ETF Trading Research 7/27/2017

Tweaking the rules that I think you will appreciate. Also, tweaking so that we concentrate on what is trending and stop the bottom fishing as discussed before.

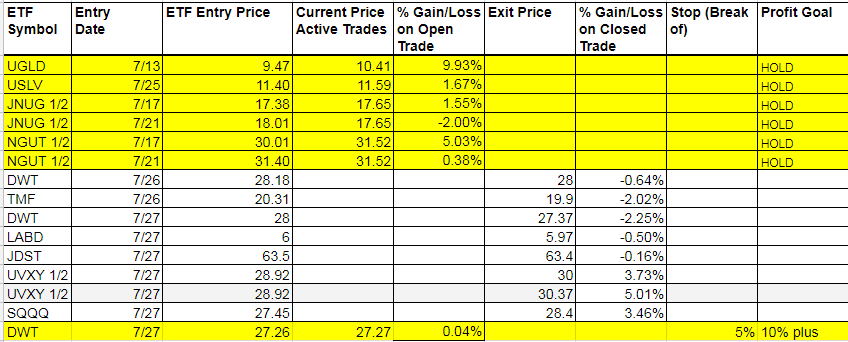

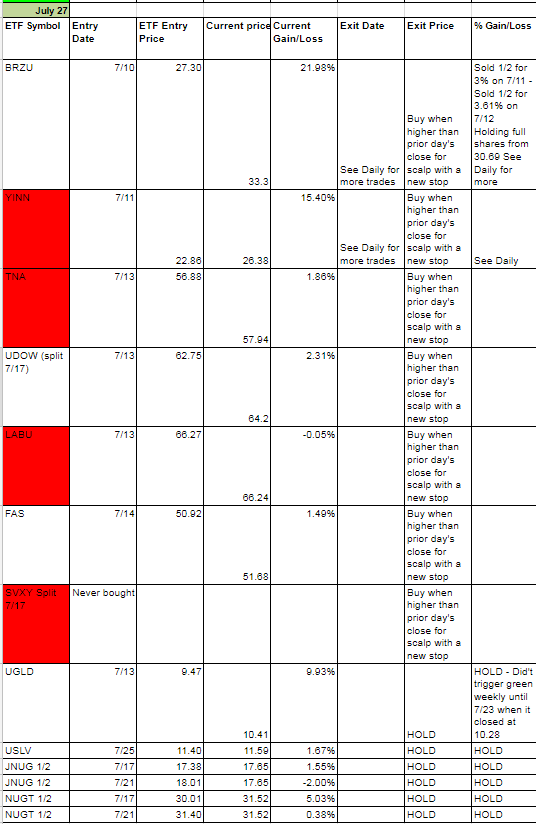

Today’s Trades and Current Positions (highlighted in yellow):

Today it took awhile, but out of the blue SQQQ and UVXY started to blast off and we caught a decent amount of the move and could have easily got more, but once again, something that you can probably trade on, I got a little greedy. I said two things, one about the 10% in UXVY where we could have automatically sold the last 1/2 shares and second about holding out for more on full shares of SQQQ instead of taking the 5% gift. On super big spikes like that, it really is sinking in after doing this Trading Service for awhile, that you shouldn’t question the Rules. It only leads to trouble.

In fact, when you look at the trailing stop of a Green weekly on JNUG from the pre-market high, it would have had us out at 18.01 which was our entry on one half of JNUG and a 3.62% profit on the other half. But what I think I learned most after doing this several times now is a new pattern that I have to implement no matter what. It’s a pattern that will leave us 1. in ice profit and 2. don’t ask questions as to why or second guess ourselves. The bottom line, green weekly or not, is to take the money and run when we have days like yesterday. I do think we head higher to 27 still on JNUG, but after seeing gains disappear on these ETFs the way I have in the 5 months since I hired the 3rd party to analyze the data, I have been able to tweak the rules to give us better profit goals and stop percentages. But now I have to alter the green rule to include “big days just sell all.” Especially it seems with ETFs because they are so volatile. Lock in the profit and come back the next day fresh. I look forward to following this rule and the old rules closely. And also, I mentioned how I wanted to concentrate on the green weekly’s for profit more. So will concentrate on those as our day trades from now on and ignore the other bottom fishing that leads to the stop outs, as tempting as they are. By doing this we won’t miss out on the big runs like we had with BRZU, YINN and LABU. We can trade those over and over for profits with some simple guidelines. The guidelines being; buy at the open if above yesterday’s close or if it opens lower and later in the day goes positive, buy it then. So you’ll have to write down the prior day’s close and then trade the green weekly with day trader rules for stops and profits. Always take those 1/2 size profits and use a trailing stop and as the ETF goes higher, reduce the size of your trailing stop.

