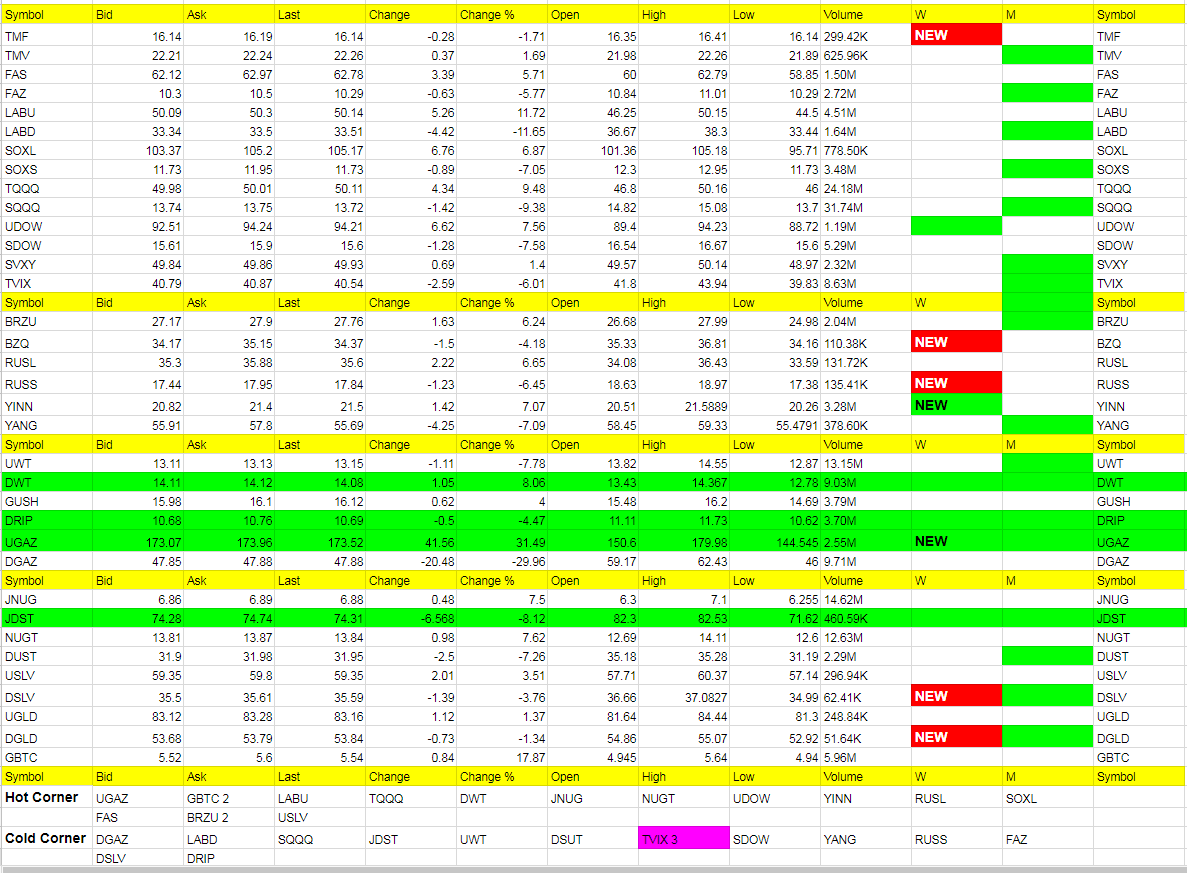

ETF Trading Research 11/28/2018

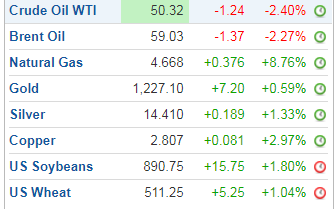

Only 3 ETFs are bullish for weekly and monthly, DWT, DRIP and UGAZ. They are due for a big turnaround but for some reason, not allowed to move up, whether it be storage or weather or Trump or OPEC. But believe me, they will.

