Today’s Trade Alert

There were no new Trade Alerts today. The job data came in better than expected and buoyed the market.

Trade Alert Updates

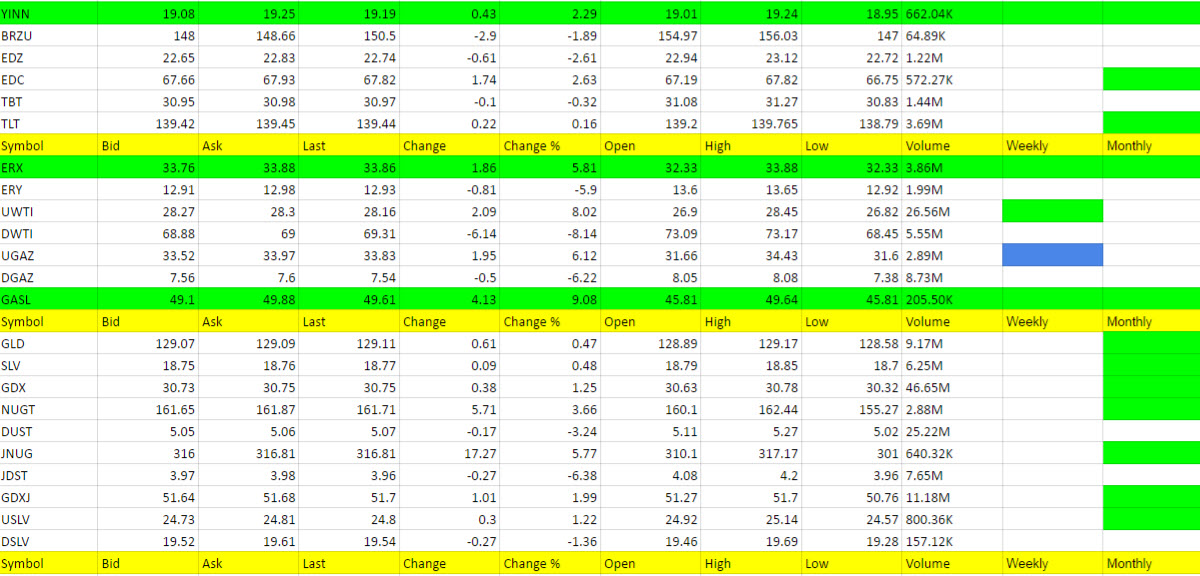

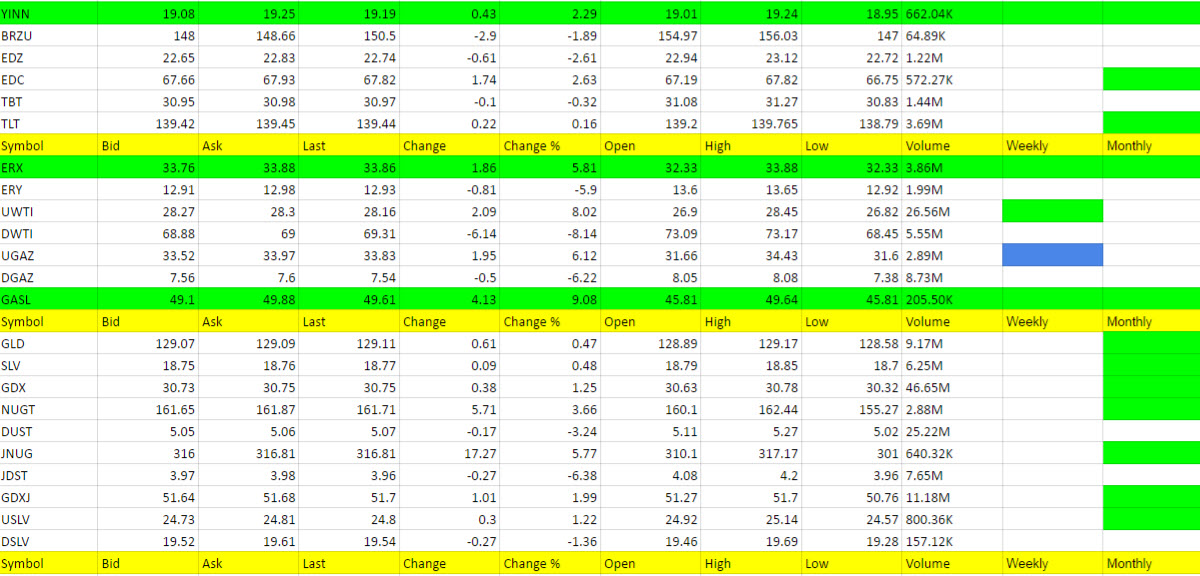

UWTI triggered long on the weekly at 23.38 on Monday and we took half off the table for a 8.16% gain at 25.29. Today we got within 5 cents of our 28.50 target and closed at 28.14. We’ll get a little greedy with our remaining shares and see if we trigger on the monthly where we may add back shares for a stronger trend and return potential. Taking profit along the way guarantees we can’t lose on these types of trades and that’s what we want to continue to do.