Anyone who has been with me since the beginning knows I am constantly self analyzing, trying to cut out weaknesses. But you also know I am a creature of habits and sometimes sink back to bad habits. I am faster at catching them I think now and do admit when I make those mistakes. But you as experts on the trading rules don’t have to follow along with all I do when I go against what the Trading Rules. Hopefully this new strategy in running this service will always keep us on the path of good trades. However, if I see something that is a potential runner like I did today in SQQQ and UVXY, I will still call it. I will try and separate those kind of potential profitable trades from others unless I decide to just convert the service to calling green weekly’s and leave it at that. Still debating on what makes the most sense for us and our profitability.

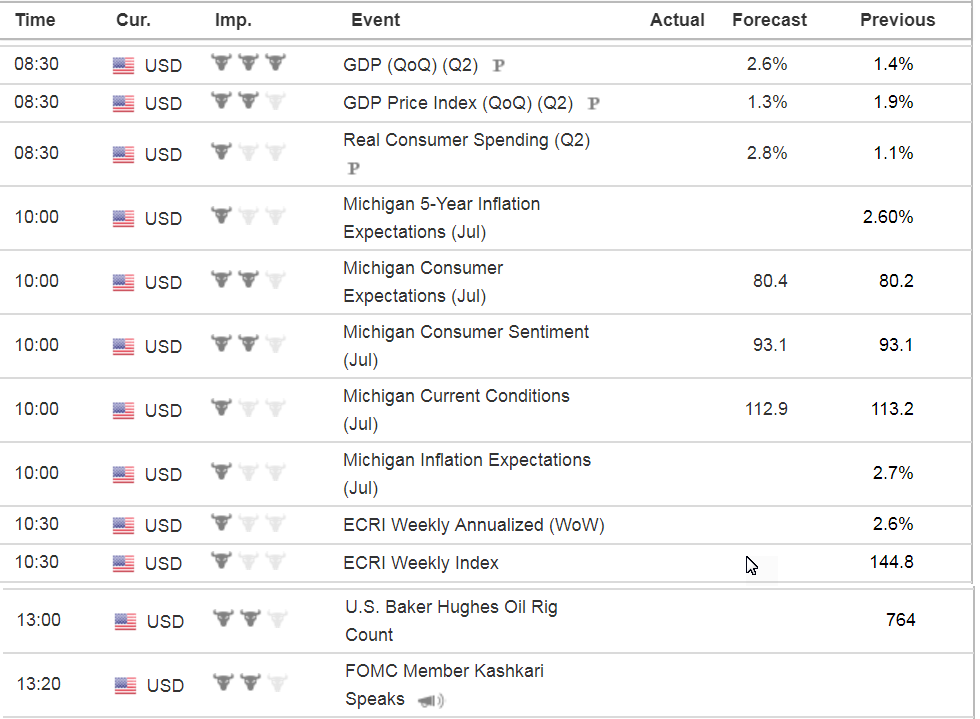

Economic Data For Tomorrow

Tomorrow is all about GDP. Forecast is 2.6% and that to me seems a little ofty after the previous reading of 1.4%.

http://www.investing.com/economic-calendar/

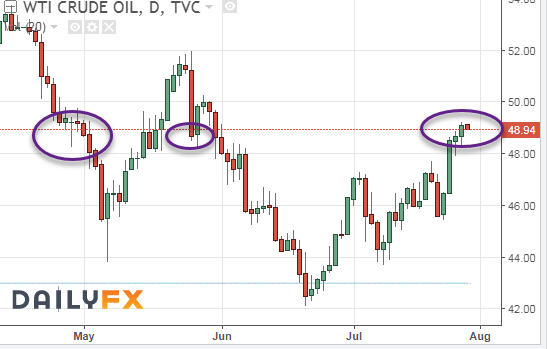

Energy

Nat Gas report came in positive but no signal on the green weekly yet.

