ETF Trading Research 7/25/2017

So far the synopsis for metals is BULLISH after the Fed. Until then, anything can happen and probably will. USD/JPY already went over 112 just now. If you get uncomfortable with your trade, that is actually a buy signal, not a sell signal. USLV has to break 12.38, JNUG 18.29, NUGT 32.04, UGLD 10.40. From there the charts look like runners for all.

I want to be clear on the bullish trend being there, underlying all this Fed noise. Market makers are very aware of your pressure points in getting you to crack and try they will. Could have got us out with small losses on this latest round overall on that run up this morning of JNUG to 17.50. Not my goal if I think we see $1,300 before $1,240 break, but market makers may try and shake you as I said. Once we hit a green weekly in JNUG you’ll see the fun begin for all of us. But let’s crack $1,260 by Friday first. That’s what I am looking for. Then $1,270 and then don’t look back for a bit.

Oil also setting up for a fall now that we have hit the target of 48+ (futures 48.39 now). DWT low of 28.05 after data today and 28.57 at close tonight after hours. DWT has a good setup going back to April in a string of successive higher lows.

Before I started the analysis this evening, I wasn’t sure what I was going to come up with as a conclusion since USD/JPY went over my target. But it is 111.95 now and as I said many times this week, “expect the unexpected.” It’s Fed week and we now will get some clear signals for some bigger trades all around.

Instead of calling RUSS, BZQ, YANG, I will choose BZQ and YANG as my proxy for these with equal shares in each. If all 3 are up, then you can choose which one you want, but you have to pull out a yearly chart to see that we are close to a 52 week low and a double bottom at 11.37. 11.81 now. YANG is at multi-year lows. Love them both here soon enough. We did get a piece back in BZQ today, as much as 3% if you were nimble, but these two are set for a big run I think.

Some Daily Sentiment Index (DSI) Data For You

Copper is at a whopping 89 and Canadian Dollar also at 89 so a turn lower is in store.

S&P is at 80 and Nasdaq 77.

Euro is at 79 and British Pound 77 while the dollar is at 11. Gold can move up with the dollar here.

Gold is at 28 and silver 33.

Let’s see if we can’t get gold and silver up into DSI 70’s territory and possibly 80’s before we do any selling.

CryptoCurrency Alert

Sales of digital assets (CryptoCurrencies) by “virtual” organizations are subject to the requirements of the federal laws.

News release: SEC Issues Investigative Report Concluding DAO Tokens, a Digital Asset, Were Securities

https://mobile.twitter.com/SEC_News/status/889946003725537287

U.S. Signals Clampdown on Red-Hot Digital Coin Offerings

Markets such as Coinbase Inc.’s GDAX and Gemini Trust Co. that offer trading in digital assets so far have dealt mostly with state, not federal, regulators. The SEC now says that will likely change. “Additionally, securities exchanges providing for trading in these securities must register unless they are exempt,” the agency said.

Calling that a “big deal,” Walch said, “Those in the crypto world have been acting as if they live in an alternate universe, and the SEC has delivered a reminder that they still live in the real world, with real investors and real people making decisions that they must be accountable for.”

This is bullish news for gold/silver physical metal overall. My take anyway. SEC isn’t involved in the physical gold/silver market, lol. Don’t you find that odd? They simply (probably via the Fed) don’t want to legitimize it. But they ignore that in fact American Eagles are legal tender.

