ETF Trading Research 9/11/2017

For those of you new here, I most of the time have the ETF Trading Research report out by 8PM PDT, and it comes by an RSS feed, but you can look at the report here sometimes before you get it in your mailbox; https://illusionsofwealth.com/category/etf-blogs/ This is also the same link if there are any technical difficulties.

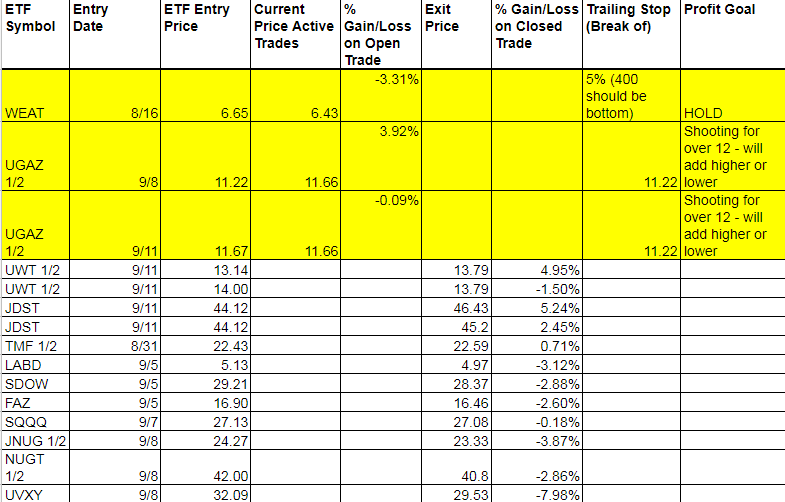

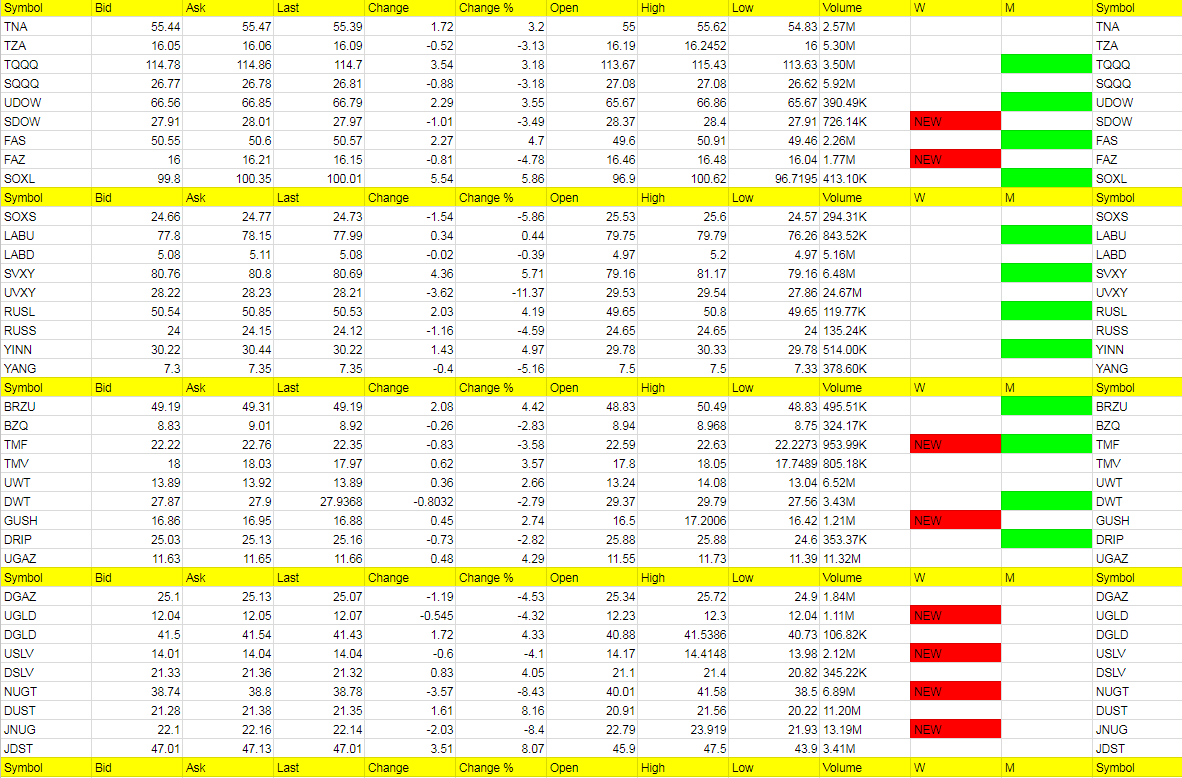

Today’s Trades and Current Positions (highlighted in yellow):

