ETF Trading Research 7/23/2017

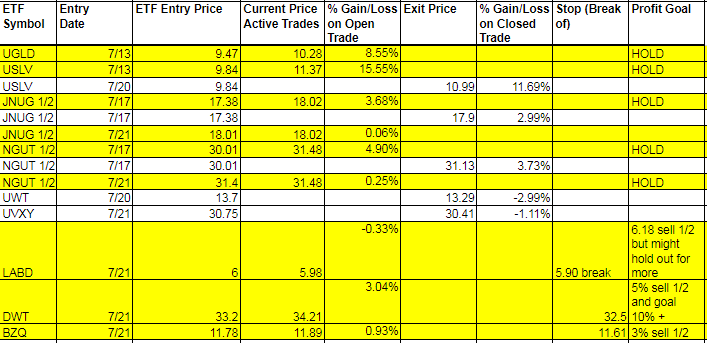

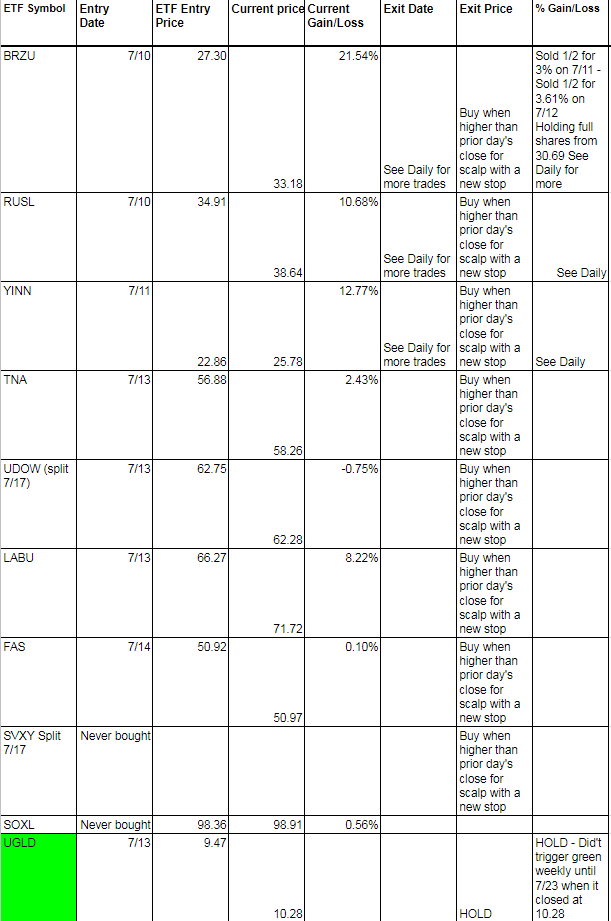

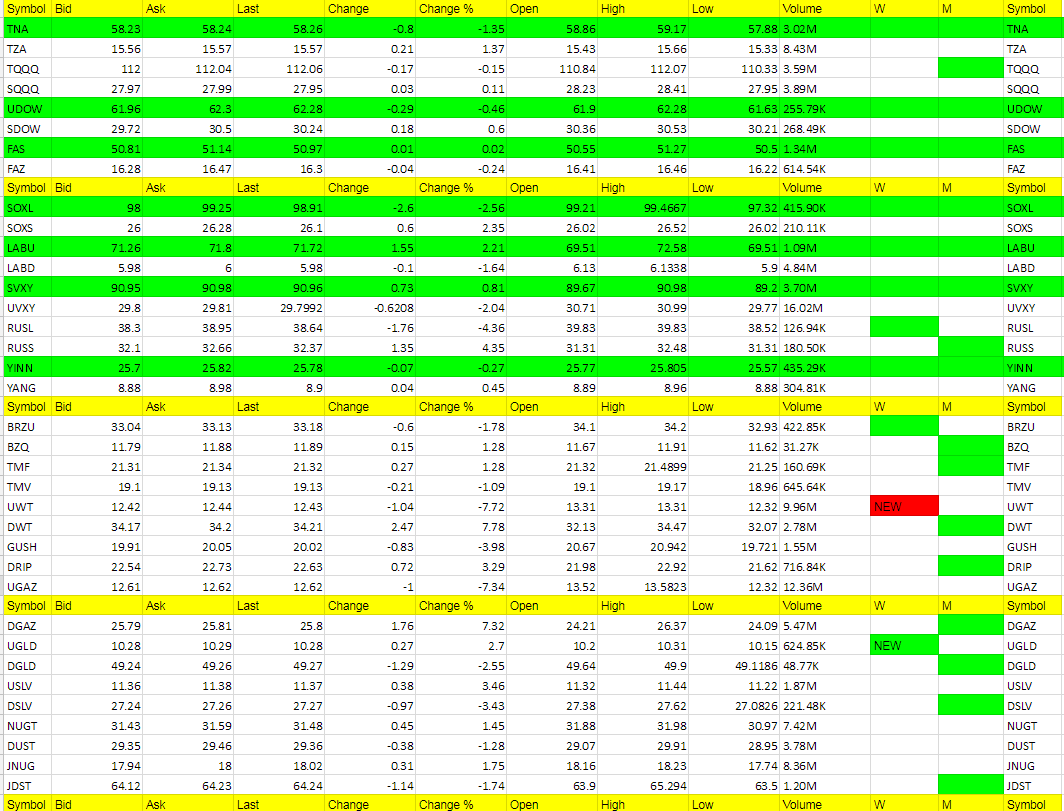

Today’s Trades and Current Positions (highlighted in yellow):

We’ve got metals and miners doing what we want and as we approach $1,260 we should have a pullback. I don’t mind taking some profit when we are up 10% or more on these and that is what I normally would do. However, I think with metals we have to make some exceptions as UGLD just turned green on the weekly and did it slowly, not a one day push higher that gets other green weekly’s to give is a false signal now and then. This is not a false signal. In fact, I think gold, while it will have pullbacks along the way, will get over $1,260, $1,294/$1,300 and head towards $1,356 on this run. What will the percentages be on these leveraged metals and miners if I’m right? This is part of what you pay me for in this service. While I may have missed some calls in the last couple weeks (I said the gutsy move in sticking with JNUG when we should have been in JDST) if you would have followed the rules you would have never traded against an ETF that just turned red on the weekly. It was a stupid call and I owned up to it. Now we are off to the races where I thought we would go to begin with, but market makers took us down one last time. Am I making up for those mistakes? Yes. Am I always trying to do my best? Of course. But I know my weaknesses more than anyone and write the Trading Rules for you to overcome my shortcomings/stubbornness. The most important part of Rule #4 is the following; 4. Only trade non-green