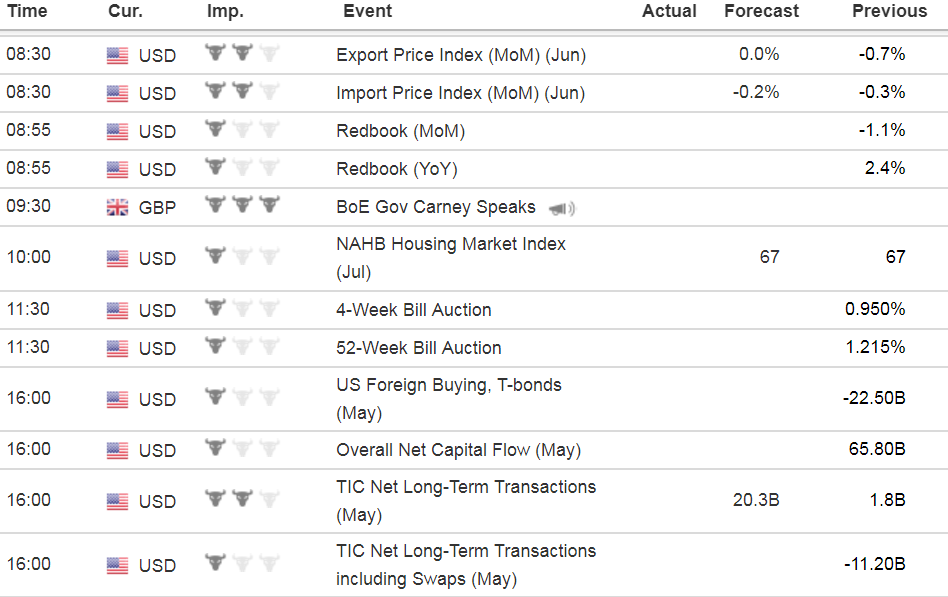

Economic Data For Tomorrow

Lots of data out of Great Britain tomorrow, topped off with BoE Gov Carney speaking as the U.S. market opens. Wed. night we have BoJ Interest Rate Decision, Outlook and Monetary Polilcy Statement that can shake things up a bit.

http://www.investing.com/economic-calendar/

Slight lean to TMF right now for interest rates. It would fit with the gold rise and market fall possibly too.

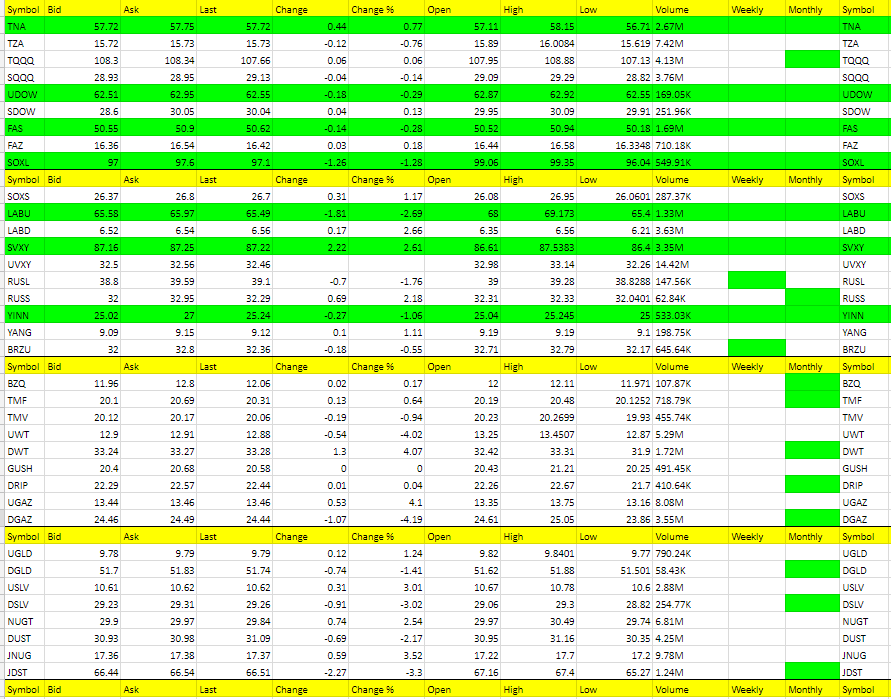

Energy

Decided to stay away from oil and Nat Gas today. No real clear picture. I will lean DWT and DGAZ tomorrow.

Precious Metals and Mining Stocks

The USD/JPY still matters based on the mid-day run up for no darn reason. We lost some profit in JNUG and NUGT and decided to be conservative, but once we saw the USD/JPY fall from those highs, got back in. We protected the downside, at least today and we’ll see what the night and tomorrow brings. Can’t make calls overnight and you have to always accept the risk of a non-green weekly ETF when holding overnight.

I hate to say it, but JNUG and USLV are on the Hot Corner two days in a row and we might from a micro point of view want to look at their opposites tomorrow as a hedge if you are long or straight trade by end of day maybe. I will say that at some point, if ever a two could break the 4 day hot streak, it would be JNUG and NUGT, and we’ll be long when/if they do.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

DWT, UGAZ, JNUG, USLV

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

DGAZ, UWT, JDST, DSLV

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out typically well before they start to fall again or turn red on the weekly. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long.