ETF Trading Research 5/10/2017

SPECIAL NOTE; I have followed these Hot and Cold corner moves long enough to know that after 2 times in the Hot or Cold corner, we get a reversal more times or not. So tomorrow you can buy DGAZ, BZQ and YANG and have a better chance of profiting. Once in awhile we do get 3 days on the list, but rarely. We are in 2 of them now.

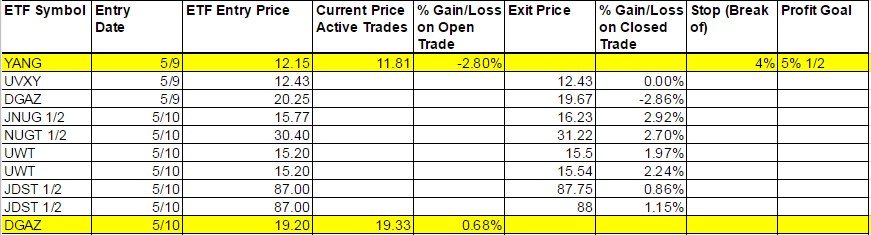

Today’s Trades

If you take away the overnight holds, today was a perfect trading day. We got out of DGAZ with a 2.86% loss and jumped back in end of day and got some of it back. YANG came back a little bit end of day and we look to get it to follow inverse what the Shanghai index did last night. Should have been up close to 3% today. We played UVXY flat and UWT got 1.97% and 2.24% on half shares each. We also played both sides of miners getting 2.92% from 1/2 shares of JNUG and 2.70% from 1/2 shares of NUGT while flipping and getting 1.15% and 0.86% from JDST. Went home flat miners but JDST and DUST finally turned red and that’s a good sign for many I’m sure. Still will get some volatility as a couple trades I tried to get on, USLV and UGLD never triggered. Kept us out of trouble when we saw them fall and helped us take profit on JNUG and NUGT and switch sides to JDST.

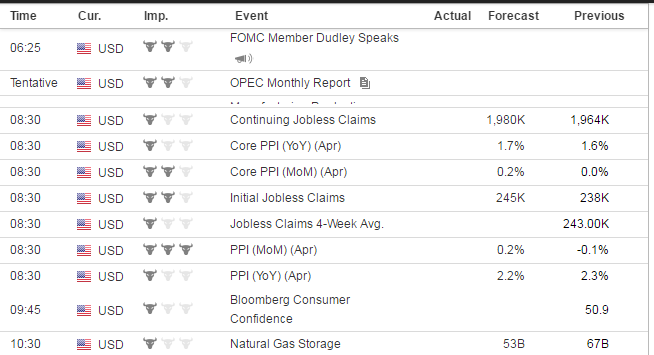

Economic Data For Tomorrow

PPI is the market mover in the morning along with Initial Jobless Claims all at 8:30am EDT.

Nat Gas Storage in the afternoon and if up on DGAZ will debate on keeping half or selling all before the data.

http://www.investing.com/economic-calendar/

Neutral on the stock market right now as we have mixed signals. Best to wait for trend rather than guess. Still want us to keep a close eye on UVXY but if the market is going to move higher I want to start trading SVXY more aggressively. I want to always keep it on our radar as we don’t know what the heck is going to go on with markets but if they do want to go higher, SVXY is the easiest trade of all to consistently make money on and after so much time of not giving it enough credit, I will “if” we do move higher. But “if” we do head lower, UVXY has about a 30% pop in it too.

My indicators FAS and TMV were mixed today with FAS up and TMV down. Look to have those on the same side and trade long the market if up for the day and short the market if down. I’m always looking for correlations and this is one I have picked up and it helped me stay away from the stock market today.

Foreign Markets

See comments on YANG above. No other calls but BRZU has had a good 2 day run. BZQ might have a rebound run tomorrow.

Interest Rates

TMF was higher today on a basically flat day. No call till we get a trend in the market

Energy

With the two bits of data coming out after the market yesterday and again today, it gave us a good setup to buy UWT. We profited and will now look to buy UWT for a possible bigger profit moving forward. At least in the short run if we can get oil to 50 again.

The on again off again DGAZ green has been very tough for us, I know. I am going on my 3rd time with DGAZ at the end of day, only because it did bounce up over a point after bottoming. We will take our profit before the data but might hold onto half shares.

Precious Metals and Mining Stocks

See above for metals. Gold has to get its butt in gear here over 1230 for any run in miners. We may go long USLV and UGLD here soon if we see them up. Tried today but no follow through.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

UWT, GUSH, JNUG, BRZU, SOXL, NUGT, UGAZ, RUSL, YINN

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

DWT, JDST, DRIP, DUST, SOXS, DGAZ, RUSS, BZQ,YANG (DGAZ, DUST and JDST new red weekly)

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. It is also used for tracking the percentage from high to keep a stop on remaining shares. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out before typically well before they start to fall again. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long. You’ll notice in the last column on the right it says “Current percentage from high.” This is your normal stop out for any ETF where I don’t specifically call it per the Trading Rules which lists the trailing stops for each ETF. It is a Trailing Stop percentage from the high and I have noticed the pattern that the closer it gets to 5% the sooner the ETF turns red on the weekly.