Still like the potential in DWT after this run up in oil. We are still within that range of a top of 49. Below is what I see and why I am thinking the 3rd time might be a charm with the last entry. We are right at the resistance level of May or the old support level from April. A break through that and we would have to revert to being fully bullish. Charts have to mean something here.

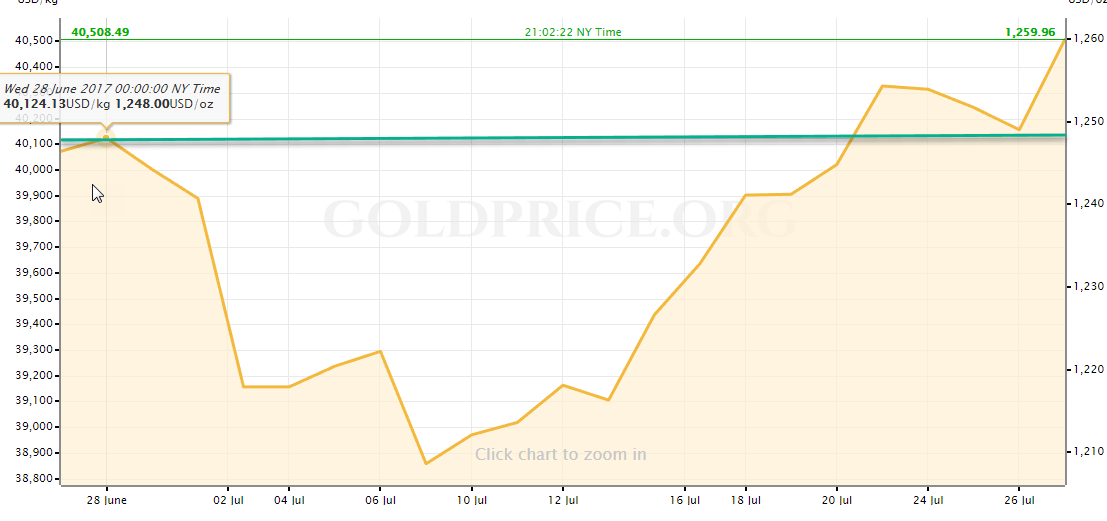

Precious Metals and Mining Stocks

Gold and silver sentiment actually rose today on a down day. Banks remember are net bullish. Funds had to do some recovering on the Fed data yesterday, so we’ll see the CFTC data tomorrow and where we are.

