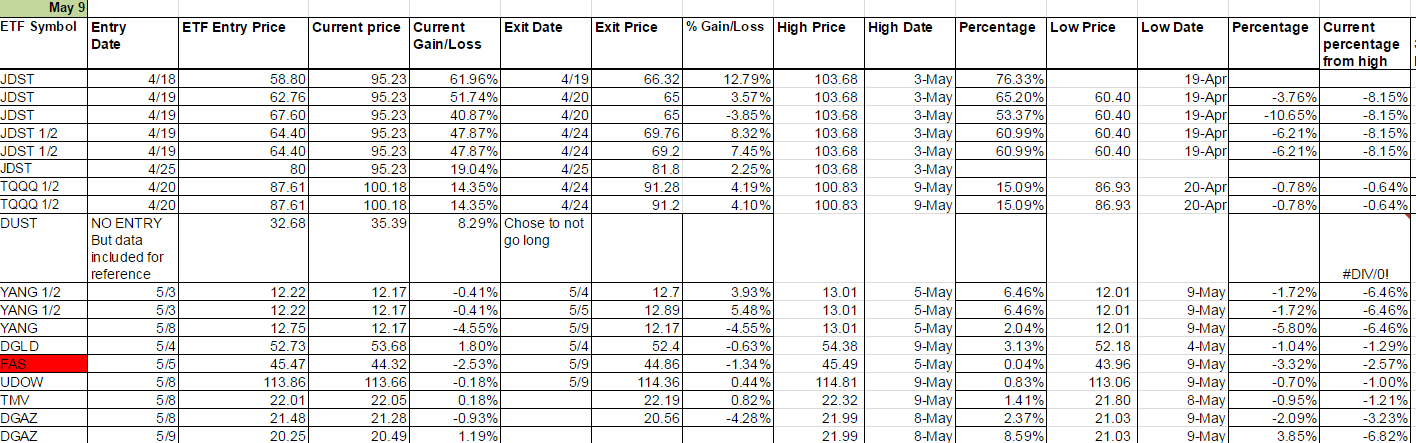

ETF Trading Research 5/9/2017

Today’s Trades

We held some non-green ETFs overnight and while JNUG was basically flat from entry, NUGT was down and UVXY I didn’t fare well with. DGAZ was also a disappointment but at least I am pretty confident we will recover with it as we are up on the last trade. YANG was another green weekly disappointment and this is rare mind you, but no idea why it opened up so low. Being that we had a few green weekly’s going already, I shouldn’t have added to the risk with the addition of JNUG/NUGT/UVXY but I did say in an alert; “JNUG/NUGT/UVXY know your risk or go home flat.”

Tonight we are only holding YANG, UVXY and DGAZ, and with UVXY you always know there is big risk, but the price action today looked good for it. We did stop out of 2 of the 3 other green weekly’s with profit. Once I saw FAS falling I made the call to sell UDOW and TMF. We had a good trade going in LABU today but chickened out and it went higher but we profited. JDST was our best trade today and we hit our goal and did ok. DWT though didn’t take off till later and we got stopped out with too tight a stop by 20 cents. I thought we could catch the ride down in oil with DWT to 45 again but just too tight a stop as DWT did head higher. The closer we get to 45 in oil the more we want to look at UWT. Below are the trades we are presently long. We won’t know the verdict on YANG until we get Chinese data overnight.

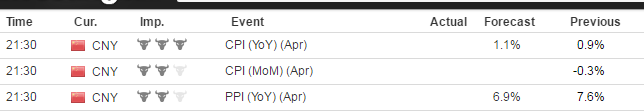

Economic Data For Tomorrow

Chinese data – a decent setup for a disappointment in CPI and if PPI came in worse, then it would open the door for a YANG move. Someone wrote me that it is always difficult to trust Chinese data. This is true. If we had more time on our hands we would hold YANG longer term as I’m with hedge fund manager Kyle Bass on the issues China has and wrote about it in my Illusions of Wealth book.

Something must be wrong. There is only one Fed member speaking tomorrow. They all have the same mantra now; economy good, start paying off balance sheet, etc.

Something must be wrong. There is only one Fed member speaking tomorrow. They all have the same mantra now; economy good, start paying off balance sheet, etc.

Anytime you have this much euphoria by the Fed, CNBC, etc. in the markets, something bad is coming. I am not sure when but feel it is coming. Especially their continued talk the last 48 hours about the VIX. I like to be contrarian sometimes but after 48 hours of them talking about the VIX, you notice I tried UVXY yesterday and am trying it again and I made my case for it in an alert today if you check your emails for the 1:41EDT email or search your inbox for “CNBC.”

Crude oil inventories tomorrow and if there is a build should get us a scalp in DWT before we bail and get long UWT as oil approaches 45 again. It comes out during market hours so we should have a trade after the volatility settles down and a trend develops.

http://www.investing.com/economic-calendar/

I said in last nights report; “I should have waited a hair longer on UVXY. If we get a push higher in the morning I would sell that move.” It was only after my analysis that I came to that conclusion, but tonight I feel better about holding it overnight so we’ll try and get that loss back and then see if we can’t get a run or at least some good profit. The jury is still out on a higher market. It is still possible. But we did have FAS turn red on the weekly today. It wasn’t behaving like your normal green weekly ETF should and once I saw it dip lower we exited and also exited as I said TMV and UDOW. Being that we are in no mans land for a trade right now, best to wait and see what the market gives us and then go long and patiently look for green weekly ETFs.

