ETF Trading Research 7/26/2017

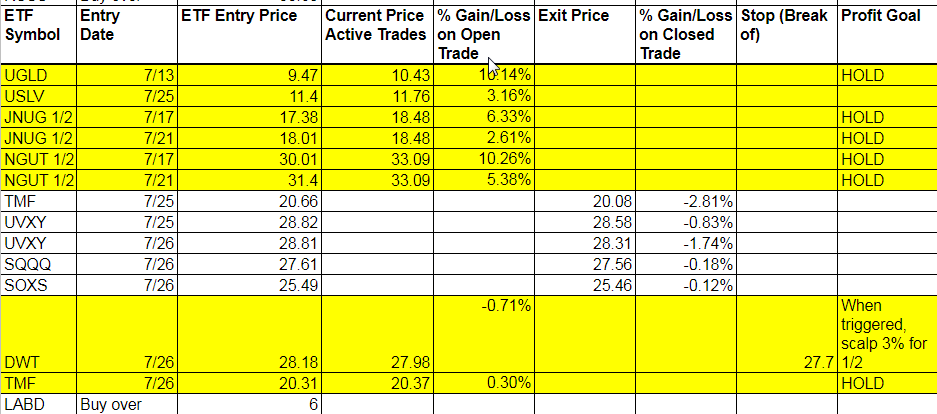

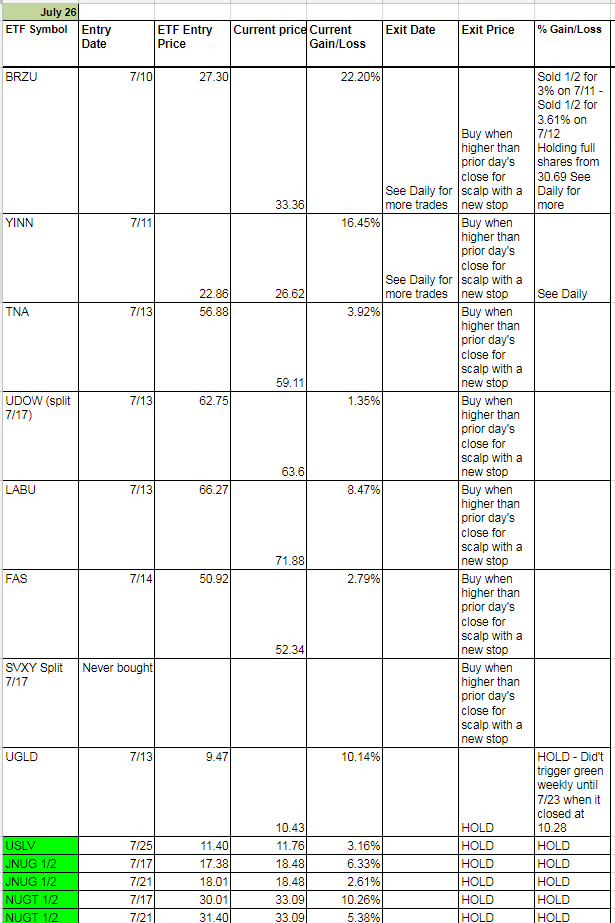

Today’s Trades and Current Positions (highlighted in yellow):

I’m going to start out today’s report by saying now that we have JNUG green on the weekly, I think JNUG can get to 27 minimum on this run. How you play it and where you take profit is up to you, but 27 is my minimum target. More on precious metals below. It might be conservative. I don’t make too many predictions that far out or get overly confident

Today’s trade made up for some past couple weeks shortcomings as we stuck with what I believed in, gold and miners going higher. We got back in silver yesterday too and it took off higher. Now all of our miner and metal plays are green on the weekly and we can relax I think a bit as we move higher. Possibly much higher. Hopefully this is one of those rare opportunities to profit.

I also think there are other good trades coming too and one thing I need to add to the trading rules is to not put all your eggs in one basket. I know I have said this before, but diversifying and trying some other ETFs that turn green on the weekly. Typically the pros say to put no more than 25% in one sector. But I know with metals here, I am comfortable with more at present. Still, we follow enough of these ETFs and the charts look so good on many that I think a little diversification is in order. Spread the risk too.

While we did get stopped out of some trades with small losses, you know I’m not afraid to get back in when the timing might be better. And normally I would have been all over UVXY end of day on a trade, but it was getting near close and I try best I can to refrain from trading too close to close and adding that extra risk. This has worked out well for me so far, but at least with UVXY I said over 28.60 it might go higher. It got to 29.24. Not too bad. And it also ended th day positive by a hair. A good sign for tomorrow maybe and a ton can still be made in it. I just didn’t like the stock market being up 90 points so didn’t make the call official for that reason either.

Want to give a shout out to this lady today. Thank you Janet!

