ETF Trading Research 8/21/2016

For the first two weeks we have done well for the service but it is time for some of you to make a decision. For those of you who are ending the 2 week free trial, please note your credit card will be charged for the service starting this week. I want to continue bringing you value and good calls and look forward to much profit in the weeks, months and years to come. I don’t think there is a service like this that can compare and I promise to keep bringing the good calls to you. While some calls may not pan out, we hope that most do and you’ll be able to take advantage of some good doubles and home run calls that always come.

Today’s Trade Alert

There were three scalping trades today, 2 of which turned out ok with RUSS and DUST and one, the labeled most risky one in UVXY, where I said we would probably get stopped out, we got stopped out. As I wrote in the last update for the day, UVXY is one that is always going to be a challenge but we’ll take stabs at it now and then when green and try for the 10% move like we got the first week of the service. I will try and get the end of day calls out before market ends but for those who are not aware, the ETFs can be traded after hours (or pre-market) with limit orders. Any questions, let me know. info@illusionsofwealth.com

Trade Alert Updates

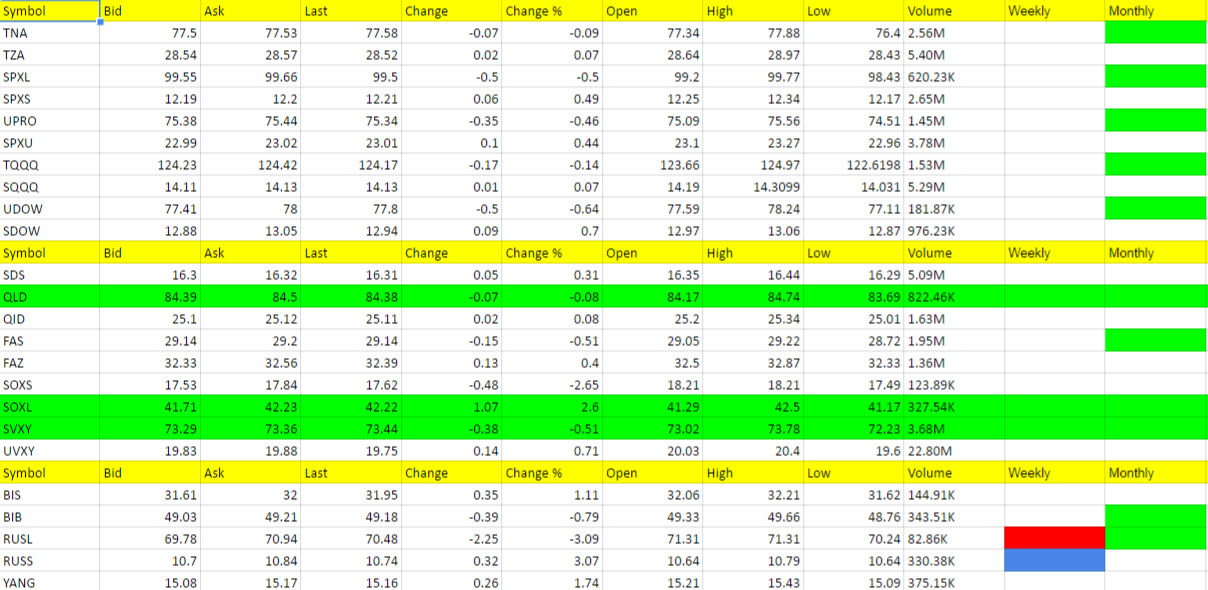

U.S. Stock Market

Still no call in the stock market but it does want to go lower in my opinion. The problem is, futures don’t want to crash just yet hence the no call at present. Futures are at 2182.25 now, down 1 from Friday but did dip early on Friday in an attempt to try and make a move.

Call: Still no call at present. Patience will be rewarded.

Foreign Stock Market

RUSL turned red on the weekly and I made a call for RUSS. We still need futures to tank to get on board so just scalping RUSS for now. Waiting now for YINN to turn red on the weekly to give us more confidence to play YANG, RUSS and EDZ.

Call; No call at present and have to be patient a bit longer for a good play shorting the market.

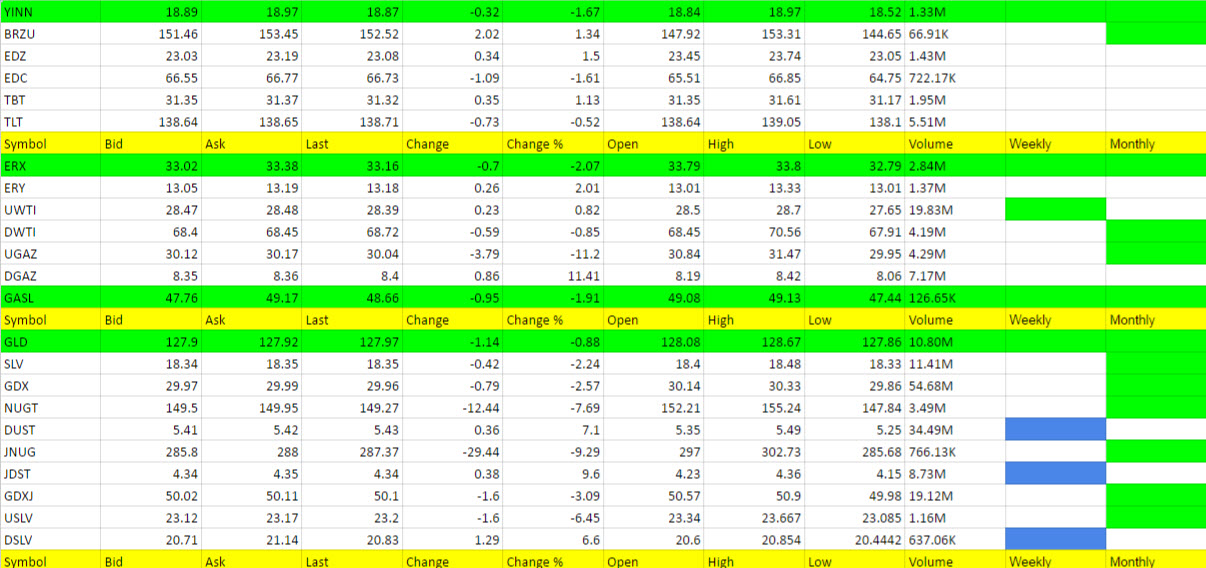

Interest Rates

TLT and TBT just churning and no real call right now.

Energy

UWTI if you are still long for any reason, stop is still 26.95 but you should be out now on a break of 27.50.

DGAZ and UGAZ no call right now. It seems UGAZ should give us a scalp bounce but not playing either side as DGAZ may just break out here too. Trend is with DGAZ but there is resistance here and support for UGAZ so we’ll wait for the right call.

ERX still green but no call.

Precious Metals Market

Gold and especially silver are setting us up for a move lower still. We just need the dollar to move higher for conviction but I am more and more liking DUST and JDST as well as DSLV where I have put all 3 on the one to watch list.

Other Calls

From time to time I will be adding individual ETFs that have triggered long or short based on market trends. These may or may not be leveraged. These types of trades will be more for longer term swing trades for IRA’s where we can catch a good directional rise. I care not what the overall market is doing with these calls and will provide entry and exit strategies.