ETF Trading Research 11/4/2018

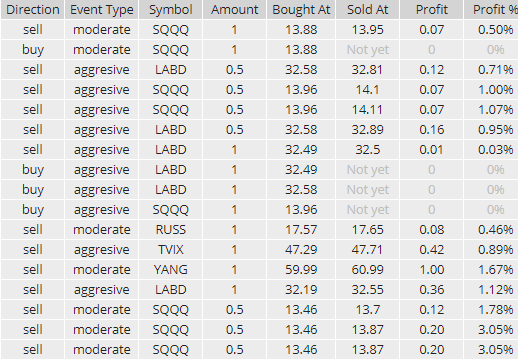

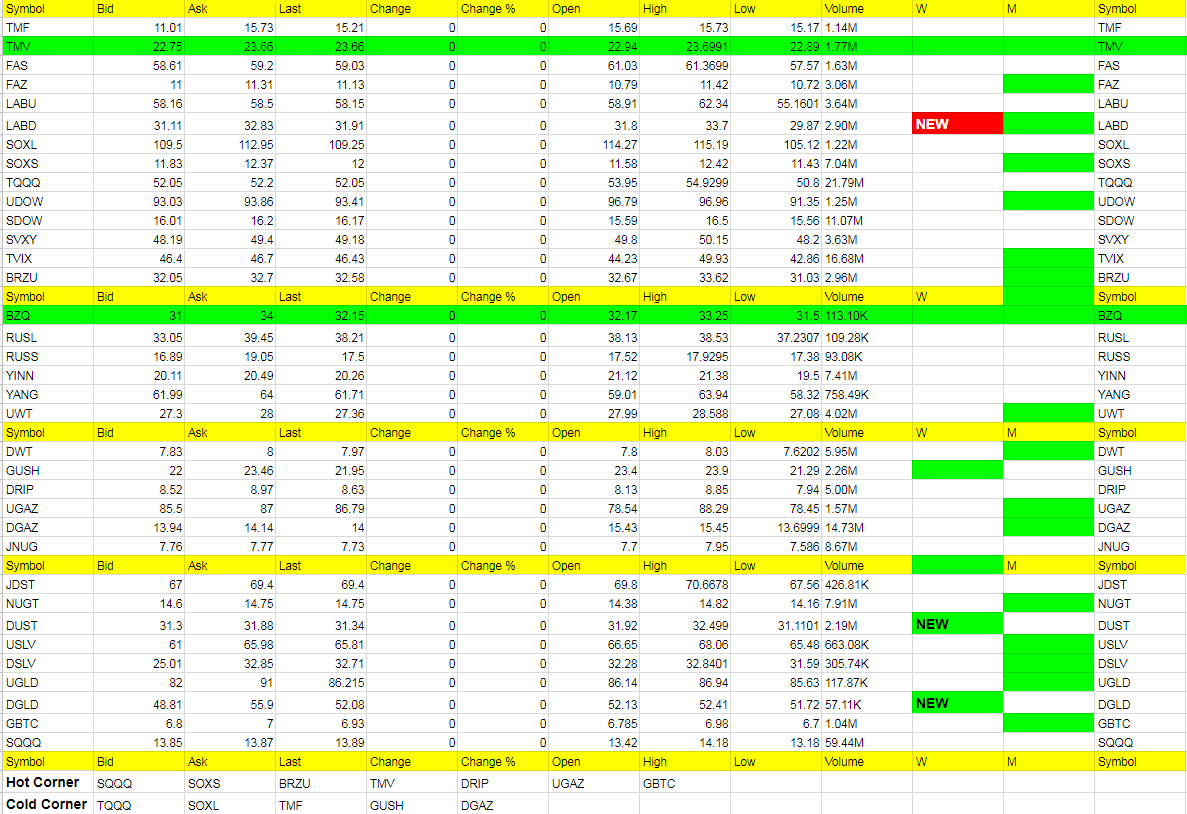

How did the Cold Corner list do on Friday?

TVIX +2.33%

SOXS +4.52%

YANG -1.71%

RUSS +0.28%

SQQQ +4.84%

SDOW +1.75%

We caughts some of those for decent profit after a push higher in the markets at the open on more Trump comments that we said may come in trying to sway the markets higher for the coming midterms.

