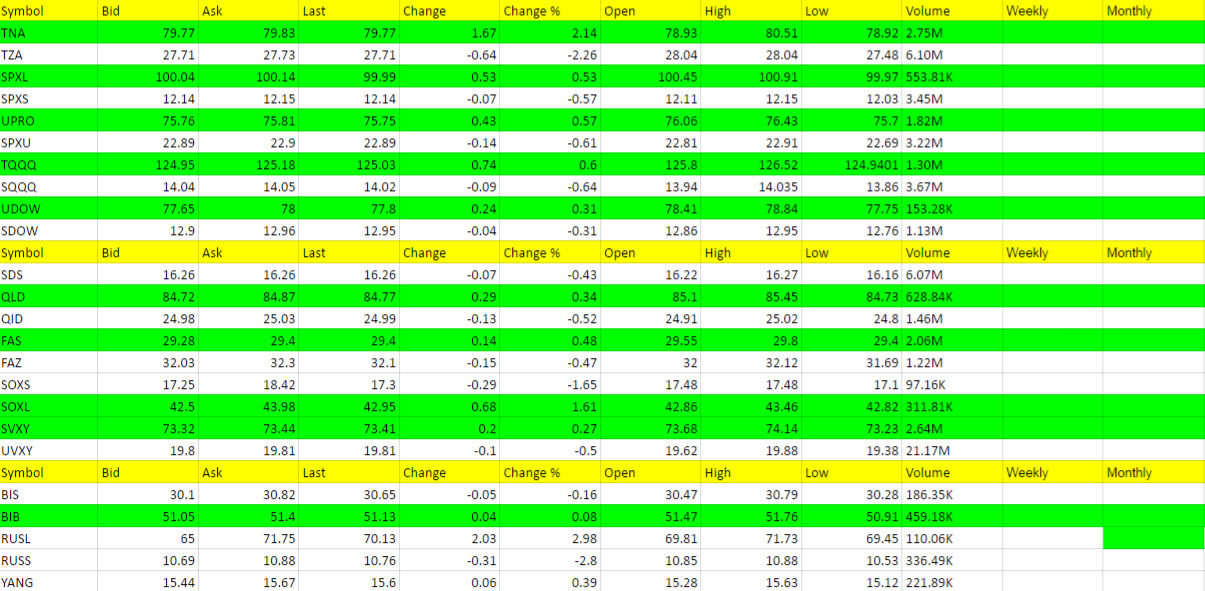

ETF Trading Research 8/23/2016

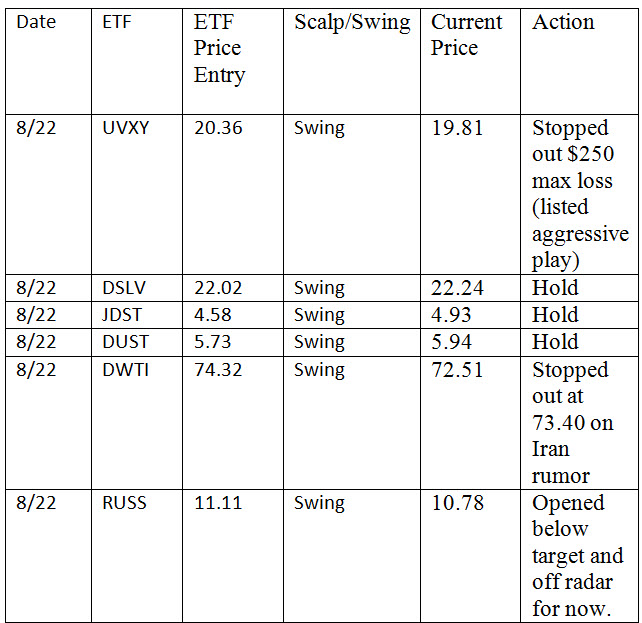

Trade Alert Updates for 8/23/2016

Today we exited two trades by keeping stops. After I sent out the morning Alert some of you may have locked in DWTI profit but soon thereafter the sky fell when a rumor caused oil to go green, turning a profit to a loss. We are working on an overall view of all trades for you to see and it should be available soon. This will be separate from the trades we are actively managing, but I want you to see the degree of accuracy we have and the importance of keeping stops and letting winners get your accounts higher.

Today’s Trade Alert

There were no new trades today, only exits.

We are up 7.64% on JDST, 3.66% on DUST and 1% on DSLV.

We lost 3.88% on UVXY, the aggressive play and 2.44% on DWTI (but was up 6% early on and hopefully some of you had trailing stops on it).

