ETF Trading Research 9/14/2016

Please read the Trading Rules again as I have added NOTE 2 and NOTE 3 the last 24 hours to help clarify the ETF Trading Service and your trading success.

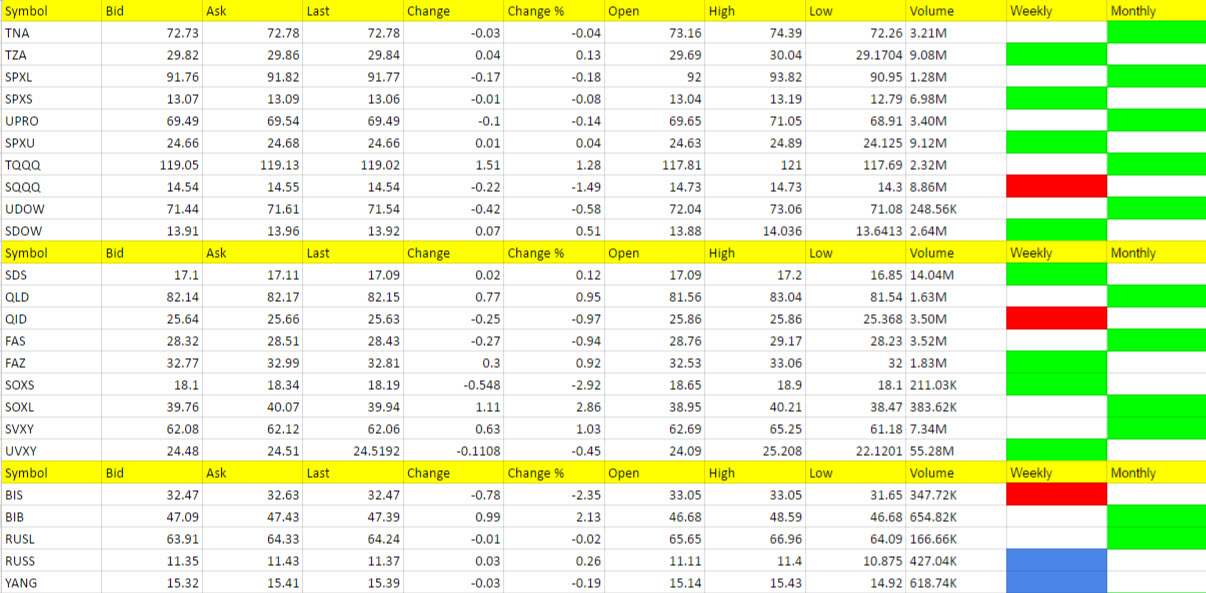

Trades for Today

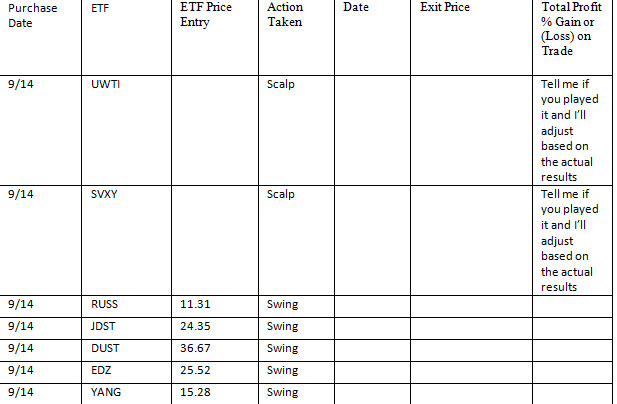

When things aren’t going your way as a Trader, you have to have the wherewithal to take a step back and look at the bigger picture. I found myself trying to go after a few scalps today, and I really hadn’t explained scalps well enough to you. Both actually took off higher but then retreated, so I took care of that issue for future trading. Scalps mean you take profit quickly and at a minimum if it moves up, keep a stop at breakeven. If it takes off, use a trailing or mental stop and that rises with the ETF. SWING trades are now described as well and I gave you the prices to enter these trades and we are up on all of them and holding overnight. These will almost always be your most profitable trades. Let me know how you did on UWTI and SVXY if you played them and I’ll adjust my profit/loss for the track record based on actual results.

JDST is up 3.16% and DUST is up about 1%.

Economic Data for Tomorrow

Tomorrow we have the Initial Jobless Claims with an expected number of 265k. We also have market movers in the Philadelphia Fed Manufacturing Index and PPI (MoM) and Retail Sales. Should make for a great trading day. I really don’t expect good data either. China is on a Holiday so should be a quiet overnight session I would imagine until Europe opens.