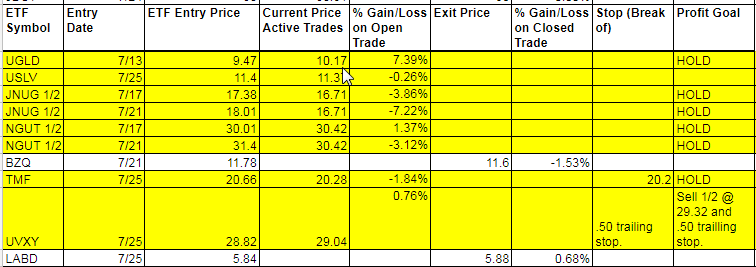

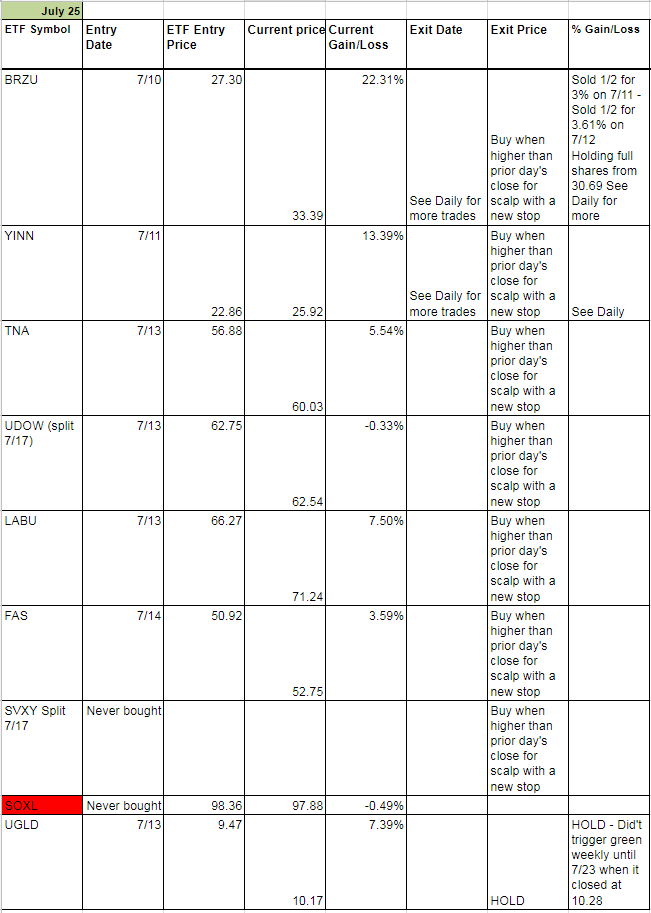

Today’s Trades and Current Positions (highlighted in yellow):

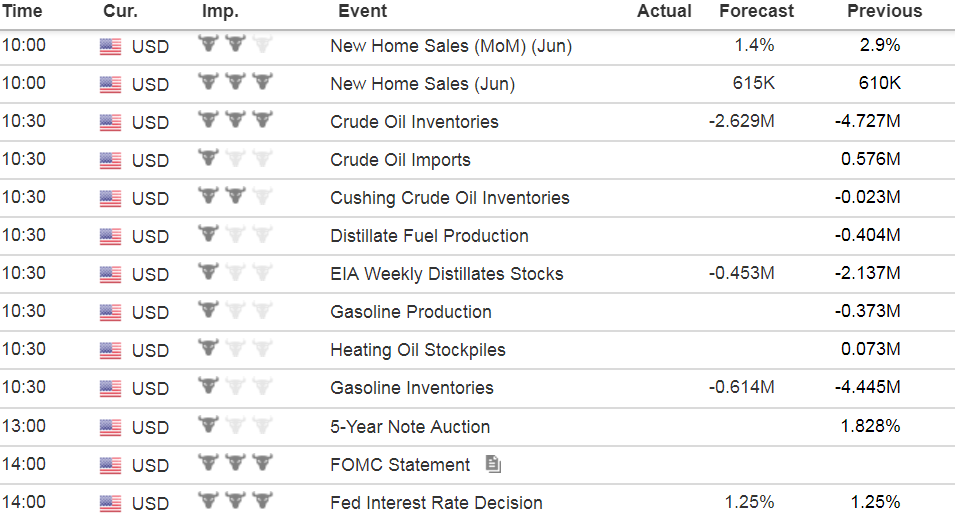

Economic Data For Tomorrow

Tomorrow we are lucky enough to have all the data come in after the market opens with New Home Sales and Crude Oil Inventories coming in at 10:00 and 10:30 followed by FOMC Interest Rate Decision and Statement. Keep in mind Friday we have GDP data. Going to be some kind of 3 days of movement.