News that Can Affect Tomorrow’s Trades

U.S. Stock Market

Still no call in the stock market and we keep getting teased that we will move lower only to bounce back up. Not easy to trade which is why we haven’t made a call as of yet. Futures are up 4.25 to 2185.75 but were up to 2190.75 earlier. I don’t like this volatility at present so will wait for a better setup.

Call: Still no call at present. Waiting for futures to fall below 2175 for some action. On the upside I may make a call but I do feel we are still toppy.

Foreign Stock Market

No calls at present. RUSS will be my first call when it triggers.

Interest Rates

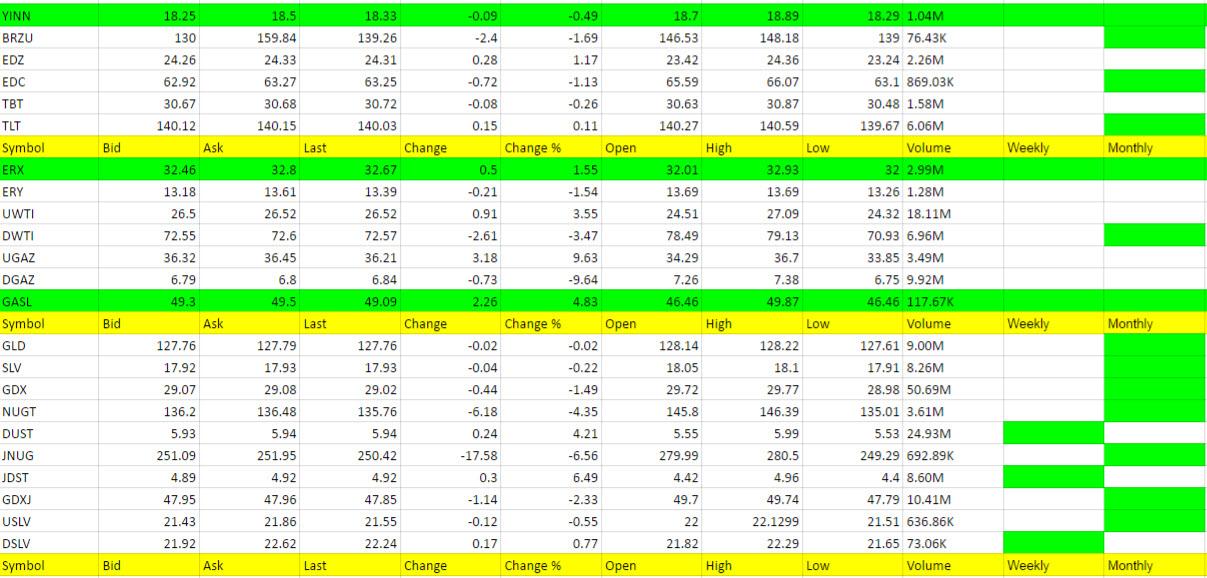

TLT still showing strength.

Energy

See above for oil calls.

UGAZ was at support yesterday and bounced off of it and again higher today. I may call it tomorrow for a trade but want to see a retreat first.

ERX is still hanging in there but tomorrow we should get direction from the oil storage report. DWTI or UWTI a better play for more action though.

Precious Metals Market

Yesterday I used the word “not” but meant “now” put JDST, DUST and DSLV on the buy list per the Trade Alert sent out. Today towards the end of the day I sent an update saying I like these and we just need to get the dollar to move higher and we can have some real fun. I said yesterday “it may take a day to play itself out” and they tested us a little bit but we stayed the course and were rewarded. This is the power of the weekly trend when it hits and why they are the best trades for you. We’ll stick with these and try to push past the levels I wrote about in the Daily Trade Alert Update.

Here is that alert again;

DUST looking good and may see resistance at 6 here but once past 6.57 we can take off over 7 quite easily which should get us green on the monthly.JDST will see some resistance at 5.06 -5.16 but then has a clean host at over 6 possibly to 7 if we get green on the monthly.

Stops are break even on these two now. I wanted dollar green by end of day and we are 1 cent away. A nice dollar run would be fantastic for these trades now.DSLV a little slower to move but still looking good.

Other Calls

From time to time I will be adding individual ETFs that have triggered long or short based on market trends. These may or may not be leveraged. These types of trades will be more for longer term swing trades for IRA’s where we can catch a good directional rise. I care not what the overall market is doing with these calls and will provide entry and exit strategies.