Stock Market

Market makers played games early and often today and they eventually got back to the Trend. The Trend is lower and tomorrow, despite the data, we should continue lower.

Please note that AAPL was a trigger long I almost gave out today, but again, a high priced stock. You can see what the power of this one ETF alone has on the ones that turned red that were short the NASDAQ in the table below. If you were so inclined to go long AAPL on a green, positive open tomorrow, you probably won’t be disappointed, but it is not a call as the overall market I think is trending lower.

Foreign Markets

The ETFs; YANG, EDZ and RUSS offer us a chance of the bigger bang for the buck and my goal is 10% on all of them. I have to assume the market will continue with this trend until it doesn’t and we have to be in it to profit, and we have already seen some big down days, so what’s next? If your answer is taking off higher, I would be surprised. But we’ll wait and see how the market reacts to ANY data, and if it is negative with positive data, we know the trend is strong in our trades favors.

Interest Rates

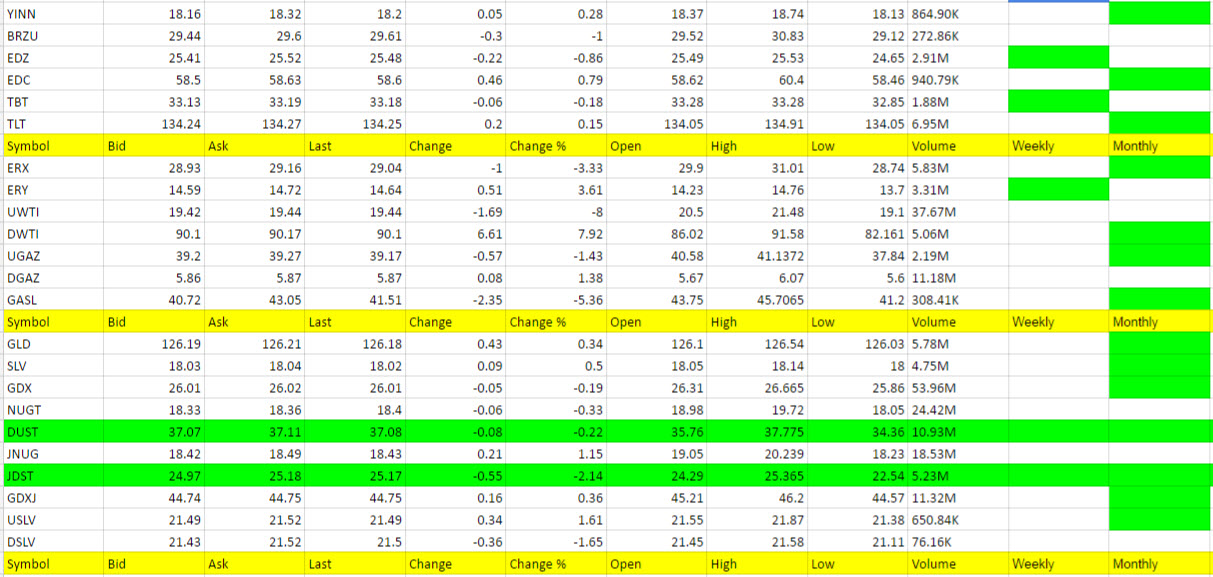

TBT never took off today as TBT had its fun in this continued whipsaw (overall) affair. TBT may be a good play over 33.26 tomorrow. If it opens higher than that, buy at the open whatever it is.

Energy

I said for DWTI over 84.05 tomorrow I might consider DWTI but it opened over that number and couldn’t push higher before the report. After the report it couldn’t do much of anything either.

LATE ADDITION: ERY did trigger long on the weekly from what I can see and this should lead to a long on ERY and DWTI at present.

DWTI finished at the high of the day at 90.10 and is 90.00 after hours last print but bid is 90.22. ERY is 14.66 up 2 cents after hours. Both are worth a shot with half shares I think at this price but will wait till tomorrow to make a call.

Professionals took UGAZ traders to the woodshed again as it was up $2 overnight and then fell to negative. No call on these at present.

Precious Metals and Mining Stocks

JDST and DUST took a breather today but we decided to jump on the weekly/monthly trend momentum and are positive in the trade. We hope to get that complete 10% move by tomorrow or the next day. Gold and silver didn’t help with being positive for the day and neither did the dollar which was red, but JDST and DUST are trading with the market, not the metal or dollars right now. This helps us profit I think.

Other Calls

From time to time I will be adding individual ETFs that have triggered long or short based on market trends. These may or may not be leveraged. These types of trades will be more for longer term swing trades for IRA’s where we can catch a good directional rise. I care not what the overall market is doing with these calls and will provide entry and exit strategies.