ETFs as a scalp. If you going to enter an ETF that is NOT green on the weekly, only trade it as a scalp. These ETFs that are non-green on the weekly are almost always going to reverse on you. The rest is keeping a stop. Otherwise be patient for a signal that gives you more confidence that the trend has reversed. For us in metals and miners, it was JDST turning red on the weekly. What have we done since then without a green weekly signal? We’ve done quite well. It doesn’t hurt to review the Trading Rules over and over as suggested in the rules themselves.

I decided to lock in some profit in USLV as we were somewhat stagnant, but we did move up more and still got a piece of that and are up 15.55% on the remaining shares. UGLD is close to a 10% gain since called and the original shares of JNUG and NUGT are doing well and after locking in some profit because of perceived weakness on non-green ETFs, we got back in without much damage on the 1/2 shares of JNUG and NUGT we sold. Remember, until green on the weekly, I am going to try and micro manage the downside potential. At the same time, I am clear on where we are going and my confidence is high on that right now, with or without the Fed this week. What can Janet Yellen say to stop rates from falling? Not much. We could get a big boost still in metals and miners, but it may not come till after the Fed and we should be a little cautious of what market makers will do until then.

Here are some rules for losers that will get you thinking. Don’t be a loser. And you are free to laugh at some of these since you have Trading Rules. They just need to be followed, even by me.

