ETF Trading Research 10/28/2018

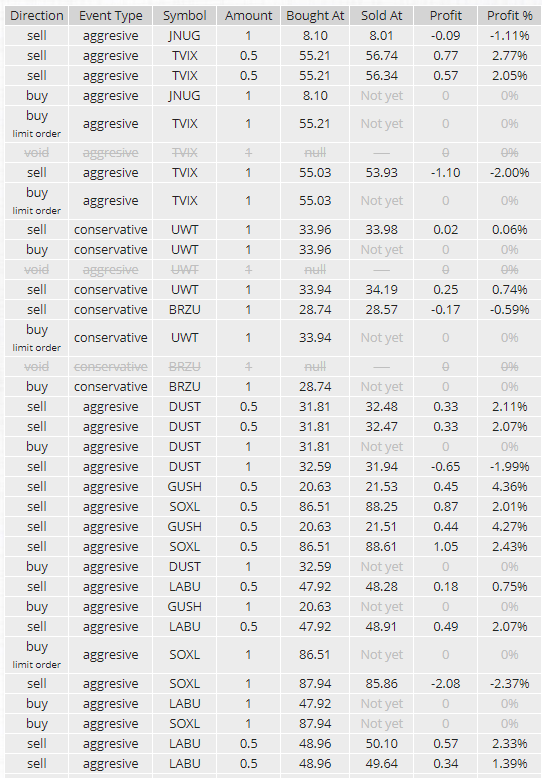

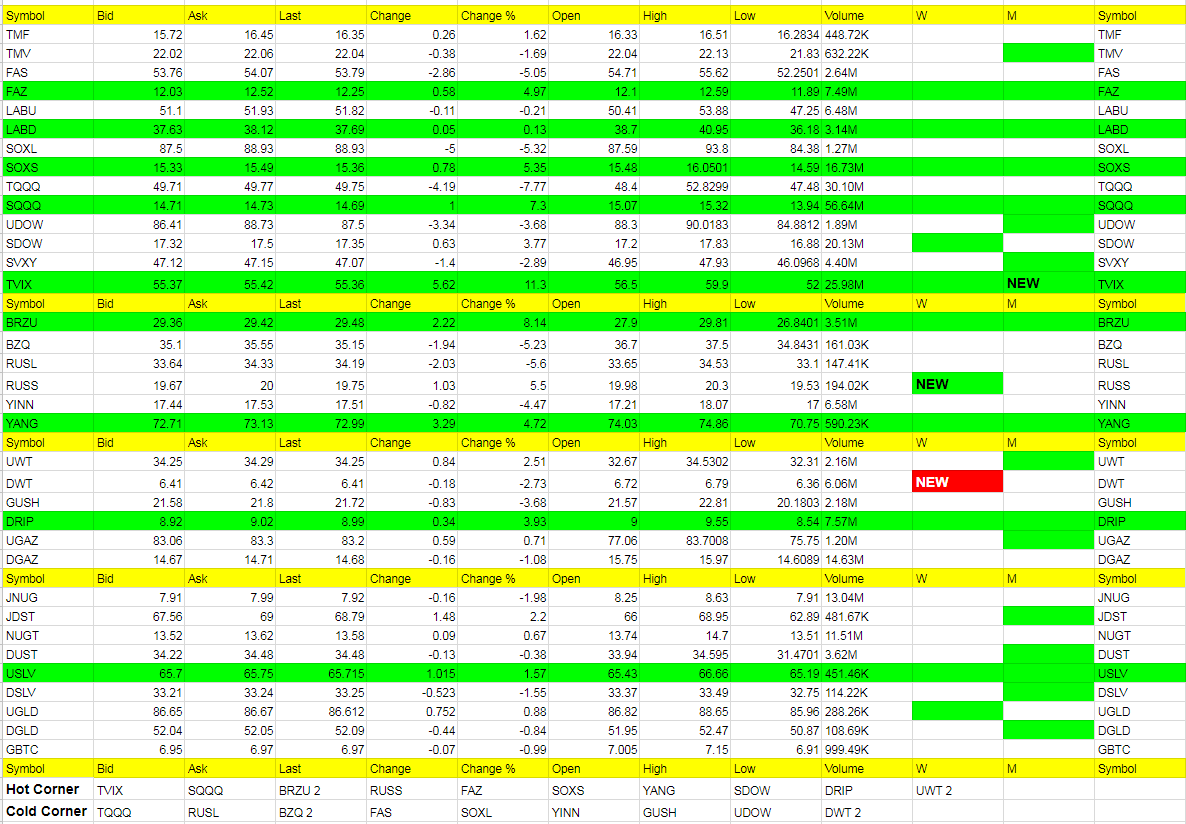

Caught some good trades in LABU, SOXL, DUST and GUSH early on and TVIX over positive end of day to wrap up the first week with a 3 day win streak. Below I’ll go into further detail on what I see for each sector for the coming week.

