ETF Trading Research 9/15/2016

Please read the Trading Rules again as I have added NOTE 2 and NOTE 3 the last 24 hours to help clarify the ETF Trading Service and your trading success.

Trades for Today

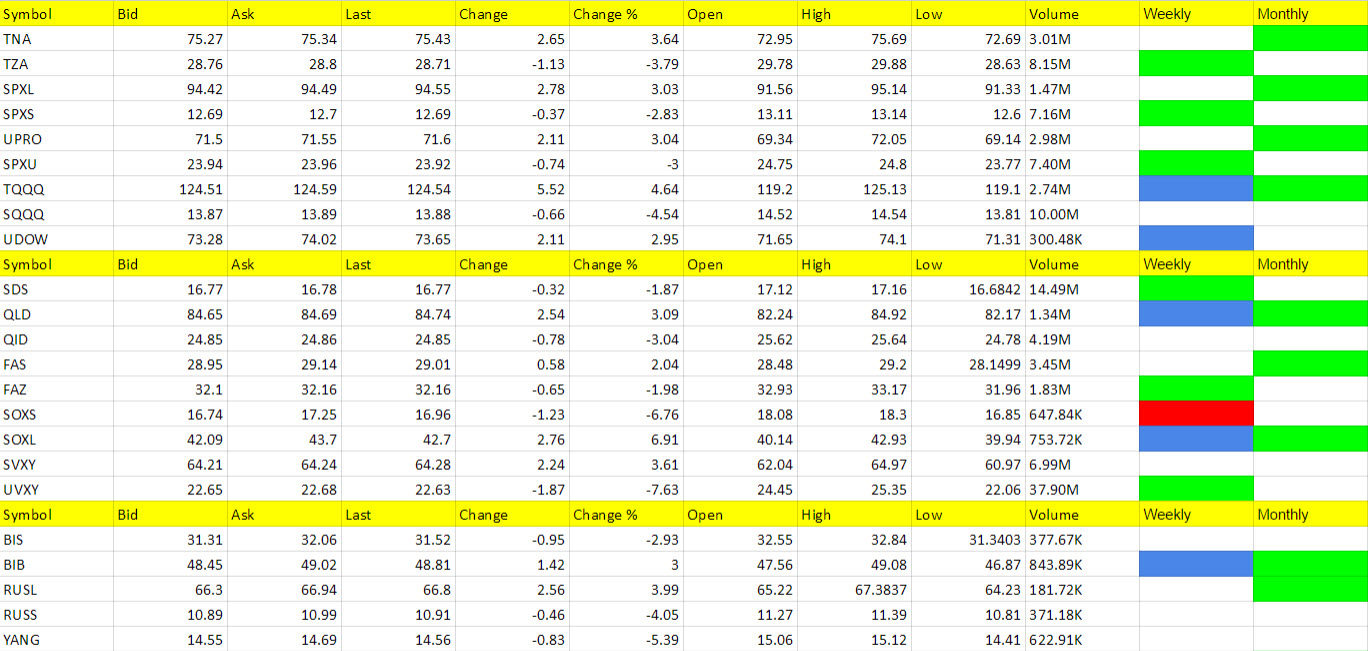

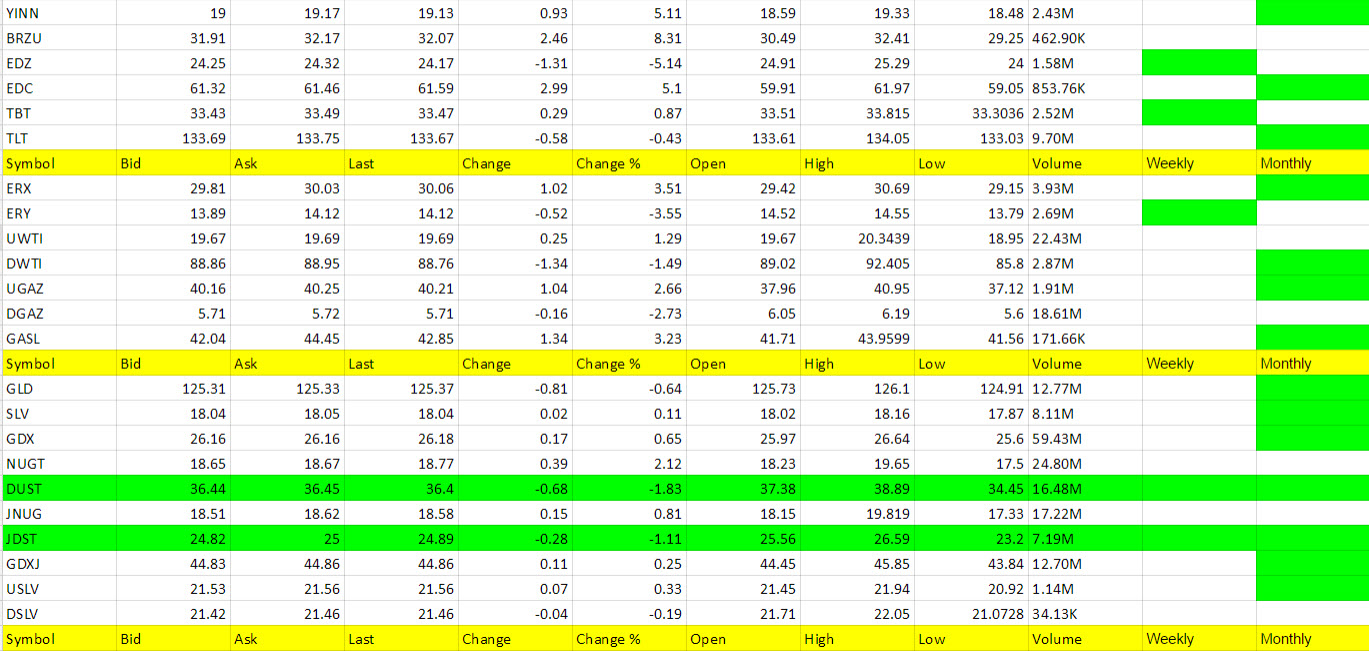

I said yesterday in the alerts that I was going to cut back on SCALP calls in these choppy markets and we never did get a trade hit today. While JNUG and NUGT were good potentials I like I hesitated to call and most of the day they churned up and down after the initial spoke down then up after the data came out. The markets themselves started the day positive then fell negative then shot higher. I could have called some scalps on SOXL, BRZU, YINN, ERX and EDC, but again hesitated with this whipsaw action plus going against the current trend which is down.

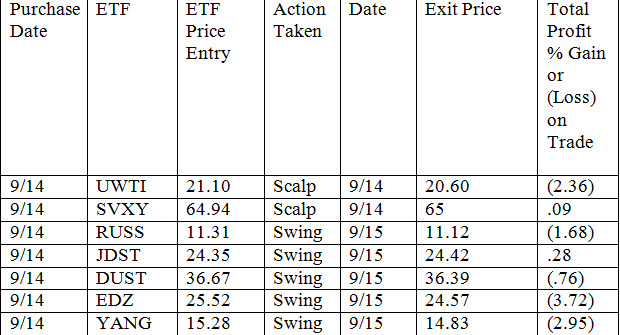

JDST we were up 3.16% and DUST up about 1% at close yesterday and after the data came out today there was time to get out about flat on them. You would have taken a hit on RUSS, EDZ and YANG as shown, mostly because they are thinly traded pre-market. The setup was there but the market couldn’t give us the follow through with mixed data that came out today.

I received emails of some of you who scalped and took profit on some of these, but for my track record I am showing the pain of holding which I know some might have. It gives me more incentive to perform and while I didn’t chase return today, I think a good trade or two can come tomorrow. As an FYI, holding overnight there is more risk and news can always shake you out of your position. If you do hold overnight, a more liquid ETF is the way to go. Shares trading over $1 million is preferred.

For the month we are still green and I have a goal of 10% to 20% over the next two weeks.

Economic Data for Tomorrow