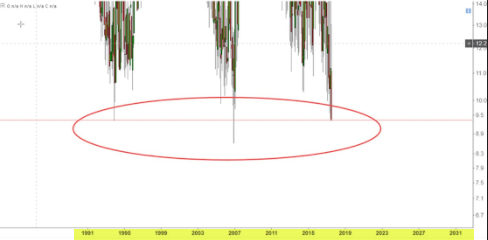

UVXY had us up then stopped out. But guess what? I am not phased by this stop out or even another one. Why? We traded it when it was up and forgot about it once it turned negative for the day and it just kept falling. But here is the big picture and why we are in for some fun with UVXY soon enough. Even if conservative I think UVXY this time can get you 10% minimum soon. This chart says it all. You might have to open it on your desktop to view it better. It’s a VIX chart that goes all the way back to 19991 and shows 3 bottoms very close to where we are now. What happened after each bottom is where I think we are headed soon with this market and volatility overall. To hell in a hand basket. Pinpointing the exact moment won’t be easy, and we don’t just buy and hold UVXY ever, but we will have opportunities to trade it and capture a good run higher with double percentage returns. June 29th we got 11.39% 1/2 shares on one such day with a trailing stop after locking in a quick 3.28% on 1/2 shares. This time we may be holding on for much more and raising our 1/2 share sell higher. But we need the signals first. We need to see how the market views this Fed.

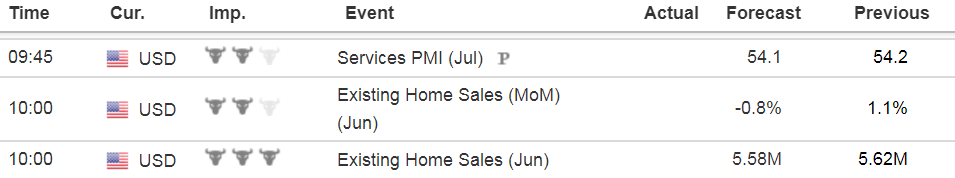

Economic Data For Tomorrow

Existing Home Sales at 10:00 and Services PMI before that on a short data day. But it is once again the Fed that comes into focus by Wednesday.

http://www.investing.com/economic-calendar/

Energy

Nat Gas looks like it will test 2.80 again, the price I thought it would go to a week ago. A break of that we will find out place to go long but it is still a short until then. One more day up for DGAZ since it is on Hot Corner 2 days straight and possibly reversal into UGAZ.

Oil has been all over the place of late. It turned green on the weekly and we got long but got out immediately Friday morning and got the loss back with a trade long in DWT. Now we have oil down 7 cents (Sept 17 contract) to 45.70 and we’ll see if the OPEC comments today and other action in the morning change things or not. I would take 1/2 off if up in the morning to lock in some of that profit. Probably should have at the close Friday but having UWT turning red on the weekly is sometimes a sign to hold on or take the risk on the other side.

We do have to be careful though with DWT and DRIP having been in the Hot Corner 2 days straight. One more day up and expect a reversal or a pullback a bit.

Precious Metals and Mining Stocks

Gold is up to 1256.60 by 1.10 in Asian trading and sivler up 4 cents to 16.52. We have to be careful with that 1260 level. However, if the USD/JPY can break below 110 now and then 109.30, then we open the trap door to metals and miners taking off. We have been right in staying long and strong metals and miners with USD/JPY break down so far. The dollar while weak, can bounce higher possibly but that won’t matter. Stick with what works with the USD/JPY. Funds are at record short the JPY and may be covering this week. COT data has banks increasing longs (smart money) and funds increasing their shorts (dumb money) for both gold and silver. This won’t end well with funds.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

DWT, DGAZ, RUSS, USLV, DRIP – UGLD new green weekly

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

UWT, UGAZ, GUSH, RUSL, DSLV – UWT new red weekly

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out typically well before they start to fall again or turn red on the weekly. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long.