I sent the following Trade Alert out today;

The UWTI trade is up nicely again today and reaching our target of 28.50, presently sitting at 27.78 or a 18.82% return. The high of the day is 27.85. The question becomes as we get closer to resistance levels, how much further will it go?

There are 2 ways to play this now, depending on your risk tolerance;

1. We haven’t turned green on the monthly so there is the potential for more profit. I still would like to see more profit locked in now so will make the call to sell 1/4 more shares and lock in the 18.82% profit.

2. If you hold and we get a reversal, which they always come, your resistance to pain in giving up profit has to be managed too. We could reverse and hit red on the weekly and you could lose 5% to 10% of your gains. That’s how these leveraged ETFs work. You need to weigh that versus the potential for more than 20% gains should we trigger on the monthly. These are the home runs we can expect.

With UWTI one more rumor out of OPEC countries, Russia or whomever, can get us sharp reversals. I would prefer not to lose profit when we are up so much.

There will always be more trades coming and I want you to start this service with some good winners from last week and this week.

I also don’t like holding over weekends too often as anything can happen and why worry yourself all weekend when you could be enjoying family and locking in a good profit?

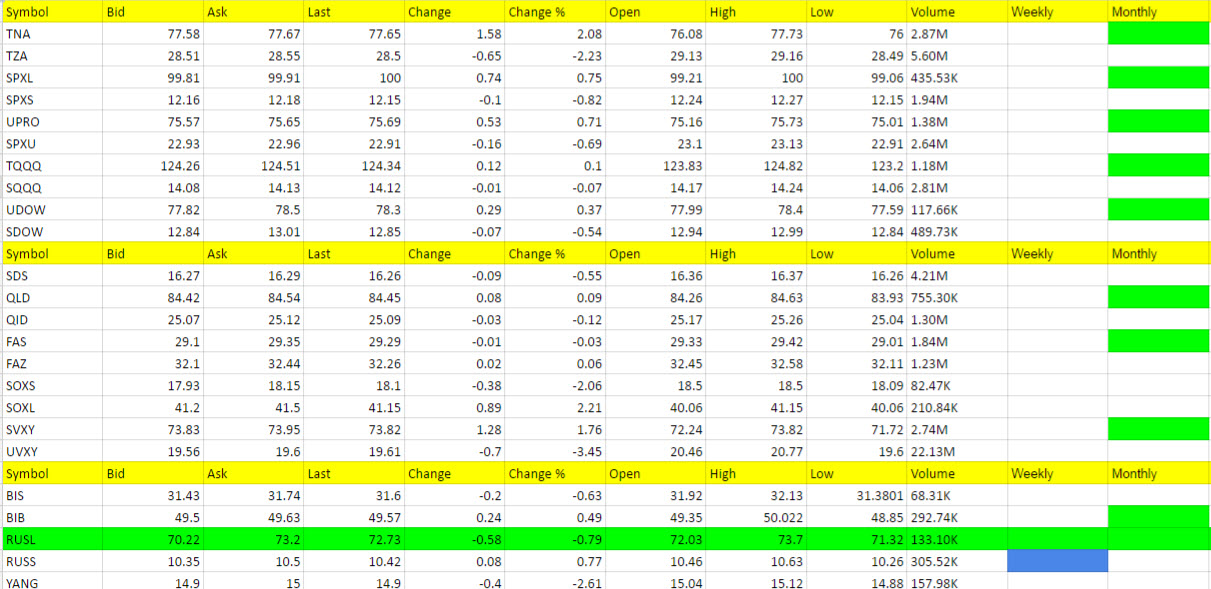

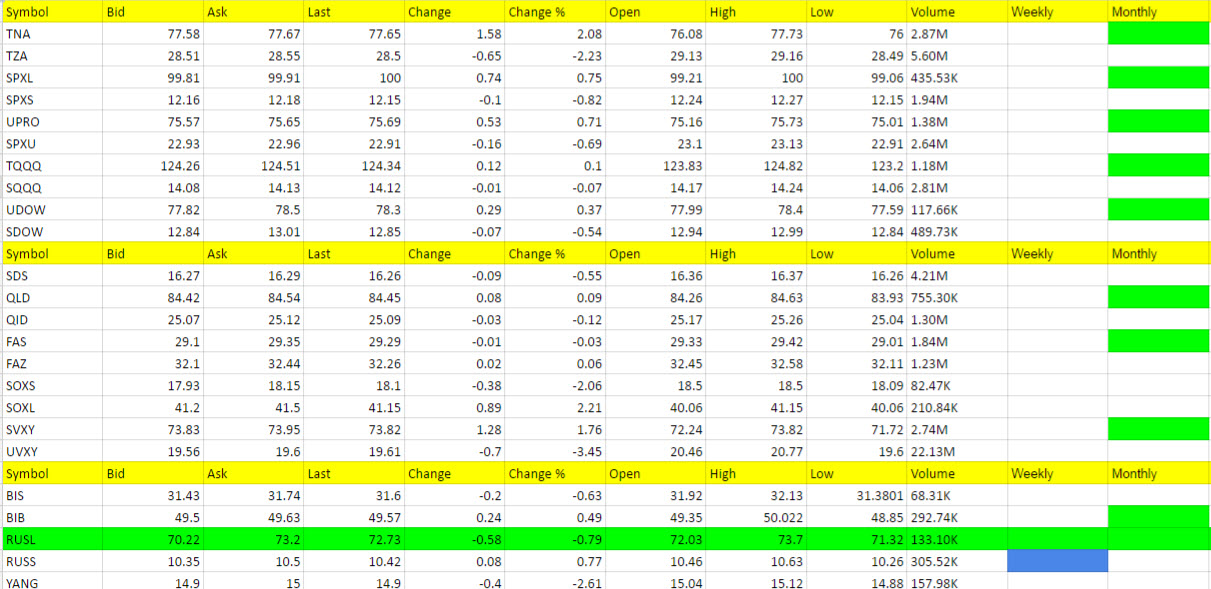

We got good news on the jobs number and no short the market ETFs triggered.

Gold started the day higher and DUST took a hit early on but is now flat at 5.24. Only aggressive traders should be in this at 5.12, and so far so good, but we need to get that dollar moving higher and gold to break down. We’re not there yet, and we haven’t triggered green on the weekly. Risk vs. reward is still to my liking but know your risk.

RUSS is peaking my interest. Just need markets to tank and this can go 20% but PLEASE wait for signal.

No new calls today so far as we wait for the break of ranges and jump the next trend.

News that Can Affect Tomorrow’s Trades