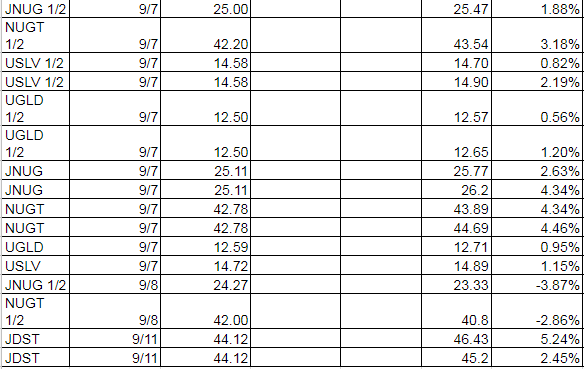

We started the day off on a bad note as the over the weekend trades didn’t pan out but selling most everything and being done with it and ignoring the losses and moving on is what we must do as traders. I kept CNBC off for the most part today as I wanted to concentrate on price action. We got the carry over on UGAZ and had a good trade in UWT. I also concentrated on our first entry into JDST and we hit it close to the bottom after the morning pullback. I know many may have thought that JNUG was taking off and we missed it, but I set our first goal for profit and we used their money the rest of the day and were out by end of day. If we got burned a little in holding half shares in JNUG and NUGT, Friday’s trades through today were are follows in metals and miners (see table below). Being that they were half shares, the losses on those should not seem as severe as the percentages show, yet they were losses and I wanted that exposure going into the weekend. We also were not long UGLD and USLV and along with JNUG and NUGT will be happy to buy these back lower or even chase a little higher if necessary. But since

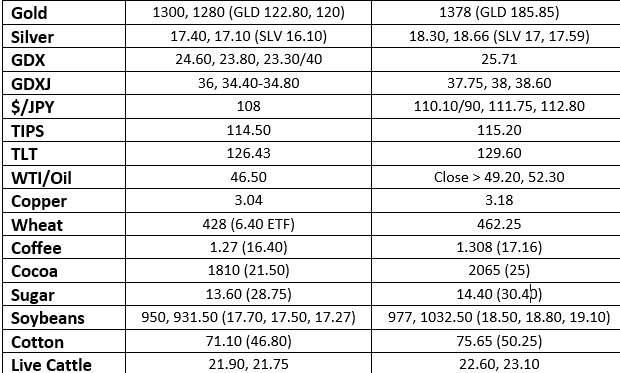

A little cheat sheet for you all today (Support left column and resistance right column);

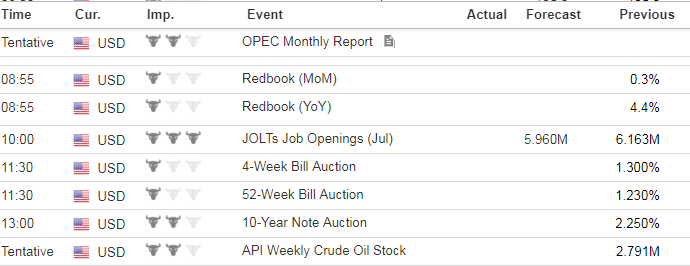

Economic Data For Tomorrow

Jolt’s Job Openings and API Weekly Crude Oil Stock tomorrow. OPEC Monthly Report too.

http://www.investing.com/economic-calendar/

Oil I still think we can move over 50 and higher but we took our profit today. See what tomorrow brings. I don’t mind locking in profit overall and we are stuck at current resistance.