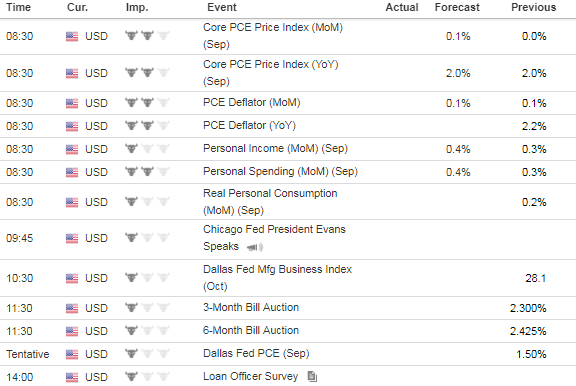

Economic Data For Tomorrow

No real important data tomorrow except maybe Personal Spending. Want to see if the consumer is tapped out or not.

http://www.investing.com/economic-calendar/

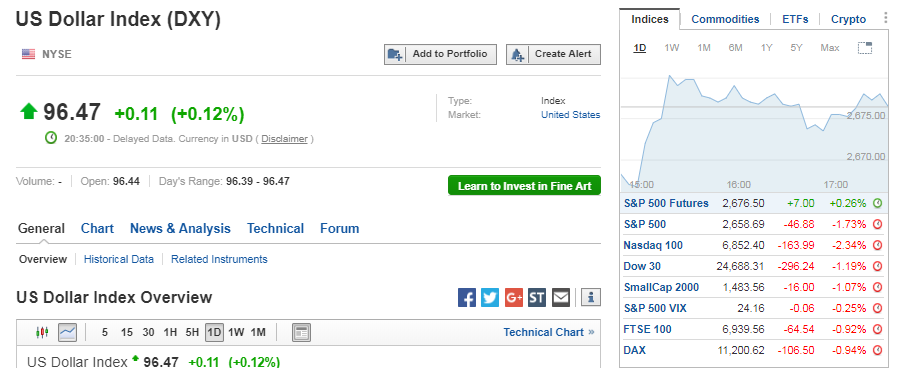

Stock Market

GDP was positive and helped boost the market early on but the market has no follow through on the bounces. We should scalp any long ETFs but concentrate on the bigger money still being made short. Futures are up 7 as I type and we’ll look to maybe tag along for a scalp early Monday with tight stops or get short whatever is leading at that time. We are due for a dead cat bounce technically speaking, but it it not a resumption of any bull market with a little of a week to go before midterms.

Foreign Markets

Mixed bag here. Any moves up then YANG and RUSS and BZQ come into play. If/when U.S. futures move south, these will benefit.

Interest Rates

Still not much action here. It’s clear to me what higher rates have done to the market, but the Fed is worried about staving off a bigger recession with the power to lower interest rates and doesn’t care too much about the short term.

Energy

DGAZ may be the trade of the day tomorrow. We’ll look to get long on any nat gas bounce possibly. I don’t mind the typical market maker wildness and whipsaw on Monday. Keep an eye on that early. If nat gas goes positive, we will look to go long DGAZ at some point.

UWT we should be in buy the dip mode now. GUSH hasn’t triggered yet but we should be getting long UWT again on Monday. But if the market does want to go south, we will have to keep a tight stop if oil goes south with it. That has been the pattern. But first long signal in awhile.

Precious Metals and Mining Stocks

DUST is still looking like the way to go here. We should see USLV and UGLD turn south here soon as well. They held up during the market downturn ok, but miners did not, hitting lower lows. I expect that to continue. You’ll recall a month or so ago I said the dollar would get to the 97/98 level and we almost hit 97 on Friday morning. This is putting some pressure on metals and especially miners still, but some earnings on some big boys have disappointed as well. I will say, if the House is taken over by Democrats, that can boost gold. Pattern I have noticed and written about. I don’t think the Senate is in jeopardy. I am looking to get long here somewhere around that time next week, but looking short to start this week out and we’ll see when we might flip sides.

Recent Posts