Foreign Markets

Yesterday I said “we took out profit from YANG but can still trade it long if the markets want to move lower.” We did get longer and will hold for now. Chinese exports fell overnight and today YANG benefited. Tomorrow night we have CPI and PPI for China.

Interest Rates

TMV moved up after we locked in a little profit but then came right back down below where we sold. Not looking to get long again at this point but will keep it in mind.

Energy

I said yesterday that “DWT possibly tomorrow if we see an opportunity.” We did trade it but stop was too tight. Will look for it again after data tomorrow.

DGAZ overall looks attractive and is in buy the dip mode for now. A little volatile though. Tough to sit through wider stops on the reversals, but we have to trade it long when the data tells us to.

Precious Metals and Mining Stocks

We profited nicely from JDST after 2 days up in JNUG/NUGT. Both JNUG and NUGT then had a nice rebound. I was very close to calling us long and should have when I saw JDST about ready to fall apart. I think I was a little gun shy after the morning trades. I was also close to calling UGLD and USLV. At least I did share this with you to give you my feelings on what I saw going on. The problem was I couldn’t sort out how much of the bounce was N. Korea rhetoric with the talk of another missile test. So I chose the conservative approach while holding UVXY for the “what if” scenario. I want to on a micro level use below 1220 lean JDST and above 1230 lean JNUG/NUGT at this point, but confirm dollar inverse action.

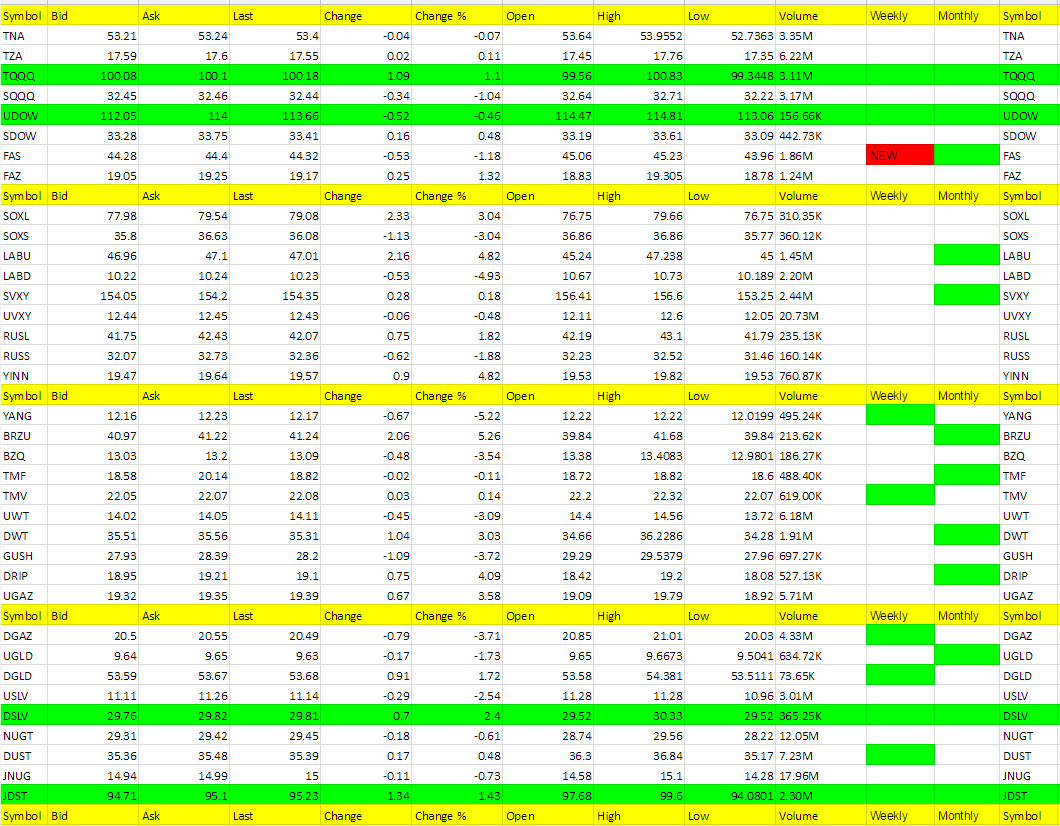

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

YINN, BRZU, LABU, DRIP, UGAZ

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

YANG, LABD, DGAZ, GUSH, BZQ (FAS new red weekly)

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. It is also used for tracking the percentage from high to keep a stop on remaining shares. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out before typically well before they start to fall again. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long. You’ll notice in the last column on the right it says “Current percentage from high.” This is your normal stop out for any ETF where I don’t specifically call it per the Trading Rules which lists the trailing stops for each ETF. It is a Trailing Stop percentage from the high and I have noticed the pattern that the closer it gets to 5% the sooner the ETF turns red on the weekly.