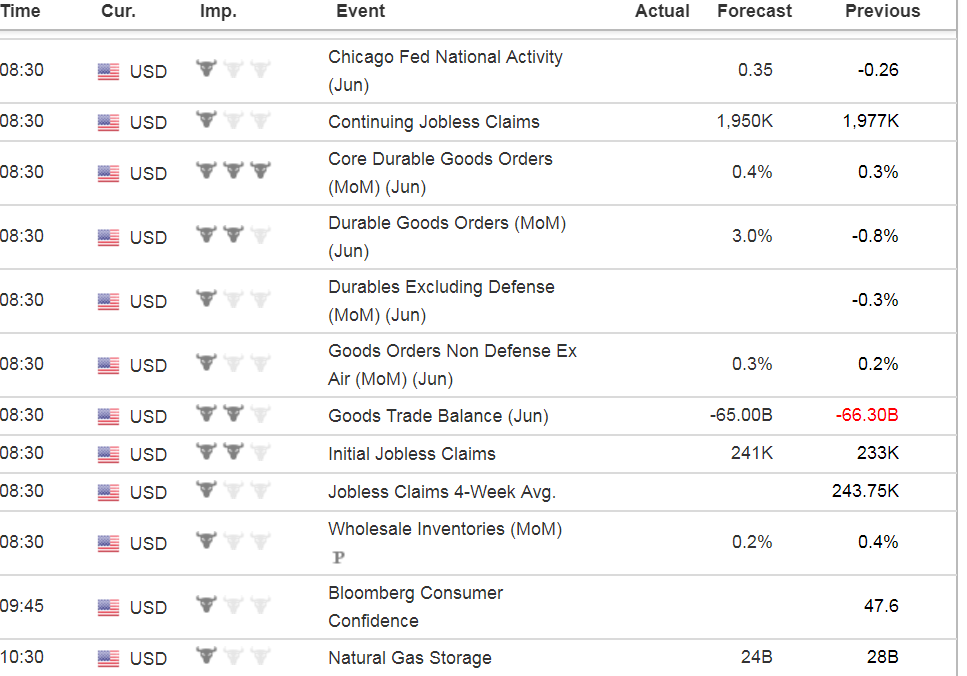

Economic Data For Tomorrow

Tomorrow we are lucky enough to have all the data come in after the market opens with New Home Sales and Crude Oil Inventories coming in at 10:00 and 10:30 followed by FOMC Interest Rate Decision and Statement. Keep in mind Friday we have GDP data. Going to be some kind of 3 days of movement.

http://www.investing.com/economic-calendar/

Energy

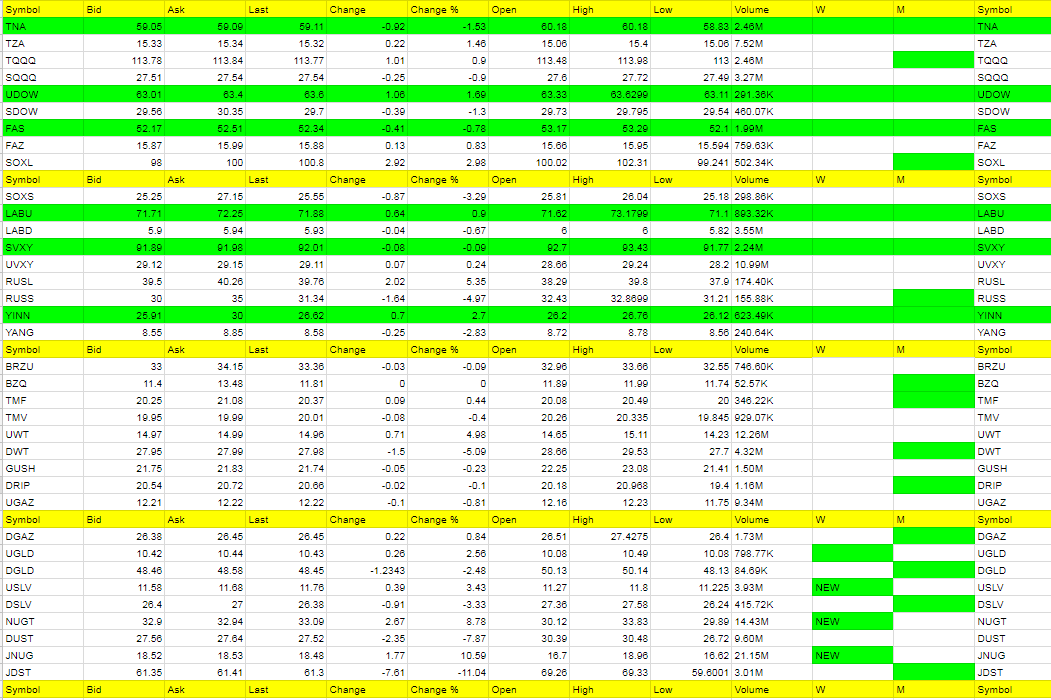

Nat Gas didn’t keep falling today but DGAZ tried. Maybe tomorrow. Still want Nat Gas to get below 2.80 before we get long UGAZ.

I’m thinking we may have got the bottom in oil with our DWT play. If we did, sitting on it for a bit should pay off big. Some risk still, and OPEC can always meddle, but for now I want to see if that area we bought at was the resistance area. From what I see, it is. Important; to solidify our trade in DWT, it has been in the Cold Corner for 3 consecutive days now and 99% of the time it means a reversal. While we may get a quick move up in oil in the morning, by afternoon we should be moving up higher in DWT. Or we just ride DWT from the open. Either way, I like this potential.

Precious Metals and Mining Stocks

Heaven. We’ll stay in Heaven awhile and hold.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

JNUG, NUGT, RUSL, UWT, USLV, SOXL (USLV, NUGT, JNUG new green weekly)

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

JDST, DUST, DWT, RUSS, DSLV, SOXS

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out typically well before they start to fall again or turn red on the weekly. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long.