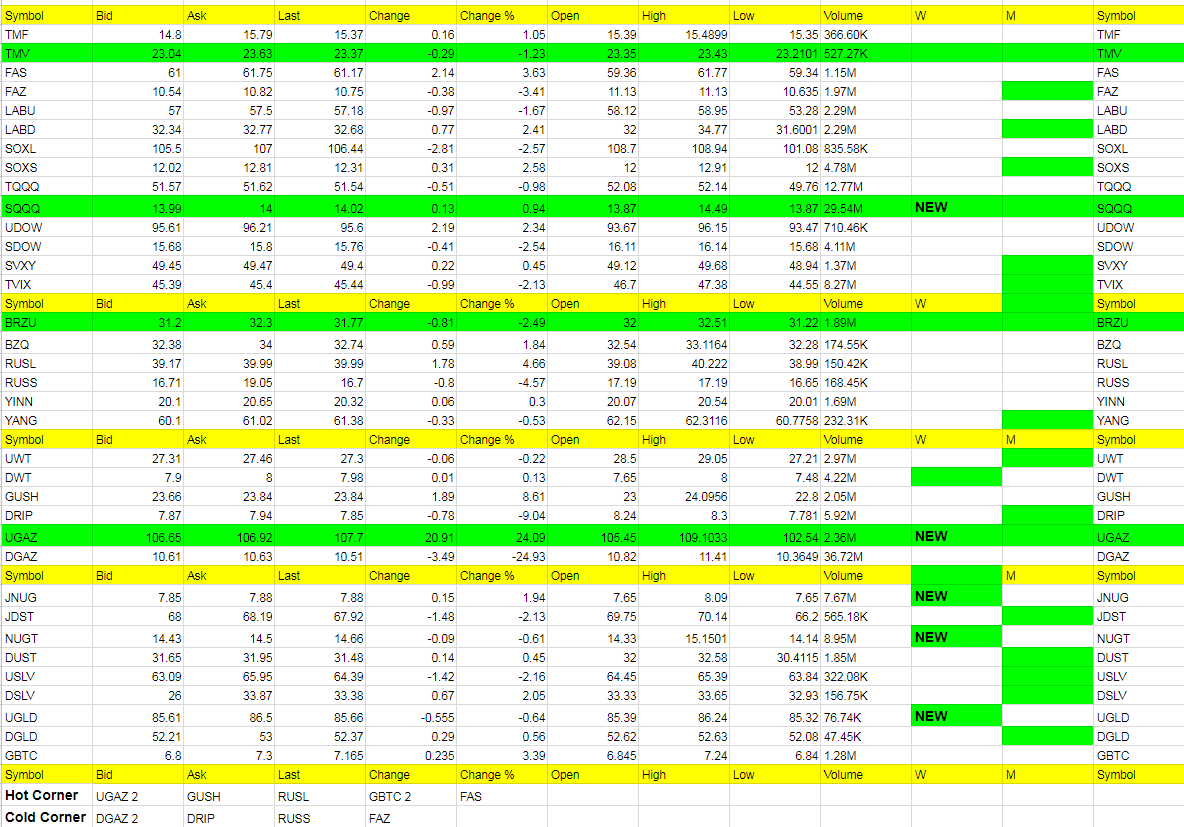

ETF Trading Research 11/5/2018

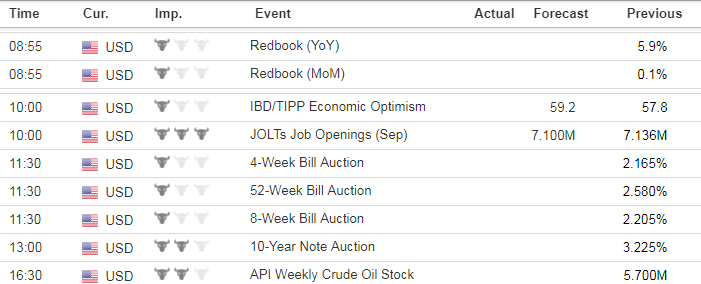

Economic Data For Tomorrow

ISM N0n-Manufacturing PMI came in better than expected.