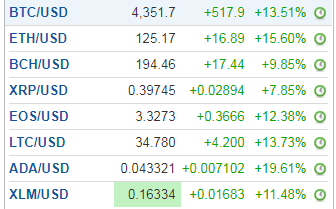

Today’s story though was about Powell’s dovish statements that got the markets, metals and miners going. Usually there is a continuation of sorts and we’ll see that most likely in the morning. We only have UDOW as a green weekly and the others would turn green weekly with any further push higher. Ironically, all of the ETFs we took home last night did great today. The early morning price action had me a bit too conservative though. Powell gave the markets what they wanted to hear. Ignored the terrible Home Sales data. Ignored the GDP flatness. Ignored reduction in Consumer Spending. Ignored the bad storage build for oil.

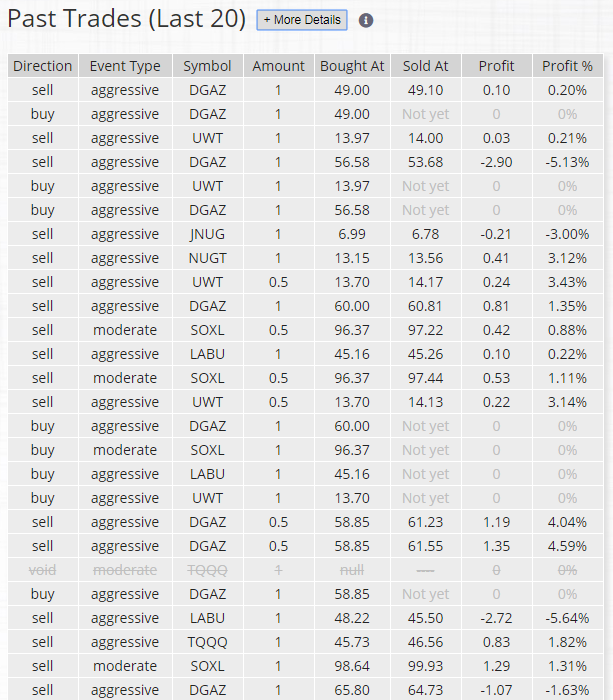

Nat gas was another wild ride. We didn’t get hurt from it but we gave back our profits. That said, on a day when DGAZ was down -30%, we have a great trade in DGAZ ahead of us. UWT for that matter.

Metals and miners came alive. I got us out near the highs of the day and we crawled out of that hole after the fals signal NUGT gave. Mixed signals there now but slight lean bullish with the dollar weakness.

Eaked out a 1.425% gain today overall.

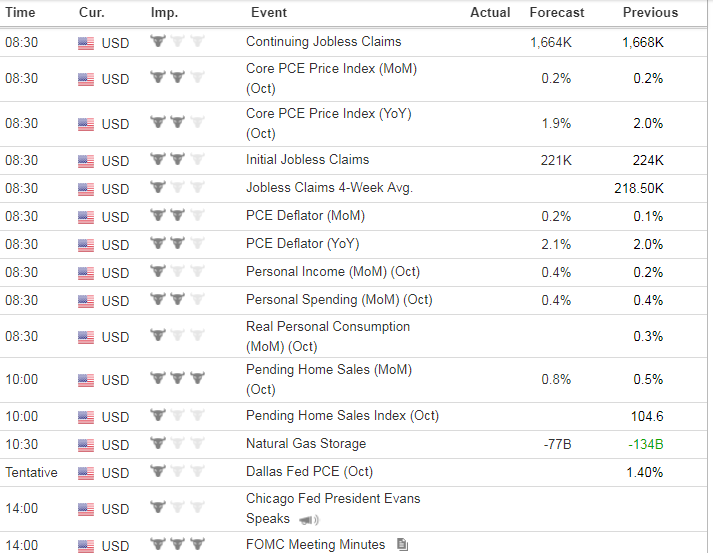

Economic Data For Tomorrow

Initial Jobless Claims and Pending Home Sales tomorrow. But the big one is FOMC minutes.

http://www.investing.com/economic-calendar/