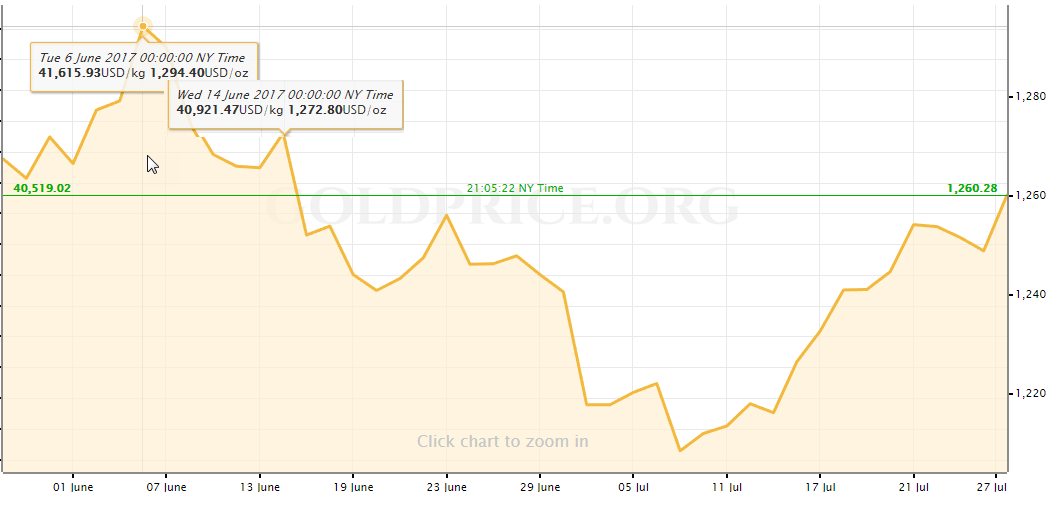

As I type we got some good news maybe in metals and miners. USD/JPY is dropping and under 111. again. If we wake up tomorrow and it is back over 111, then gold and silver and miners will still have some trouble. We’ll use the 111 mark now for day traders as a reason to go long JDST, with or without my call. Over 111, JDST is the call. Under 111, JNUG is the call. Scalps only on JDST or sell half for .50 profit and use a trailing stop. I prefer this to be the bottom and we just shoot higher. But we need to break that low from July 24 which you can see in the chart below. Gold so far isn’t pushing higher, sitting at 1259.40, near our old resistance or what we hope now is new support. Silver up a penny to 16.60. But the part that surprised me the most today was USD/JPY moving so high, over 111.50. Some might conclude that gold was down today because of the dollar being up but technically, GLD was only down 9 cents today. If the dollar is up as big as it was, gold should have been down more so I can’t buy that relationship holding true right now. If gold were to fall, I see the June 28th low of 1248 as a bottom, worse case scenario. That’s not going to have me shaking in my boots. Today I thought we would get 1270 and then as you look at the second chart below, fall from the 1270-1272 level but they trumped me a bit and took it down well before 1270. But over 1270 now and 1294 comes into play and after that 13ot, then 1364 are our next target to push through. Everything to me points to this, not new lows again.

Sentiment on the dollar was down to 9 yesterday and it was due for a bounce is all. I pointed that out in last nights report when it was 11. Copper too I mentioned as it was due for a pullback. Copper is a screaming short right now. Last time sentiment was this high was 2010.

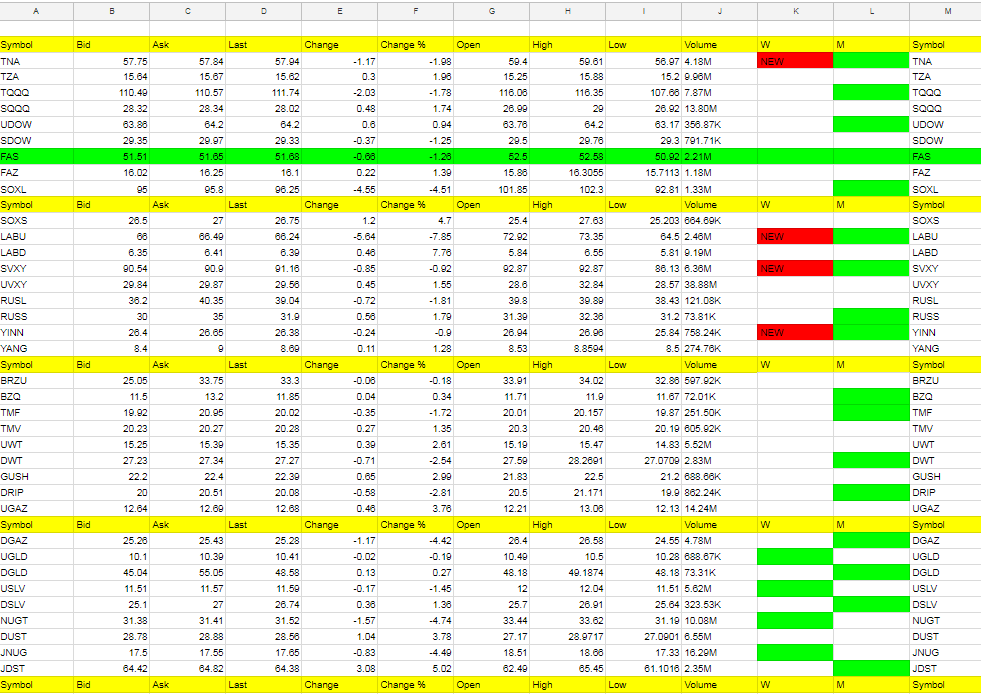

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

LABD, JDST, SOXS, UGAZ, DUST (UWT was close to 3 in a row which leads to DWT I think as a good trade for tomorrow, which we are already in).

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

LABU, JNUG, NUGT, SOXL, DGAZ,

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out typically well before they start to fall again or turn red on the weekly. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long.