http://www.investing.com/economic-calendar/

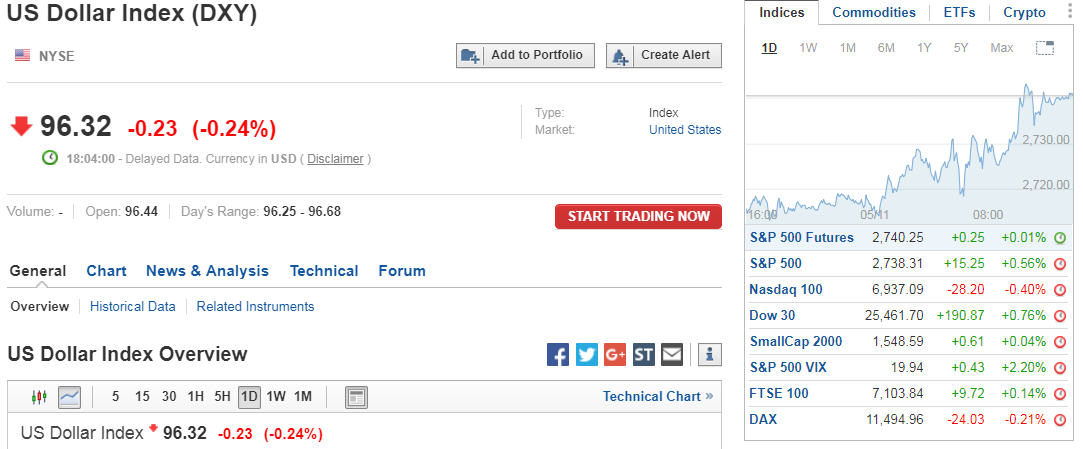

Stock Market

Last night I did say we should bounce higher and did early on and then a pullback and got to the 2740 mark. For now, we should be neutral and let the market dictate. We have midterms tomorrow and then Fed Wednesday. Going to get a little crazy.

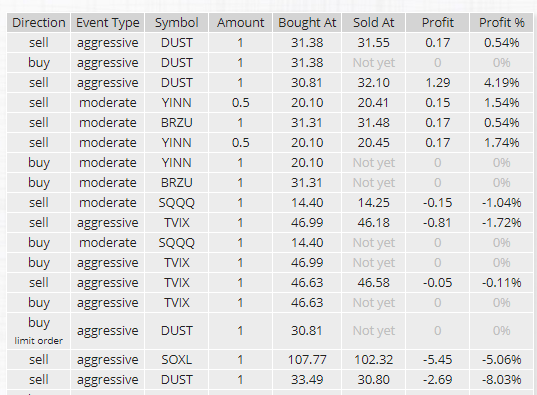

On a side note, I have counted that most of my losses stem from holding an ETF overnight. I am still working on the bugs to my system for swing trades, as I know they work, but the market volatility is difficult to swing right now. Even JNUG, NUGT, UGLD triggered green on the weekly today and look what happened to them. Being a little cautious but we’ll get there.

Foreign Markets

Concentrated a bit more on these as two triggered long the market. My expectations is they continue higher.

Interest Rates

Yesterday I said TMF make take over for a bit and it did.

Energy

We took a shot at DGAZ early on and profited but what a big story the nat gas move was up over the weekend. That’s just crazy. But UGAZ was green on the weekly.

UWT is intriguing here. About all I can say with data coming out next couple days.

Precious Metals and Mining Stocks

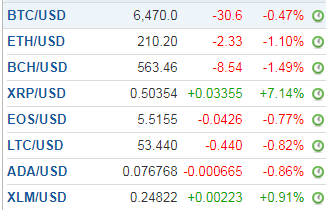

Dollar I said was the key but metals moved up in the morning on the dollar dip then fell with the same dollar dip. Neutral for now. Slight lean down.

Recent Posts