Core CPI comes out tomorrow along with Michigan Consumer Sentiment. China, South Korea and Hong Kong are on a holiday still. I wouldn’t put it past Europe and U.S. market makers to run up the markets more and force the Chinese to cover come their Monday morning trading. Could see some fireworks.

Stock Market

As AAPL goes, so goes the market? I put out a note that AAPL had turned the corner yesterday and today it took the QQQ higher and after the slew of mixed data, the market drifted higher most of the day. If tomorrow is a down day, the market makers are in complete control and it won’t make for easy scalps and no trend trades I expect. But if we get the market to keep moving higher, in what will be the best week for the market in 6 weeks, then we need to trade with it. Markets have to prove trends and if we are reversing, there is plenty of time to profit from the new trend. We just want to avoid whipsaw. I have labeled some blue one to watch ETFs just in case.

Foreign Markets

RUSL, YINN, EDC took the reigns today. I may call some for scalps tomorrow if we continue higher but we go home flat.

Interest Rates

TBT might be the buy the dip play now. At least for a bit longer.

Energy

We were looking for a new trend in oil to develop but it didn’t reach our targets for DWTI. Flat now.

UGAZ in a range now, waiting for something to trigger it.

Precious Metals and Mining Stocks

Yesterday I said that JDST and DUST are trading with the market, not the metal or dollars right now. Today was the same (and obviously JNUG and NUGT too. We may just SCALP one of these tomorrow and take advantage of this correlation.

Other Calls

From time to time I will be adding individual ETFs that have triggered long or short based on market trends. These may or may not be leveraged. These types of trades will be more for longer term swing trades for IRA’s where we can catch a good directional rise. I care not what the overall market is doing with these calls and will provide entry and exit strategies.