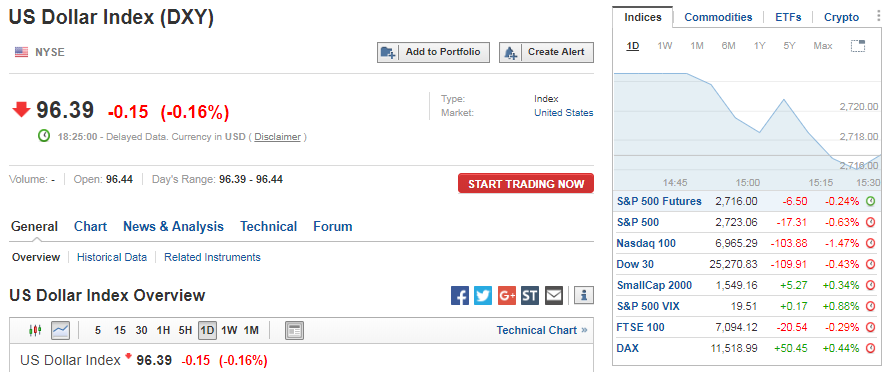

How are we looking for this week? Leaning bullish despite futures opening down -7.50 as I type to 2716.75 with /NQ down -18.50 to 6891. Read more below how I see it play out.

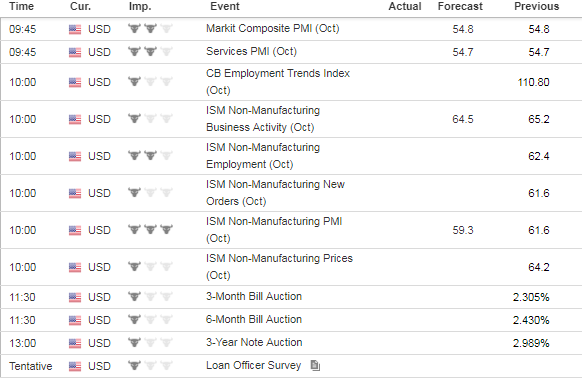

Economic Data For Tomorrow

ISM N0n-Manufacturing PMI the important one tomorrow.

http://www.investing.com/economic-calendar/

Stock Market

Tomorrow we may open lower but will be looking for a dip to buy on Monday or Tuesday. My unwritten rule this week will be to buy what is positive that is long the market either at the open or once the ETF goes positive. However, if we are low enough, we may take some stabs long. Midterms may play into this somewhat, we don’t know yet, but if lower for any reason, I do think we bounce higher.

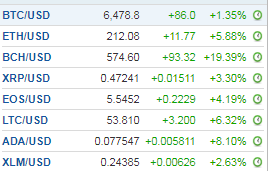

Foreign Markets

With the U.S. market ready to possibly take off higher again, let’s look to go long YINN especially followed by BRZU and RUSL.

Interest Rates

TMV got back on track and higher rates haven’t been bullish for the markets. TMF make take over for a bit.

Energy

Nat has has shot up big time to 3.50 here. Another reason why it is difficult to carry a position over the weekend, but this is a huge move. Most likely we have a top in place but nothing we can do about that right now. DGAZ will be on our radar as a buy. Those who can trade early, may want to take a shot.

Oil is a tough one right now. We get reports of a draw in oil and the price falls. And then falls more. Best to look for other trades right now but keep an eye on UWT and GUSH for bounces if positive.

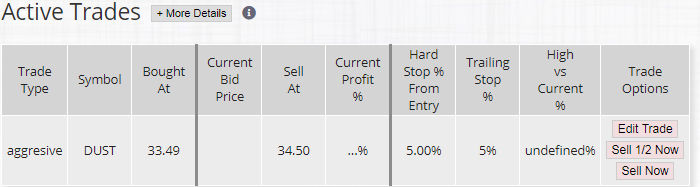

Precious Metals and Mining Stocks

Dollar is still key to metals and miners here. I think we head back up to 98/98 but am off in my timing. I don’t want DUST to get out of hand and when we were down -3% to -4% on Friday should have just sold it on an up day for us. We’ll keep a close eye on metals and miners. I don’t think their time is now. If money does flow back into stocks in a big way, it comes out of metals and miners in my opinion. At least for a bit. But that doesn’t matter. What is the dollar doing? Gold will do the opposite.

Recent Posts