ETF Trading Research 4/19/2017

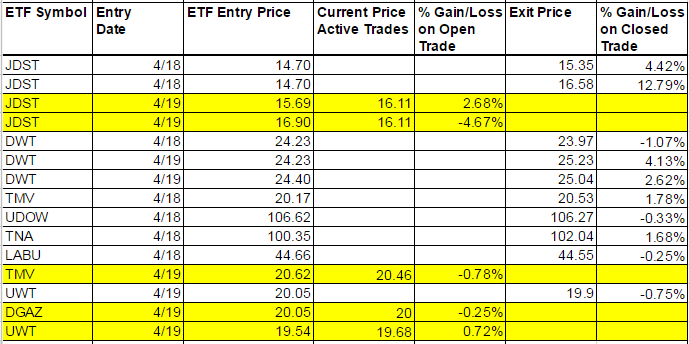

Today’s Trades – Current Trades (Non-Green – Bought/Sold/Hold) – Those highlighted in Yellow we are still long.

You can see from the right hand column of closed trades we did well overall today. I could have taken more profit earlier on JDST but do think we move higher as it just turned green on the weekly. You’ll see it also on the green weekly sheet. DWT treated us well today too but didn’t hold onto the shares long enough. We did get a retreat though from 27.14 to 26.33 and I did go long UWT after hours to get us even on that trade for the day, but we should be able to scalp more from UWT in the morning. It is a scalp only.

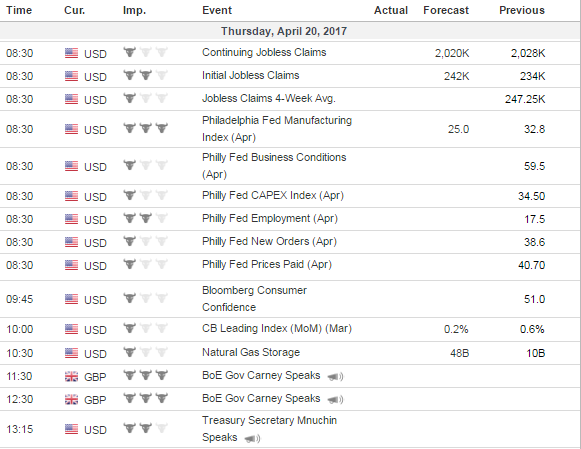

Economic Data For Tomorrow

Tomorrow we have market moving data early at 8:30 and kind of glad to be flat U.S. right now as this can go either way. We have Initial Jobless Claims and Philly Fed Manufacturing at 8:30. After that Nat Gas Storage where we will see if we are up DGAZ or out beforehand to profit from it. Worked well enough for DWT today to wait till after but we’ll see. Been pretty warm out so I have to lean DGAZ. We do have BoE Gov Carney speaking twice and more importantly at 1:15 Treasury Secretary Mnuchin speaking which he came out today and said that President Trump doesn’t have a weak dollar policy. He may expand on that tomorrow and it could still be dollar and gold moving and thus miners, so beware in the afternoon and if up more in JDST possibly lighten the load a bit.

http://www.investing.com/economic-calendar/

Stock Market

I should have given my thoughts yesterday about a bad oil report more credibility today in making some calls short the market like UVXY in particular. That and the IBM miss on earnings didn’t help the market today. We’ll see if we get a bounce now to continue the up and down no trend market that is more difficult to trade. I really thought there would be more to the Trump trade and at least we came out ahead overall on the overnight long the market holds.

