ETF Trading Research 8/24/2016

Trade Alert Updates for 8/24/2016

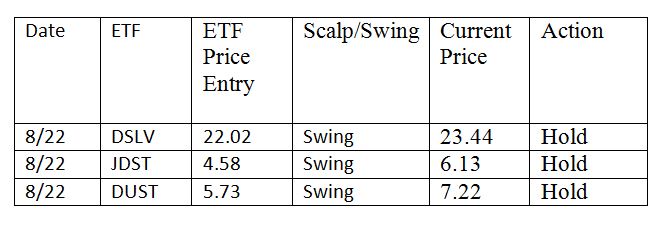

Today we exited 50% on JDST and DUST for a 23.36% and 17.45% profit and we are presently up 33.84% on JDST and 26% on the remaining shares. DSLV we are up 6.44% and holding. Move stops up to 5.50 on JDST and 6.80 on DUST with a stop of 23 on DSLV.

Today’s Trade Alert

There were no new trades today.

News that Can Affect Tomorrow’s Trades

U.S. Stock Market

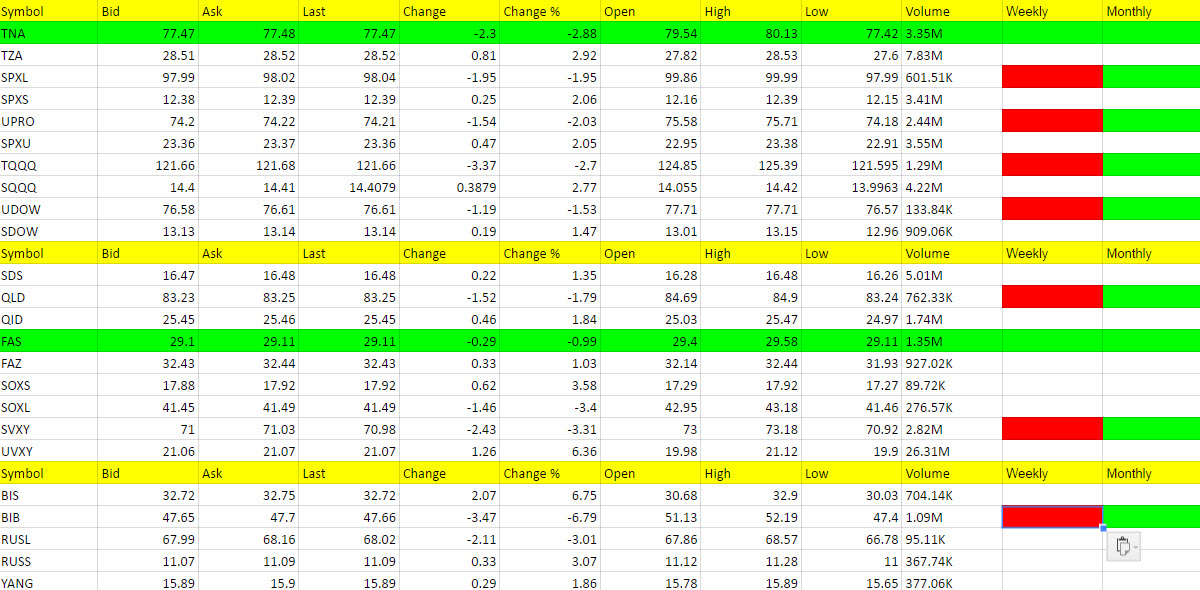

Definitely leaning short the market again, which has been my desire, but I don’t let my desire get in the way of price action. We’ll be patient for the trades but we may get some good ones soon.

Call: Still no call at present. Yesterday I wrote “Waiting for futures to fall below 2175 for some action” and where are we right now? 2175.50. We did dip below and bounce back up to this level in trading today, which is normal at resistance levels. But I do think we break down soon.

Foreign Stock Market

No calls at present. RUSS will be my first call when it triggers as I said yesterday. I even wrote a couple days ago I like it at 10.8o if you recall and it is 11.07 close for the day.

Interest Rates

TLT down a little bit today.

Energy

DWTI was up today with a small oil decline. 77.93 presently but waiting for the trigger.

UGAZ is on the verge of triggering but want to see one more pullback first as we can’t chase just yet.

ERX is still hanging in there and garnered some strength today.

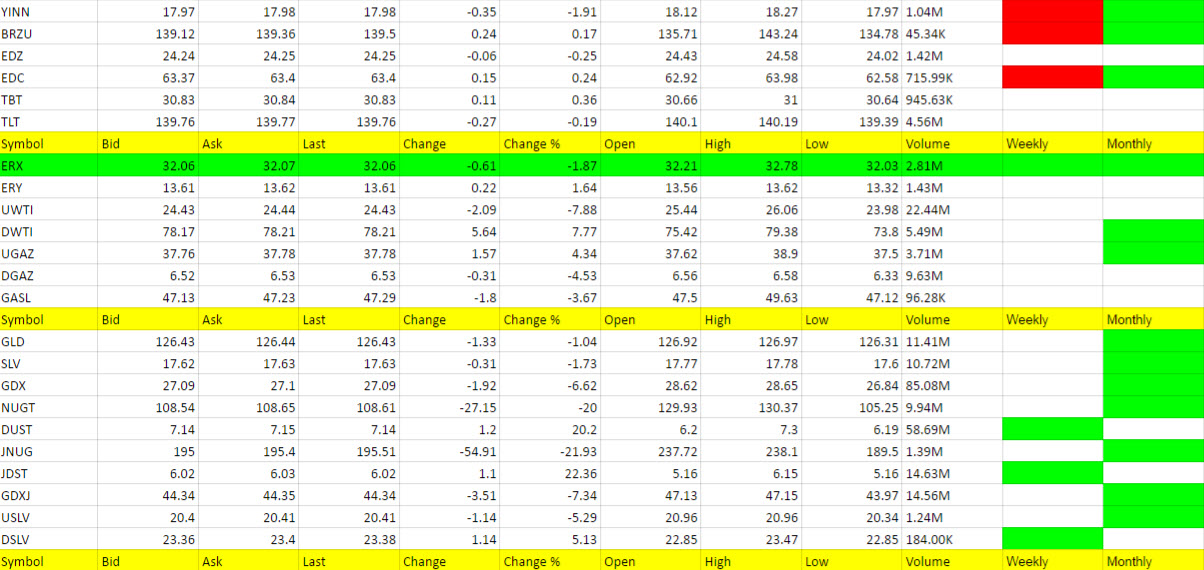

Precious Metals Market

We are calling the metals market about as good as anyone can. See above for trades and lets see if we can get a monthly trend out of shorting the metals now or if we get a reversal. I will be quick on the stops on any sign of a reversal and exiting the current trades. Keep in mind you can always do this yourself, which I know some of you have. There is nothing wrong with taking profit. Nothing at all. Another trade always comes.

Other Calls

From time to time I will be adding individual ETFs that have triggered long or short based on market trends. These may or may not be leveraged. These types of trades will be more for longer term swing trades for IRA’s where we can catch a good directional rise. I care not what the overall market is doing with these calls and will provide entry and exit strategies.

NOTE: You’ll notice that we had a red weekly turn on many of the ETFs. We are setting up for some good reversals I think now.