The Baker Hughes US Rig Count data comes out tomorrow. Last week it was pretty bad with the additions and this week I don’t think it will be as bad and may bode well for the UWTI trade. That said, if you follow it and get shaken out on a stop after the report if it comes in negative for oil, you can exit the trade. I’d like to see a continue run up into the trade and if you are conservative and want to lock in a 20% plus profit in one week, then please do so before the report.

U.S. Stock Market

Still no call in the stock market. Futures are at 2183.50, and up from yesterday by 3.75 points. Market has taken what the Fed has said and that’s how we’re trading, bullish. But no new ETFs have turned bullish and this to me shows weakness, and a possible topping in the markets.

Call: Still no call at present. Patience will be rewarded.

Foreign Stock Market

YINN and RUSL still green but BRZU and EDC turned red. I needed these to start turning and we should get some good mileage out of them when the opposites are called.

No call at present.

Interest Rates

TLT bounced higher and is an every other day green, but no call with it churning like this. Of course I still like it longer term.

Energy

UWTI is a hold for more profit and you can move stop from 25.20 to 26.95.

DGAZ and UGAZ no call but UGAZ is on the watch list now color blue after today’s report.

ERX green once again and I should have stuck with it on my call. I think in starting the service again I was a little too conservative to start.

Precious Metals Market

Gold started the day higher and DUST lower but it did get back to even despite an overall stronger stock market. It did fall back rest of day and I have removed all these short the miners from the blue one to watch list. No calls either way right now. Will keep an eye on gold and dollar and call either side that may trigger. Looking actually a little bullish right now. Dollar is weaker and we have to question if it will continue lower or bounce from this level as it did not too long ago. It could touch 93.50 and give gold a chance to test its highs again. Technically we are still range bound and will be patient for the trend.

Other Calls

From time to time I will be adding individual ETFs that have triggered long or short based on market trends. These may or may not be leveraged. These types of trades will be more for longer term swing trades for IRA’s where we can catch a good directional rise. I care not what the overall market is doing with these calls and will provide entry and exit strategies.