Foreign Markets

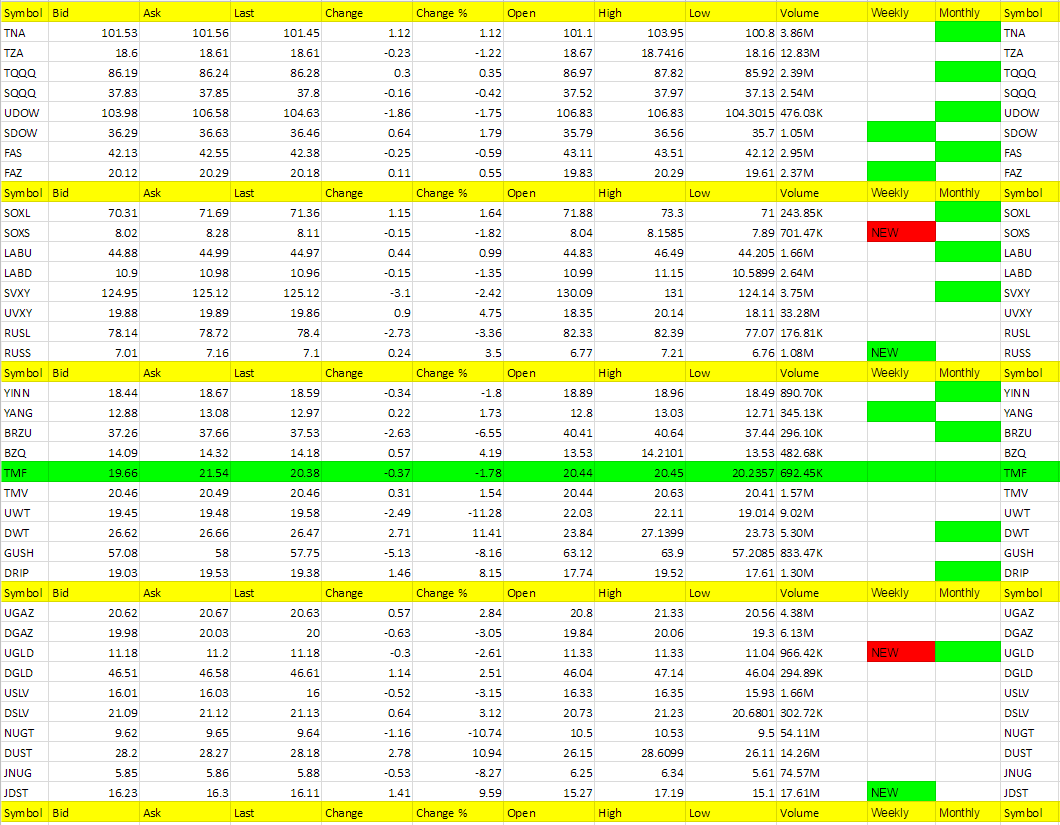

YANG did continue higher today as the markets overall didn’t want to go higher. RUSS turning green on the weekly is a buy at the open tomorrow.

Interest Rates

I have to say TMV held up pretty good today considering the markets moved lower. It seems rates really do want to move higher which is the only reason we held onto it. Will that be enough to push the markets higher as money leaves bonds? Maybe. Didn’t happen today though.

Energy

I said I will lean long DWT even before the oil report and today we got rewarded but could have easily got more. I might be a little more conservative as the last couple weeks haven’t given us much but today overall I don’t think anyone would complain about. I did get long UWT after hours to ride that wave up but we will be back in DWT soon thereafter and I think it will turn green on the weekly then.

Precious Metals and Mining Stocks

We had some fun with JDST today, locking in profit early and often until the end of the day, but even that trade should turn our well as gold was falling after hours. I expect gold to continue to fall here. It is below 1279 now.

Silver held up ok today. I do expect it to go lower but have not called us in DSLV again just yet.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

DWT, JDST, DUST, DRIP, UVXY, BZQ, RUSS

DRIP, RUSS, (RUSS and JDST new green weekly)

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

UWT, NUGT, JNUG, GUSH, BRZU, RUSL, DGAZ (UGLD turned red on the weekly)

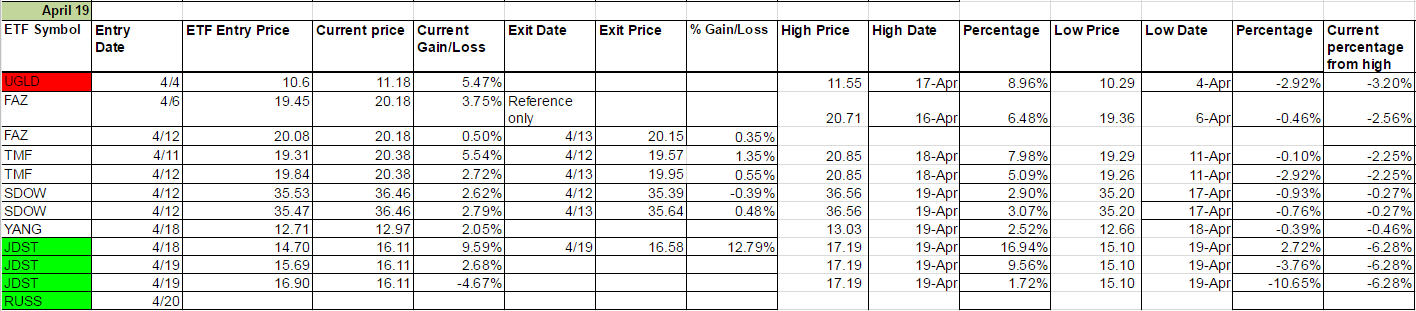

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. It is also used for tracking the percentage from high to keep a stop on remaining shares. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out before typically well before they start to fall again. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities too. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long. You’ll notice in the last column on the right it says “Current percentage from high.” This is your normal stop out for any ETF where I don’t specifically call it per the Trading Rules which lists the trailing stops for each ETF. It is a Trailing Stop percentage from the high and I have noticed the pattern that the closer it gets to 5% the sooner the ETF turns red on the weekly.

If things go to scale, FAZ and TMF and SDOW should be the next to turn red on the weekly, but of course it will all depend on if this market has a leg up or not. Good to see RUSS join YANG. Oil going lower is not good for Russia. Neither is Trump’s “buy American.”