Precious Metals and Mining Stocks

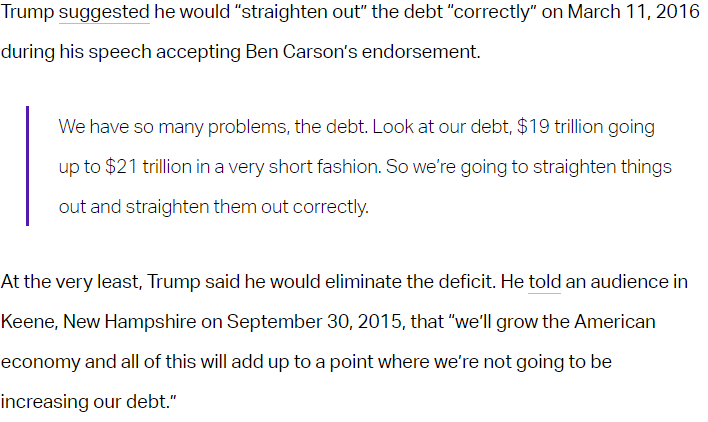

Special shout out to the National Debt passing $20 trillion. Anyone here CNBC talking about it today? Just curious as I had the sound down. My guess is no, but if someone heard it, shoot me an email to confirm. Quick check of the CNBC website and no mention. Quick look at Zerohedge and naturally they are on top of the debt situation.

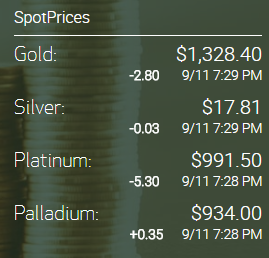

Current Price

Where to with gold? The answer is higher, but we have to see what legs the downturn has as the dollar moves up. From my perch I still see a dollar bounce in the works that can put pressure on metals and miners. USD/JPY also bounced off the recent lows and is over 109 again.

Did you see that end of day price move in JDST where it dropped a point and a half? Something just not right about that.

Remember what I said about sentiment being near the highs in gold last week? Today we dropped -11 to 62 from 73 and we more than likely have more to fall. Also, dollar went from 7 to 15, +8.

I want to be long metals and miners again but most of the time I get a red signal, and we did on all of them, it tells me to at a minimum be neutral. If you were to buy JNUG, for example, each day it opened higher and kept a stop if it went negative, it may be a good way to test the waters. It may take a day or two though. Love to have that flash crash in JNUG for us over the next couple days. Gold under $1,300 might get me long no matter what though. Scare a few people out. We’ll stay neutral and trade price action while looking at better setups with other ETFs for now. However, gold $1,400+ is still the goal here and I am thinking $1,400 might be conservative (we also have 2 days on the cold list for JNUG and NUGT – one would get me long for sure, or a hard spike down we may go long half shares and ignore the red weekly as the hot and cold corner trades have high probabilities after 3 days). Also, reminder in case you missed it:

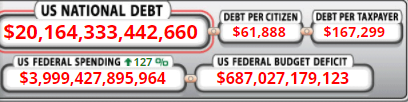

Also, look at that 127% rise in US Federal Spending and recall the Budget of the U.S. Government;

https://www.whitehouse.gov/sites/whitehouse.gov/files/omb/budget/fy2018/budget.pdf

President Obama said of Bush’s spending that it was “unpatriotic” increasing the national debt $4 trillion. President Obama raised it $9 trillion.

President Obama said of Bush’s spending that it was “unpatriotic” increasing the national debt $4 trillion. President Obama raised it $9 trillion.

Do we understand yet that government only knows how to do one thing; Spend! If not, please read my book Illusions of Wealth.

WHEAT – the more I follow wheat here the more I get disappointed as an allocation of our capital. I want investment that are poised for a run and wheat just isn’t cutting it. I may pull the plug tomorrow if it doesn’t get going. In that table above 6.40 is support for WEAT. Below that we should more than likely keep a stop and be done with it. In other words, now or never.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

DUST, JDST, SVXY, SOXL, YINN, FAS, DGLD, BRZU, DSLV, UGAZ, RUSL, TMV, UDOW, TQQQ, TNA

Cold Corner (the biggest move lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

UVXY, NUGT, JNUG, SOXS, YANG, FAZ, DGAZ, USLV, UGLD, RUSS. TMF, SDOW, SQQQ, TZA (BZQ was close at -2.94%)

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out typically well before they start to fall again or turn red on the weekly. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long.

Sell half shares on a spike up on any ETF you are long, even if goal is higher. Spikes higher are almost always followed by moves in the opposite direction. Try and get out with a market order quickly before the quick move back lower. Lock in that profit!