http://www.investing.com/economic-calendar/

Energy

I did give out as a soft call pre-market UGAZ as a buy at 12 and that you would get 1% to 3% from it and at the high you may have got the 3% if you sat all day on it. But a 2% scalp would have been fine too. I don’t like holding on and hoping but rather take the money on non-green ETFs, except for gold which I have more confidence in. Nat Gas may or may not be ready for blast off. I almost want to buy both sides and if we get a pullback in DGAZ, sell it and profit and hold on for the coming blast off in UGAZ. That would be the ideal trade. If UGAZ breaks out, we’ll know it and can ride it pretty far. Holding both is a no lose situation overall and I think if we did get a pullback in DGAZ to under 2.80 for any reason, we take that profit and ride UGAZ for the move back to 3.10 or higher. This might be the trade of the week next week coupled with DTW.

Oil got good data after hours and shot up past the 48 target. While many others are getting bullish, and tomorrow we may see a continued rise, it is setting us up for a big trade in DWT.

Precious Metals and Mining Stocks

Very choppy market in metals. Could have just pulled the plug and be out till after the Fed, but read above as to what I think of gold. I have to lean very bullish post Fed and am sticking with that call. In fact, metals hung in there well and they are using of course the after markets close and Asian trading to push gold and silver lower pre-Fed. We might get a good sized pullback overnight and who knows, maybe even a mysterious fat finger to boot, but post Fed we should be off and running in metals. Any pullback in metals should be bought. Silver will lead gold higher when it is ready to make it’s move.

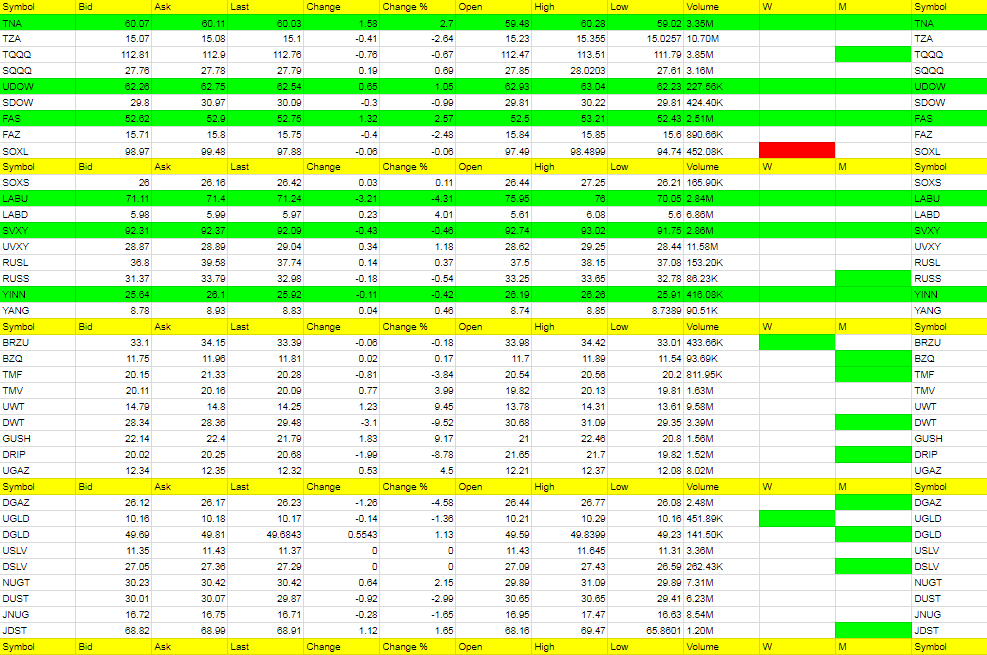

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

UWT, GUSH, UGAZ, LABD, TMV

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

DWT, DRIP, DGAZ, LBU, TMF – SOXL new red weekly

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out typically well before they start to fall again or turn red on the weekly. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long.